Industrial, and commercial real estate

In the early part of the 21st century, successive governments placed emphasis on the development of Ghana’s private sector, fueling the influx of foreign investors and multinational firms into several sectors of the economy, including insurance, financial, oil and gas, telecommunications as well as healthcare services. This led to increased demand for not just office spaces but for an improved office stock. As demand increased, local and foreign construction companies began to invest in commercial real estate across various areas in Accra.

Commercial real estate in Accra is generally concentrated in the Accra Central Business District and the Airport areas – these areas have seen massive development of Grade A and B spaces. In as much as there has been an increase in demand for office spaces over the years, the rate of occupancy, relative to the supply, is low. The impact of COVID-19 will not be brushed aside as it has also played a role in the reduced levels of occupancy. As companies continue to work remotely, the probability of some returning to physical working spaces is low, which may further reduce occupancy rates in the market.

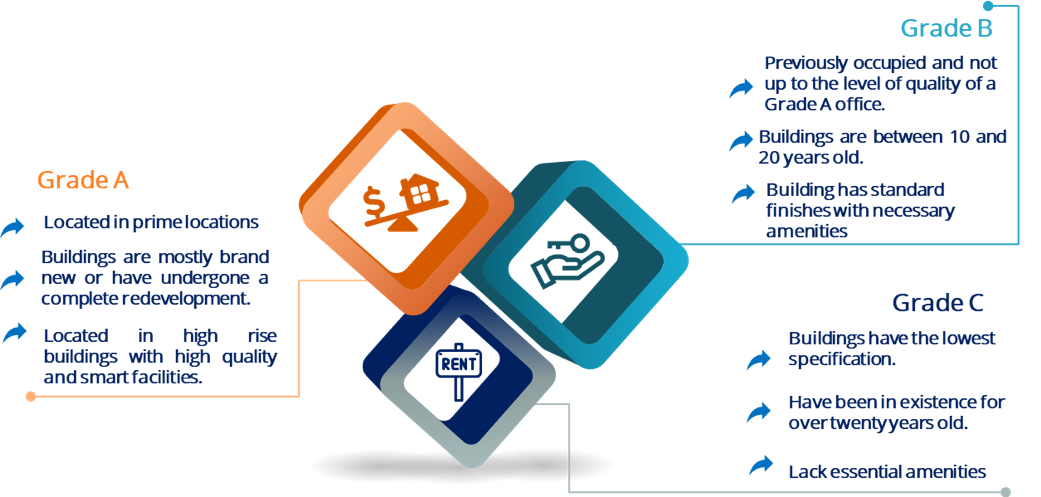

The Office Grading Structure in Ghana

Ghana’s office grading structure follow global standards created to aid estate agents, investors and other stakeholders in the property market justify property prices and to support thorough analysis of the sector in terms of the level of demand among others. Just as on the global scene, office buildings in Ghana are classified into Grade A, Grade B and Grade C. The figure below defines the elements considered for each grade.

Figure 1: Grade Specifications in Ghana’s Commercial Real Estate Market

Grade A and B offices have better conditions and are more competitive, thus attracting high-end clientele and resulting in high rental rates.

Office supply in Accra is centralized in two main areas; Accra’s Central Business District (CBD) and the Airport Area. Commercial real estate in the Accra CBD covers the West Ridge and North Ridge districts and is typically occupied by large financial institutions as well as government offices. Whereas, offices in the Airport Area covers the north of Accra and is occupied by professional services and the oil and gas industry. Further, the Airport area benefits from its accessibility, both in regards to the airport and residential areas and has recently seen an improvement in the quality of offices. Most of the offices in the Accra CBD area are of Grade B quality, while most Grade A offices are located in the Airport Area.

Occupancy Rates for Grade A and B Offices in Accra

Occupancy or vacancy rates are relevant metrics in the property market, as occupancy rates have a positive correlation with prices. Occupancy rate is the ratio of rented or used space to the total number of available spaces, while vacancy rates is the opposite of it.

