Dairy products are highly nutritious and a healthy protein option for most consumers in Ghana. As such, it is a common Fast-Moving Consumer Good (FMCG) on the shelves and in the stores of most consumer retail outlets which proves the investment in Ghana’s Dairy Market. Dairy products are versatile; they are consumed by individuals of all age groups in varied preparatory forms – sometimes as solid food and other times as beverages. Dairy products are made from milk and include foods such as butter, cheese, ice cream, yogurt, and whipped cream among others.

Ghana’s dairy market has shown remarkable growth signs in the past decade. The demand for dairy products continues to rise steadily owing to changes in consumer diets that have resulted from greater global integration. There is also a growing middle-income and urban population with better access to various forms of dairy products. Notwithstanding the growing demand, domestic supply is well below the effective market demand, creating a dependence on imports to close the deficit in the market. Greater exposure to foreign media has also made consumers more adventurous and aware of multiple product categories and brands and their different value offerings. Each year, several brands and categories of domestic and imported dairy products are introduced into the market creating a competitive landscape for the dairy sector.

Domestic Production of Dairy Products

Ghana’s domestic dairy market is heavy on the production of milk and cream products. A greater proportion of domestic players produce and distribute primarily milk and cream products, specifically; powdered milk, evaporated milk, fresh milk, and ice cream. Very few players manufacture fresh milk, with cheese and butter products usually produced on a small scale and mostly in informal settings. Locally, cow milk is the main source of fresh milk consumed in the country. About 45,000 tons of fresh milk is produced annually largely by pastoralists such as the Fulanis. Pastoral production of fresh milk is informal and accounts for more than 90% of total fresh milk produced in Ghana. Mostly, middle to high-income earners are cautious about patronizing local fresh milk because of concerns about their hygienic status.

Commercial production of dairy in Ghana falls under three broad categories based on scale and product coverage: large-scale production, medium-scale production, and small-scale production.

- Large-scale producers primarily produce dairy products such as powdered milk, evaporated milk, ice cream, and yogurt products for nationwide delivery and in some cases to other West African markets.

- Medium-scale producers are heavy on dairy products with relatively short shelf life such as yogurt and fresh milk. Their distribution chain usually stretches to a few major cities

- Small-scale producers also produce yogurt and the local cheese (also known as ‘wagashi’), distributing at the community levels.

Over the past five years, domestic dairy production has experienced remarkable growth signs. More local entrants have taken an interest in the market by establishing dairy production hubs while existing players continue to expand their production lines by introducing new ranges of dairy products into the market. Presently, despite competition from foreign brands, notable domestic players have capitalized on their understanding of the thriving market and their comparative advantage to gain a fair share of the market. These domestic players together with their brands have become household names, dominating the milk and cream market of the dairy sector. Notwithstanding, there are several foreign brands in the market. The table below provides details on the notable domestic players within the dairy market:

Key Domestic Players in Ghana’s Dairy Market

| Company Name | Year of Establishment | Business Outline | Dairy Product Line | Dairy Brands |

| Fan Milk Plc | 1959 | Produces and distributes milk-based and fruit-based milk, yogurt, and ice cream products. | · Ice cream

· Yoghurt |

Ice cream: Fan Ice

Yogurt: Fan Yoghurt, Super Yoghurt |

| Nestle Ghana | 1968 | Specializes in manufacturing and distributing dairy products, co-parkers, culinary, chocolate drinks and confectionery, baby foods, cereals, coffee, and drinking water. | · Evaporated Milk

· Milk Powder

|

Evaporated Milk: Ideal, Carnation

Milk Powder: Nido, Gloria

|

| Promasidor Ghana | 1999 | Manufactures and distributes dairy products, cereal, culinary, beverages, and non-dairy products. | · Milk Powder

· Cheese |

Milk Powder: Cowbel, Miksi, Mixwell, Loya

Cheese: Le Berbere |

| · | ||||

| Arla Foods | 2017 | Manufactures dairy products including milk and cream, butter, and cheese products | · Milk Powder

