RISING SOAP TRADE AMONG WEST AFRICAN COUNTRIES

Intra-African trade (especially in manufactured products) has been touted as a major driver of economic development in Africa as it promotes the scaling of African industries. Though this concept of intra-African trade is not new to African economies, it was significantly impaired by colonialization and has since been a struggle for many African economies to effectively trade among themselves, especially in manufactured products. The extroverted pattern of trade towards the West and now Asia has undermined regional integration and exposed many African countries to external shocks. Notwithstanding, this pattern seems to be increasingly shifting among West African economies, especially for less endowed countries like Burkina Faso and Togo where ECOWAS trade represents about 60% – 70% of their total global trade.

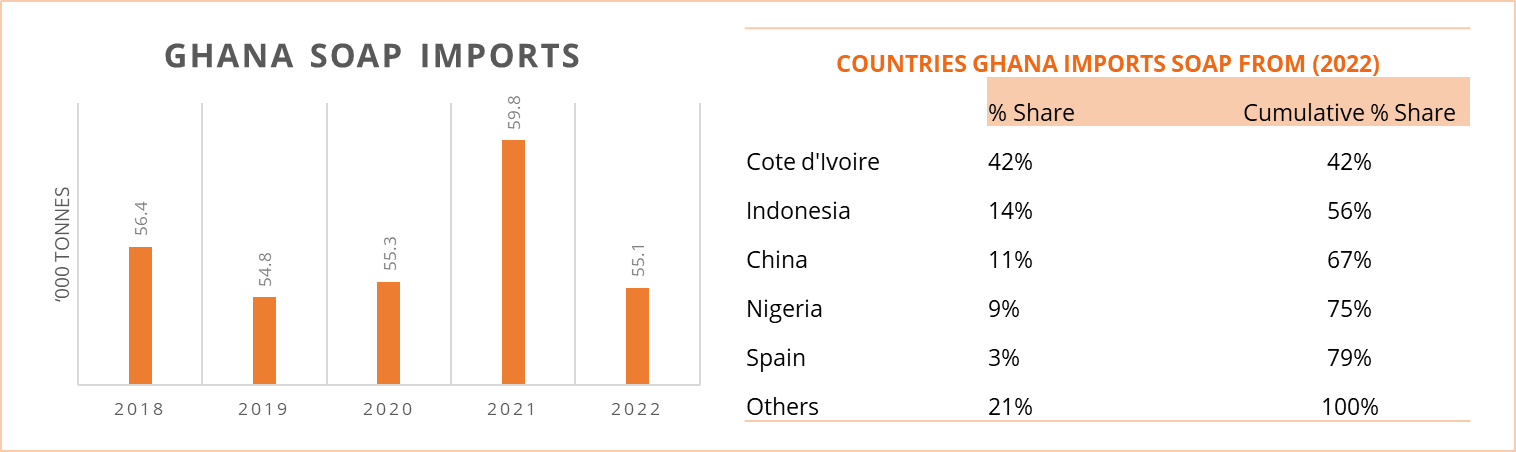

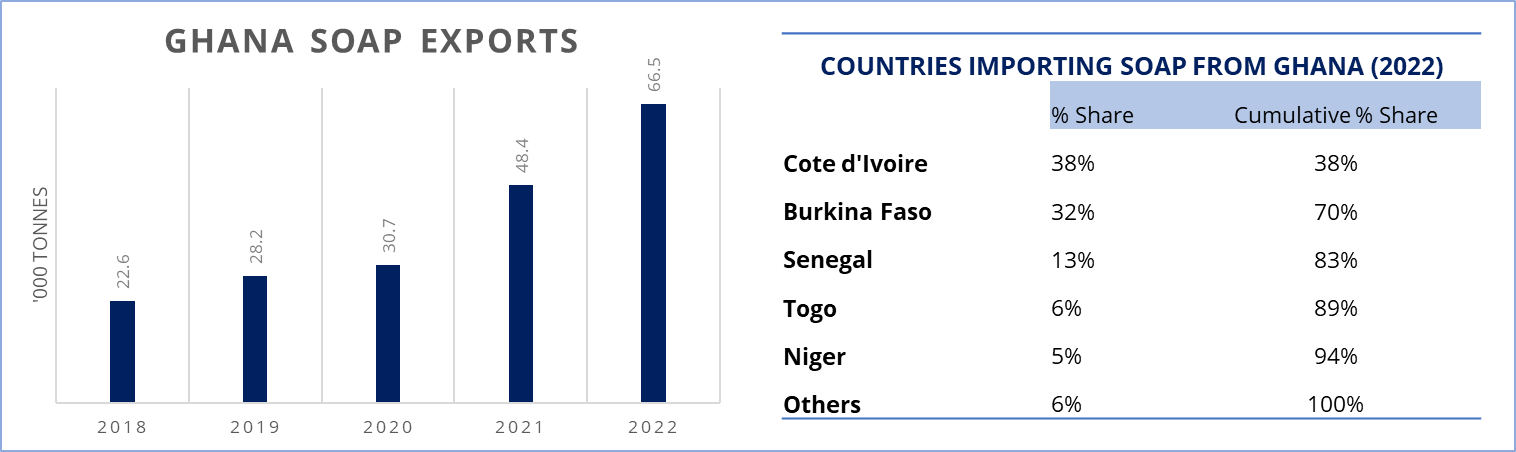

Trade in soap is such a promising indicator of improving regional trade of manufactured goods within West Africa. A country like Ghana now imports over 50% of manufactured soap from neighboring Cote d’Ivoire and Nigeria, while over 90% of her exports of manufactured soaps go to other West African markets in Cote d’Ivoire, Burkina Faso, Senegal, and Togo as domestic production in-country scales. In 2022, Ghana was a net exporter of soaps exporting over 66,000 tonnes of manufactured soaps.

Soap Manufacturing in Ghana; From Net Importer to Net Exporter

Although Ghana, like many African countries, had for a very long time been a net importer of several manufactured products, the tide appears to be changing especially among Fast Moving Consumer Goods (FMCGs) such as soap. Generally, import volumes of soaps have declined significantly as domestic production improves. Between 2012 and 2015, Ghana imported an average of 76,000 tonnes of manufactured soap annually but has since 2016 been importing just between 50,000 to 55,000 tonnes of manufactured soaps annually. Though imported soaps still hold a significant share of the soap market, the perception of quality it enjoys is no longer exclusive to them. Many local brands are now considered to be of good quality and widely accepted in the market. Nevertheless, there are still some segments of the soap market such as liquid bath soaps that are heavily import-dominated. Popular imported brands include Nivea, Dove, Dettol, Olay, Irish Spring, and Palmolive. These brands are perceived to offer high-quality and advanced formulations, which appeal to middle and upper-income consumers. There has also been a trend of local traders traveling to China to toll-manufacture their own liquid bath soap brands.