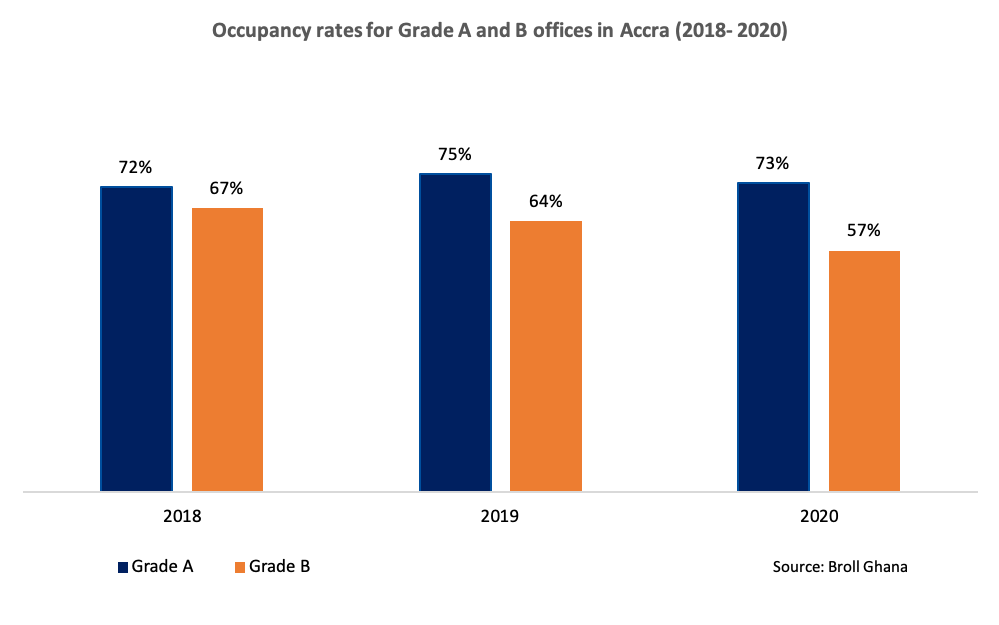

Generally, in Accra, occupancy in Grade A offices tend to be higher than occupancy in Grade B offices indicating a higher preference for the former. Grade A offices are mostly occupied by large firms and multinational companies who have a steadier revenue flow, whereas Grade B offices are mostly occupied by SME’s with relatively less stability in their income flows. Over the past three (3) years, the occupancy level in Grade A offices have remained relatively stable, averaging 73% between 2018 and 2020. On the other hand, occupancy rate in Grade B buildings have been on decline since 2018 with the greatest decline being in 2020, partly due to the effects of the Covid-19 pandemic.

Figure 2: Occupancy Rates in Grade A and B Offices in Accra (Source: Broll Ghana)

Trends Shaping the Market

Impact of Covid-19 on Commercial Real Estate in Accra

The Covid-19 pandemic has significantly affected the commercial real estate market in Accra as it has led to delays in potential transactions. Most property viewing appointments were cancelled due to border closures and lockdown restrictions. Some occupiers, including both local and international businesses, exited their spaces due to the negative effects of the pandemic on their businesses; office spaces were severely hit by the pandemic, as several businesses adopted to working remotely. Going forward, most businesses are set to re-order their work structure to accommodate remote working thus, saving on rent and electricity costs in the long run. As the effect of the pandemic reduces, occupancy rates may stabilize though the long run effects of the pandemic may linger.[1]

Supply Increases Meets Decline in Demand

On aggregate, demand for office spaces has declined over the years, though supply has increased, thus forcing marginal reductions in prices. For instance, grade A spaces attracted rent between USD25 to USD35 per sqm per month in 2019 as compared to USD30 to USD45 per sqm per month in 2018, as more than 41,000 sq meters of additional space came onto the market in 2018 in locations such as Atlantic Towers, SCB Towers and 335 Place. Notwithstanding, Grade A office buildings have higher demand compared to other office grades due to the availability of modern amenities and the location of these offices. New developments such as Atlantic Tower have recorded higher occupancy rates even though generally demand remains low. Grade B offices however experienced low demand, most likely due to their outdated amenities. [2]

Large Corporations Move to Build Their Own Offices

A notable observation is the fact that large corporate institutions are transitioning to building their own headquarters, thus causing vacancies in rental properties. Companies that have made this move include Ecobank Ghana Limited, MTN Ghana, VIVO Energy Ghana Ltd, PricewaterhouseCoopers (PwC Ghana) and Toyota Ghana Company Ltd. This trend is expected to continue, which will further deepen the demand slump over the long term.

About Firmus Advisory Limited

Firmus Advisory offer a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Laudina Adjei-Boatey

Research Executive

Firmus Advisory Limited

References

[1] Devtraco Limited. 2020. “Implications of COVID-19 on Real Estate in Ghana”. Available at: https://devtraco.com

[2] Broll Property Intel. “Ghana Market Barometer” Available at: https://www.brollghana.com/publications/

Read or Download the PDF Version of this Report Below

[pdf-embedder url=”https://firmusresearch.com/wp-content/uploads/2021/07/Increase-in-Supply-Marginal-Decline-in-Demand-An-Occupancy-Analysis-of-Commercial-Real-Estate-in-Accra_Firmus_Research.pdf” title=”Increase in Supply, Marginal Decline in Demand (An Occupancy Analysis of Commercial Real Estate in Accra)_Firmus_Research”]