· UHT Milk · Butter · Cheese |

Milk Powder: Dano

UHT Milk: Dano Butter: Cheese: |

| · | ||||

| Mafricom Ghana Limited | 2020 | The company manufactures and distributes dairy products, grains, cereal, packaged and frozen foods, beverages, pharmaceuticals, and clothing. | · Powdered Milk

· Butter |

Powdered Milk: Momo

Butter: Alimo |

| Nature Farms Ghana Limited | Produces fresh milk | · Fresh Milk | Nature |

The Dairy Import Market

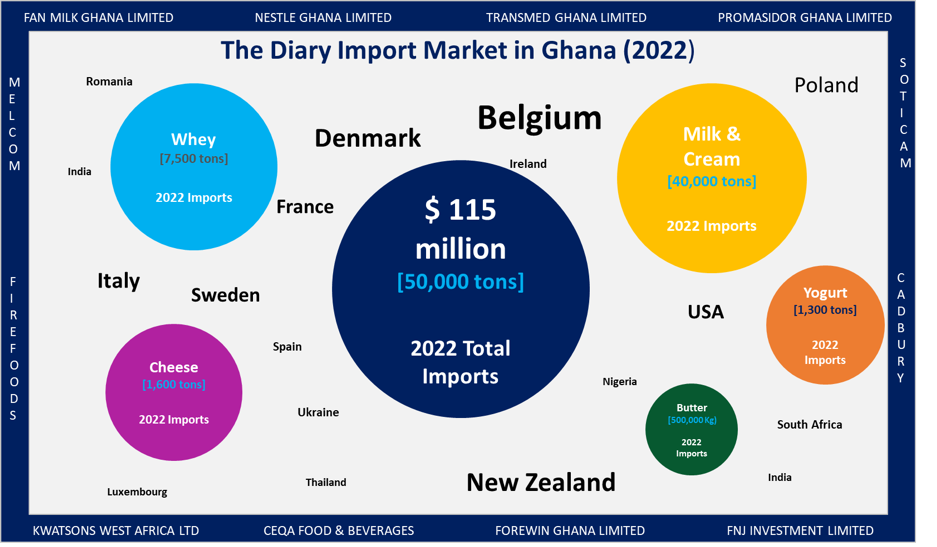

In 2022, about $ 115 million worth of dairy products were imported into Ghana, equivalent to some 50 thousand tons of products. The import volumes were however lower than the volumes in 2021 which was around 67 thousand tons of products, representing a decline of about 26%. The dominant dairy product categories imported are milk and cream products and Whey, usually used as raw materials by domestic dairy production units.

Figure 1: The Import Dairy Market in Ghana, 2022 [Source: Ministry of Trade and Industry]

- Milk and Cream Products: About 40 thousand tons were imported in 2022, constituting 80% of all dairy imports. The most common product under this category is milk powder, with about 17 thousand tons imported in 2022. Apart from being used as raw material for domestic dairy companies, milk powder is highly preferred among consumers because of its longevity and because it is consumed across different demographics. Dairy companies also use it as the main milk base for products such as evaporated milk, yogurts, etc. The top countries of origin for milk and cream imports are Belgium, New Zealand, Denmark, and Sweden. Known domestic dairy companies that import milk and cream products are Nestle Ghana Ltd., West Africa Refreshment Ltd., Fareast Mercantile Co. Ltd., Fanmilk Ghana Ltd., FNJ Investment Ltd. Promasidor Ghana Ltd., and Forewin Ghana Limited.

- Whey: Whey Powder is the dominant whey product imported into Ghana, used as raw material by Fanmilk, Promasidor, Cadbury, Nestle, and other dairy companies. About 7.5 thousand tons were imported in 2022, constituting 15% of all dairy imports. It is mostly imported from Italy, Poland, the United States of America, Denmark, and France.