Source: Firmus Research and Customs Data

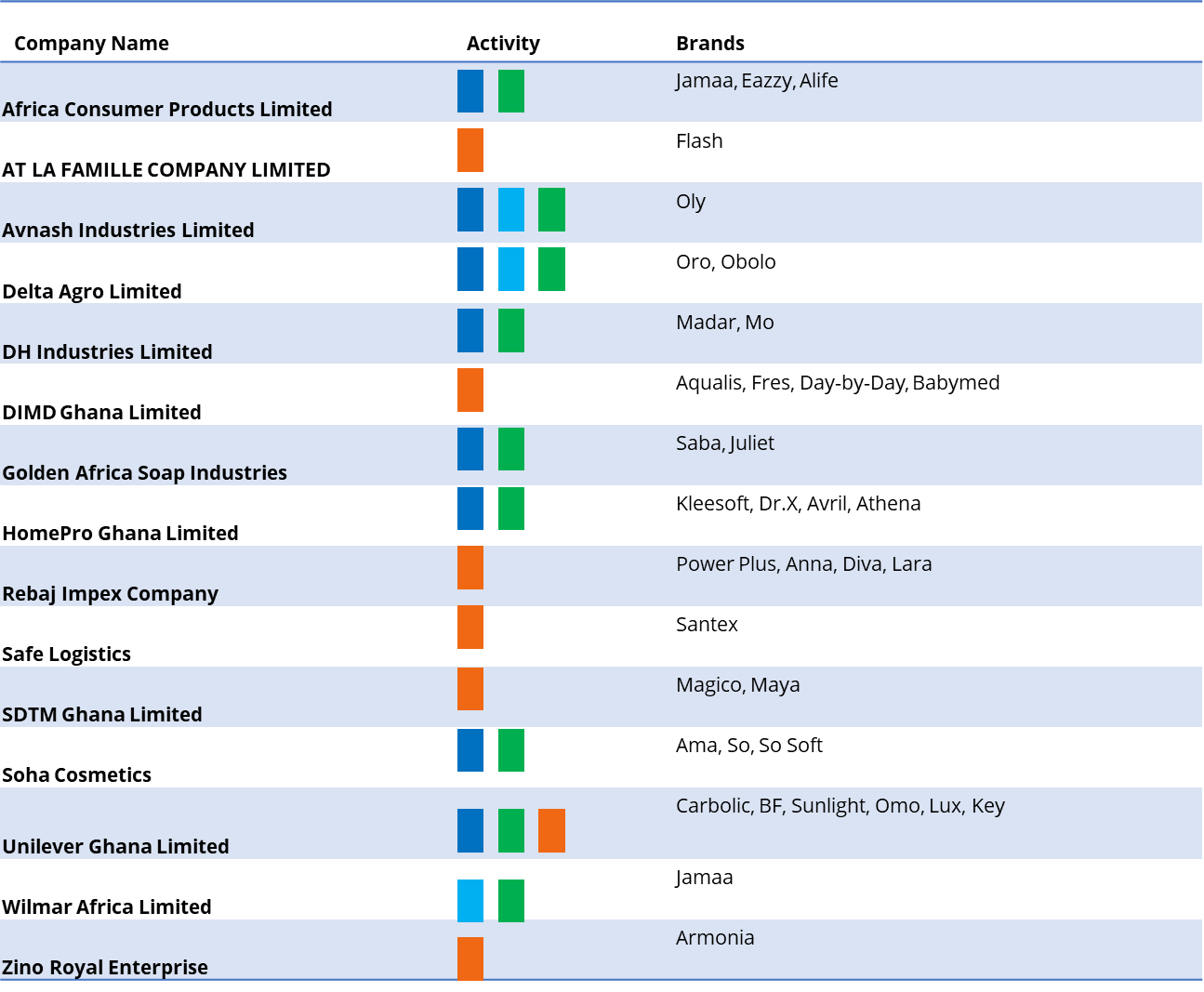

Presently there are over 10 major producers of soaps in Ghana with new entrants joining each year. There are also small-scale producers and home-based producers in the market catering to different segments of the market. The significant growth in domestic production has been facilitated by increasing consumer preference for locally made products, rising population and income levels as well as growing consumer preference for organic and natural soaps, produced with local raw materials. Numerous Small and Medium Enterprises produce handmade, organic, and herbal soaps. Brands like Alata Samina (African Black Soap) and Pure Honey Soap cater to niche markets focused on natural and organic skincare solutions. These products are often marketed through local markets, pop-up shops, and online platforms, gaining popularity for their natural ingredients and traditional production methods.

The growth in domestic production has had a positive spillover effect on the soap value chain. For instance, soap noodles, the primary raw material for soap production have witnessed a significant reduction in imports as new and existing companies have joined the value chain, to produce and supply soap noodles domestically. Some domestic soap manufacturers like Avnash Industries and Delta Agro produce soap noodles as raw materials to produce their brands of soap as well as sell to other domestic producers.

Another positive spillover effect is the rising exports of domestically produced soap. Soap exports from Ghana tripled between 2018 and 2022. Interestingly, even though Ghana imports about 35% – 40% of all its soap imports from Cote d’Ivoire, Ghana is increasingly exporting more soaps to Cote d’Ivoire with about 25,000 tonnes exported in 2022 (compared to imports of 23,000 tonnes). This further demonstrates how integrated West African trade is becoming on the soap front. Particularly, domestic soap production in Ghana is attractive not just because of the growing local market but for the prospects of reaching the extended West African market. Agreements such as the Ecowas Trade Liberalisation Scheme (ETLS) and the African Continental Free Trade Agreement (AfCFTA) give further impetus to this argument. Laundry soap, both bar and powder, is the most dominant soap category exported to other West African Markets.

Source: Firmus Research and Customs Data

Key Players in Ghana’s Soap Value Chain

Source: Firmus Research and Customs Data

Thinking of Investing in the Soap Manufacturing Sector in Ghana? A Few Things to Note:

Consumer Preference

Traditionally, Ghanaians have always preferred bar soap for either bathing or washing. However, in recent times, the market has become more susceptible to different soap formats including liquid soaps and powdered soaps, especially in urban communities. Notwithstanding, bar soap is still the most preferred soap format for various uses. A survey of over 100 soap users in Accra indicates that about 71% of users prefer bar bathing soap to liquid bathing soap (29%). The longevity of the bar soap’s usage is a dominant reason for this preference. Most users indicated that a single bar soap can last between 3 – 4 weeks for single-user cases.

