Fish and other seafood, a preferred source of animal protein for most consumers in Ghana, were traditionally consumed by smoking, salting, drying, and boiling. However, following colonialism and the growing exposure to cultures worldwide, other methods such as frying, fresh (sushi), and canning have become widely accepted. Canned fish is particularly generally accepted and consumed across the country and is a major source of protein for several Ghanaians including students. As such, a variety of canned fish (and other seafood) products such as sardines, tuna, mackerel, squid, salmon, kippers, and anchovies are consumed in the market. However, sardines, tunas, and mackerels are the most preferred options.

The growing acceptance of canned fish products in the Ghanaian market is seen in the steady rise in its imports and the growing number of brands introduced into the market. In the early 1990s’, there were a handful of canned fish brands in the market; brands such as Titus sardines and Starkist tuna flakes were the preferred and sort after brands in most homes and on top of store shelves. Recently, however, consumers have embraced a variety of canned fish brands as several of them have been introduced into the market. The figure below highlights the import trends for canned fish products.

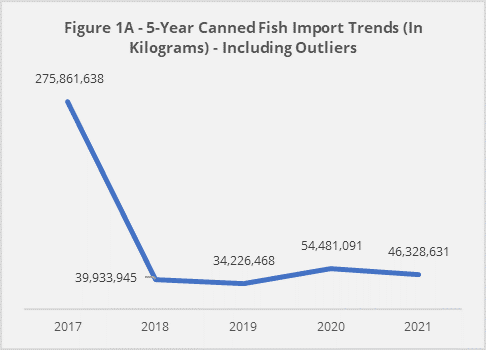

Figure 1: 5-year Canned Fish Imports Trends

| Source: Customs Division of the Ghana Revenue Authority |

Figure 1A and 1B shows the trend of canned fish imports in the past 5 years (from 2017 – 2021), with Figure 1A including outliers. In 2017, there was a huge import by a first-time importer that constituted more than 80% of 2017’s imports. This is treated as an outlier. Without the outlier, generally, canned fish imports have been increasing steadily, as shown in Figure 1B, averaging 40.7 million kgs per year.

Canned Mackerel Dominates the Canned Fish Market

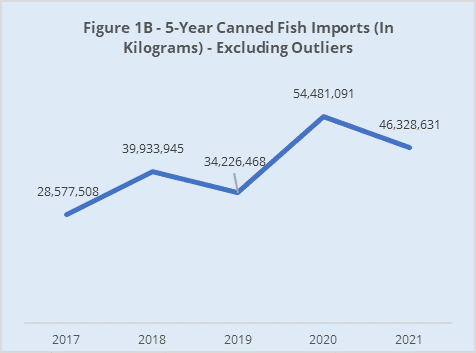

Among the various categories of canned fish products consumed by Ghanaians, canned mackerel constitutes the highest volume, followed by canned sardines and tuna.

In 2021, total import volumes of canned mackerel were estimated at 23.8 million kgs, constituting about 51.2% of all imported canned fish products. Canned sardines followed closely with total import volumes of 20.9 million kgs, constituting 41.5%. Among the three main imported canned fish products, canned tuna is the least imported, most likely due to the well-established domestic production sector. Other canned fish products (salmon, anchovies, herrings, squid) constitute just 0.1% of the total canned fish (and seafood) imports.

The chart below provides more information on the import volumes of different varieties of canned fish from 2011 and 2021. From the chart, we see a sharp rise in the import volumes of mackerel in 2017. This was an outlier situation with a single entity importing 247 million kgs of mackerel.

Figure 2: 10-Year Import of Canned Fish Product

Price Trends in the Canned Fish Market in Ghana

Price is king

Consumers have become very price sensitive in the canned fish market, owing to the challenging economic environment and the multiplicity of brands in the market. Data gathered from ten wholesalers at Makola indicated that 80% of consumers choose less expensive brands of canned mackerel, sardines, and tuna, regardless of their quality. As a result of this trend, several less expensive brands of canned fish products have been introduced to the Ghanaian market. Aside from price, brand visibility also plays a key role in attracting consumer interest. Among the numerous less expensive products on the market, consumers choose products that are more visible to them through advertisements or referrals.