- Cheese: Cheese is imported in very small quantities. About 1.6 thousand tons were imported in 2022, constituting 3.2% of all dairy imports. Unlike other countries in the West, most local cuisines in Ghana do not require cheese as a primary ingredient. Consumers of cheese are usually expatriate communities, Ghanaians from the diaspora, and a few middle to upper-class elites. It is usually sold in big supermarkets and shopping malls. The local cheese, ‘wagashi’ is consumed mostly in Muslim and Fulani communities. Wagahsi’s preparation, which includes frying, tends to be significantly different from the use and preparation of imported cheese. Notable companies that import cheese are Skyline Investment Ltd., Transmed Limited, Fire Foods Ghana, Kwatson West Africa Ltd., Melcom, and CEQA Foods and Beverage. Notable countries of Origin for cheese imports include South Africa, Poland, Denmark, Ukraine, France, and Spain.

- Yogurt: A lot of yogurts are imported from countries such as Morocco, Spain, and Nigeria to supplement domestic production. About 1.3 thousand tons were imported in 2022, constituting 2.7% of all dairy imports. Notable companies that import yogurts are Transmed, Gold Coast Matcom, Rujmali Enterprise, and Soticam Ghana.

- Butter: Imports of butter in Ghana are significantly low. Ghanaians are used to margarine than butter and thus prefer it to butter. In addition, butter tends to be more expensive than margarine. About 0.5 thousand tons were imported in 2022, constituting 1.1% of all dairy imports. Most of the butter imports come from New Zealand, Ireland, Romania, France, and Belgium.

The Diary Export Market

Ghana exported some 9.4 thousand tons of dairy products in 2022, mostly to neighboring West African markets. The primary dairy exports are yogurt products, ice cream, evaporated milk, and milk powder. In 2022, about 3.2 thousand tons of yogurt products were exported from Ghana mainly to Cote d’Ivoire, Burkina Faso, Togo, and Benin. Likewise, about 3 thousand tons of ice cream was exported to neighboring Cote d’Ivoire and Togo. Evaporated milk and milk powder are mostly exported to Nigeria and Burkina Faso. The dominant exporting companies are Nestle, Fanmilk, Promasidor, and Tony Norvisi Supply.

Key Market Developments – A Growing Health Sense Among Consumers

There has been an increasing draw towards healthy options in Ghana’s diary market largely due to the growing urbanization and greater media exposure. Specifically, there has been an increased demand for skimmed milk and non-dairy creamer options.