Generally, however, consumers project the following factors as their primary points of consideration when deciding on which brand of soap to purchase:

| FACTORS INFLUENCING BRAND SELECTION AMONG GHANAIAN SOAP USERS | ||

| 1 | Product Quality and Efficacy | 40.7% of consumers selected product quality and efficacy as their primary consideration. Factors such as cleansing power, fragrance, moisturizing properties, and skin compatibility influence purchasing decisions. Products that offer additional benefits, such as antibacterial or skincare ingredients also appeal to discerning consumers. |

| 2 | Brand Reputation | 20.37% of consumers prioritize brand reputation. This suggests that established brands or those with a good reputation in the market can hold a significant market share. Brand loyalty is crucial in influencing repeat purchases and generating word-of-mouth recommendations. |

| 3 | Price | Despite its importance, price is slightly less influential to product quality and brand reputation. Just 19.4 % of respondents cited price as the topmost factor they consider when purchasing soap. On average, a bar of soap in Ghana sells for GHC 15.00 or US$ 1.00. |

| 4 | Natural or Organic Ingredients | 13.89% of respondents consider natural and organic ingredients when purchasing soap reflecting a growing trend towards health-conscious products. For example, certain herbal or natural ingredients may hold cultural significance and be preferred by consumers seeking products with traditional healing properties. Unilever Ghana responded to such consumer preferences by introducing new products such as Geisha Moringa Soap and Charcoal Soap. |

| 5 | Packaging and Presentation | Packaging is the least influential factor, only toping the decision of just 5.6% of respondents. While still a consideration, it suggests that packaging and presentation alone may not significantly sway consumer decisions in the Ghanaian soap market. However, colorful and well-designed packaging can create a positive impression and convey perceptions of quality and value. Packaging that effectively highlights key product benefits and ingredients can further enhance consumer appeal. |

[Source: Firmus Survey, 2024 | Location: Accra | Sample: 100]

Understanding these factors is essential for soap manufacturers and marketers to develop effective strategies that resonate with Ghanaian consumers and drive sales growth in this competitive market.

What Regulatory Requirements will you have to consider?

The business environment in Ghana is largely well-regulated to ensure the safety of products (especially consumer products) as well as to facilitate access to various government incentives and support. For a soap manufacturer or importer in Ghana, the following are the regulatory compliances required to facilitate the business.

| Regulatory

Institution |

Applicable

Business Activity |

Why Comply? |

| Company Registration

[Register General’s Department] |

|

|

| Tax Registration

[Ghana Revenue Authority] |

|

|

| Manufacturing License

[Customs Division, Ghana Revenue Authority] |

|

|

| GIPC Investor Registration

[Ghana Investment Promotion Centre] |

|

|

| Sanitation and Business Permit

[Municipal and District Assemblies] |

|

|

| Environmental Permit

[Environmental Protection Agency] |

|

|

| Fire Permit

[Fire Services] |

|

|

| FDA Registration

[Food and Drugs Authority] |

|

|

| GSA Registration

[Ghana Standards Authority] |

|

|

| Bonded Warehouse License

[Customs Division, Ghana Revenue Authority] |

|

|

| Insurance: Recommended for every business, though non-mandatory. | ||

Conclusion.

The soap market in Ghana is a vital component of the country’s consumer goods industry, driven by population growth, urbanization, rising disposable incomes, and increased awareness of hygiene practices among consumers. As new players enter the soap market, it is expected to remain moderately competitive in the medium term. Also, with the soap trade rising within West Africa, more brands will explore markets beyond their borders. In the long term, brands that can deepen their presence in the wider West African market will have greater efficiency in production, firmly establishing them as leaders in the market.

References.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies in Ghana, Nigeria and other West African markets. Employing the full set of market research tools (depending on a business’s particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to several local and international companies and have obtained experience in the areas such as customer experience surveys, market insights, and brand tracking studies across multiple sectors.

About the Authors

Anita Nkrumah

Head, Research and Trade Development

Firmus Advisory Limited

Bridget Opoku

Research Executive

Firmus Advisory Limited