Three Categories of Prices Can be Identified in the Canned Fish Market

Data gathered from fifteen retail stores indicate price differences for products of the same size. Price differences are usually due to consumer brand perception, demand, product quality, advertising, and promotion among other factors. According to the retailers, canned fish products with higher prices are mostly considered to be traditional brands[1] (e.g. African Queen Mackerel, Geisha Mackerel, Titus) and some few new but popular brands (e.g. Enapa, Delay)

Three categories of prices can be identified in the canned fish market in Ghana: high-price range, middle-price range, and low-price range. The categories are defined in the figure below.

Figure 3: Prices of Canned Fish Products in Ghana

| Source: Field Survey, 2023 |

Online Retail Shops Prices at Premium

There is a small variation in price for canned fish products sampled in physical stores compared to the price of the same product on various online platforms. According to interviews conducted with two online vendors, the reason for the price premium is to cover premium services offered to online customers such as the convenience of online shopping and to cover the cost of website maintenance.

The tables below show the retail prices of canned products sampled on the market and online platforms[2]. Market information for canned products includes categorization based on the size (weight) of the product and average retail prices (for online and physical stores).

Table 1: Prices of Selected Canned Mackerel, Canned Sardines, and Canned Tuna in Ghana

|

CANNED MACKEREL |

||||

| Product Category |

Size per unit |

Avg. Retail Prices (Gh¢) per unit[3] | ||

| Pieces in Box | Physical Market | Online Market | ||

| High end

( e.g., Geisha, African Queen) |

425g | 24 | 20 | 22 |

| 155g | 50 | 9 | 10 | |

| Mid end

( e.g., Ena Pa, Lele) |

425g | 24 | 14 | 16 |

| 155g | 50 | 7.5 | 8 | |

| Low end

(e.g., Cindy, Costa) |

425g | 24 | 12 | 14.5 |

| 155g | 50 | 6.5 | 7 | |

|

CANNED SARDINES |

||||

| Product category |

Size per unit |

Avg. Retail Prices (Gh¢) per unit | ||

| Pieces in Box | Physical Market | Online Market | ||

| High end

(e.g.,’ Titus, Bella, Belma) |

125g |

50 |

9 |

10 |

| Mid end

(e.g., Milo, Lele, ATLANTA) |

125g |

50 |

7.5 |

8.5 |

| Low end

(e.g., Rosalinda, Laser) |

125g |

50 |

7 |

8 |

|

CANNED TUNA |

||||

| Product category | Size per unit | Avg. Retail Prices (Gh¢) per unit | ||

| Pieces in Box | Physical Market | Online Market | ||

| High end

(e.g., STARKIST, JOHN WEST) |

160g |

24 |

16 |

18 |

| Mid end

(E.g. Ena Pa Tuna, Lele Tuna) |

160g |

24 |

15 |

16.5 |

| Low end

(*Daphnis Tuna) |

160g | 24 | 11 | 14 |

Market Outlook

Though there are already numerous brands of canned fish products in the market, there is still an opportunity for new brands to make significant headway as consumers are still open to options that meet their preferences and budget. Further, potential investors may also explore domestic production to meet the increasing demand, especially for canned mackerels. There are also possibilities to explore further localization of the canned fish products, such as infusing them with pepper and other local spices and herbs. Finally, the full implementation of AfCFTA (African Continental Free Trade Agreement) opens up other markets in Africa to both producers and importers of canned fish products

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights and customer satisfaction studies. Employing the full set of market research tools (depending on a business’s particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to several local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights, and brand tracking studies across multiple sectors.

About the Authors

| Anita Nkrumah

Head, Research and Trade Development |

| Laudina Adjei-Boatey

Research Executive |

[1] Traditional brands are brands that have been in existence for a longer period of time. These brands are well-known and accepted among Ghanaians. They are considered to be the best in quality.

[2] Online platforms for pricing information were accessed on Hubtel online, Glovo supermarket, Jumia, GH basket, Market express, and Melcom online

[3] Average prices were collected for two brands each of sardine, mackerel and tuna from online platforms and the Makola central market between 24 – 28 October 2022.