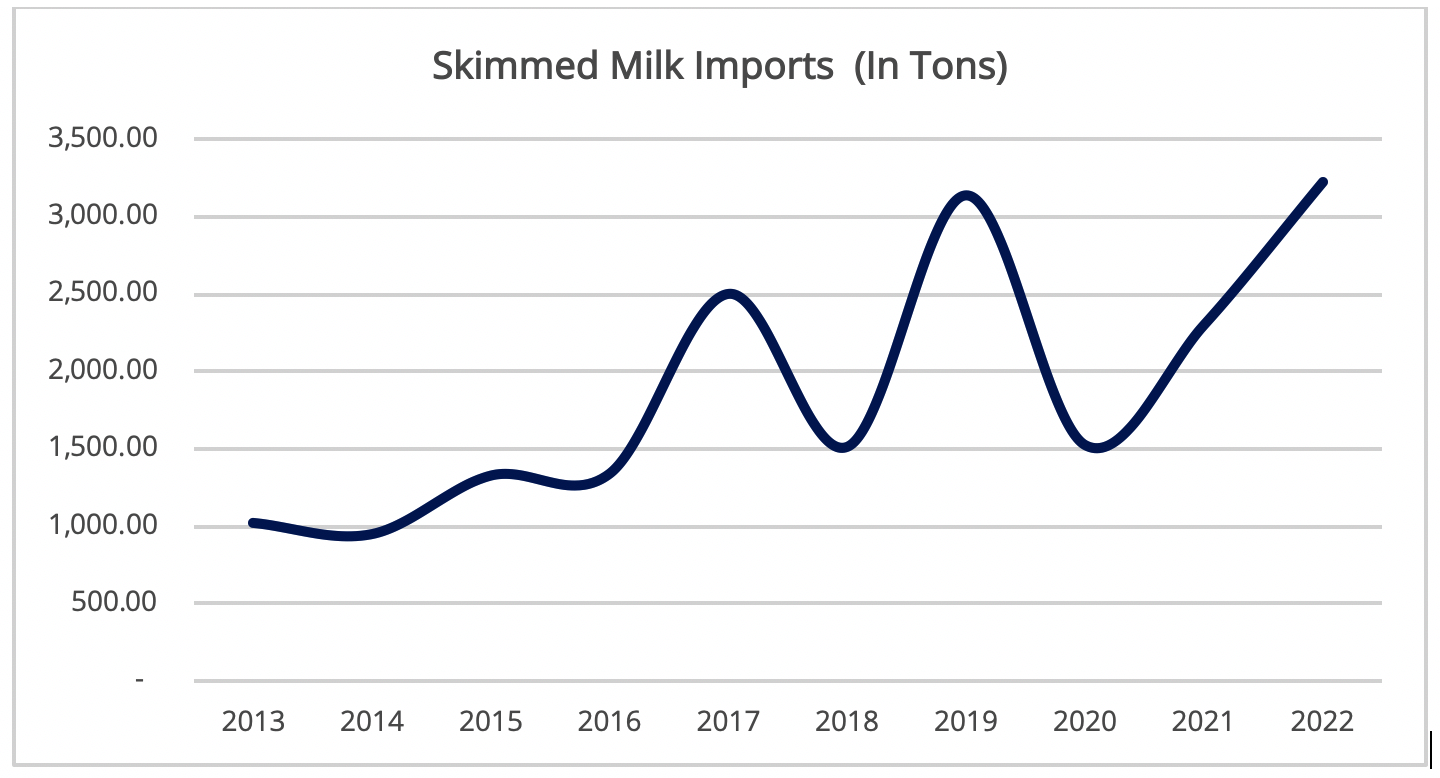

Increasing/ Growing Demand for Skimmed Milk

Growing health consciousness among consumers has led to an increasing preference for non-fat milk among consumers; skimmed milk, also known as fat-free milk contains less fat and, in some cases, no fat at all. Due to the wellness and health benefits of skimmed milk, demand for skimmed milk continues to rise, averaging 2.3 thousand tons per year in the past 5 years.

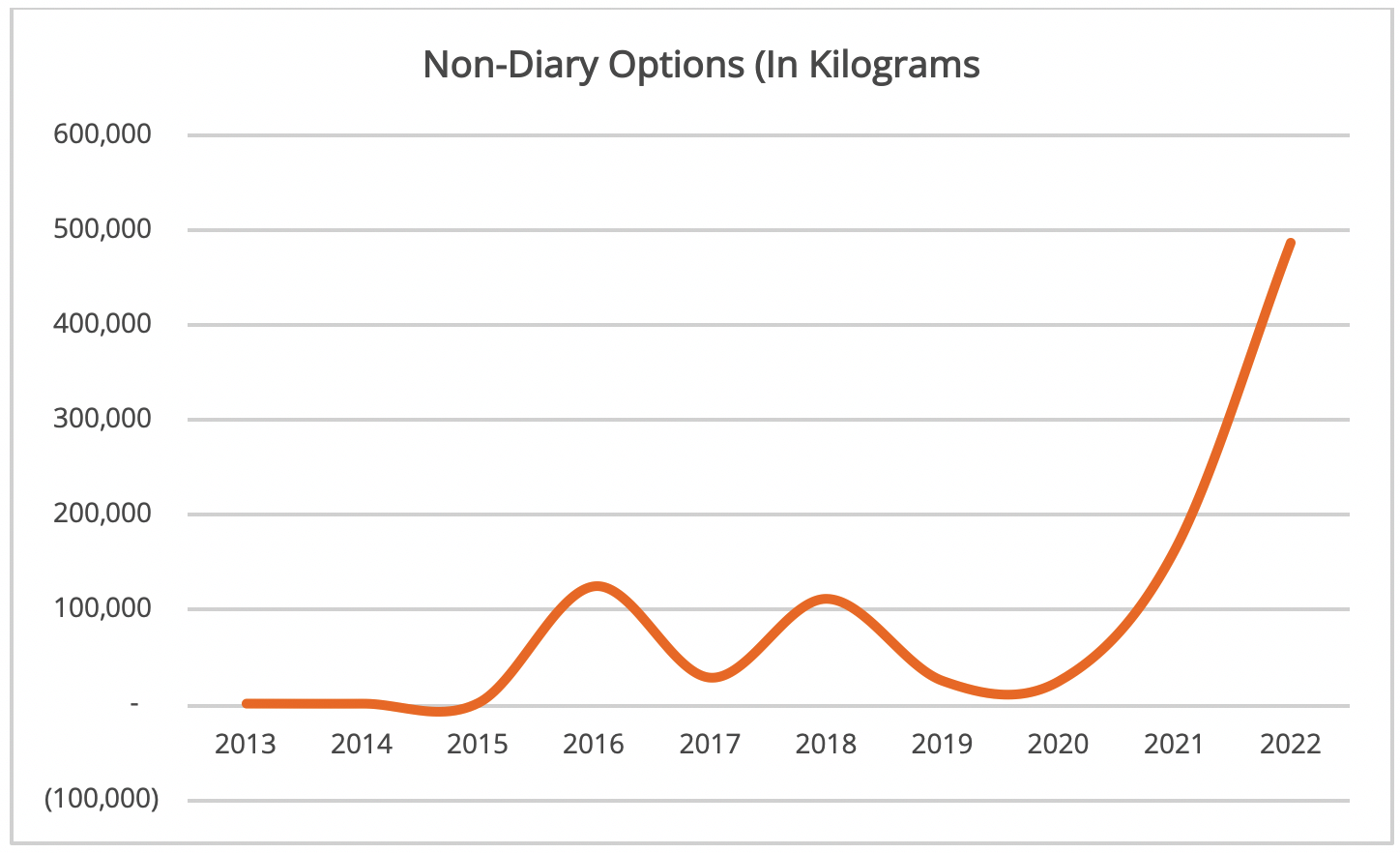

Growing Demand for Non-Diary Options

Like other healthy options, preference for non-dairy has been on the rise, especially in the past 3 years. Though the import volumes remain low compared to other milk and cream products, there is a stack difference between the average annual import levels during 2013-2017 (32 thousand kilograms) and 2018-2023 (162 thousand kilograms). The table below shows a steep rise in non-dairy options.

Market Outlook and Opportunities

Presently, milk and cream products dominate Ghana’s dairy market and will continue to dominate the dairy market, especially powdered and evaporated milk because of its longevity as well as the fact that consumers have developed a deep taste preference for it. Notwithstanding, other dairy products such as non-dairy products, and skimmed milk are expected to become a staple in the homes of most middle and high-income earners.

Further, brand loyalty in Ghana’s dairy market among consumers will continue to weaken due to the economic downturns. As a result, several opportunities exist for existing players and new entrants to introduce more options for low-priced milk and cream products, especially powdered milk and evaporated milk. Powered and evaporated milk is widely consumed across the country especially among low to middle-income groups that are severely affected by the difficult economic conditions.

Also, there is an unexplored opportunity for standardizing the production of cheese in Ghana. The ‘wagashi’ cheese is the only known Ghanaian cheese type produced locally (and in commercial quantities) in Ghana and it is widely consumed across Ghana. However, several Ghanaians, especially the growing middle class, are not able to enjoy this product because of the lack of standardization in its production.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’s particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to several local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights, and brand tracking studies across multiple sectors. Contact us today for all your professional research needs.

About the Authors

Anita Nkrumah

Anita Nkrumah

Head, Research and Trade Development

Firmus Advisory

Rachel Dampson

Rachel Dampson

Research Executive

Firmus Advisory