The post FMCG Market Watch: Consumer Electricals and Electronics in Ghana appeared first on Firmus Research.

]]>The consumer electricals and electronics market stands as a dynamic and ever-evolving sector, reflecting the rapid advancements in technology and the growing demands of an increasingly connected world. The rapid pace of innovations in technology is driving demand for newer and improved electrical and electronic products. Simultaneously, the expanding middle class of individuals and businesses are constantly replacing or upgrading older products with more advanced versions which has contributed to the growth in the market. This article explores the multifaceted landscape of the industry with a focus on electrical products and electronics such as air conditioning machines, refrigerators, freezers, washing machines, irons, electric burners, food processors, microwaves, blenders, microphones, speakers, rice cookers and kettles.

Market Segmentation

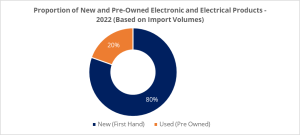

The electrical and electronics markets can be broadly divided into two main segments: new (first-hand) and pre-owned (second-hand) sectors. The second-hand market is primarily characterized by pre-owned items from well-renowned and high-end brands such as Samsung, Philips, and Sony. Players in this market d

istribute varieties of preowned electronics and electricals sourced from several countries. Generally, in Accra, Lapaz is recognized as the central hub for the distribution and retailing of pre-owned electrical and electronic items.

Figure 1: Proportion of New and Old Electrical and Electronic Products, 2022

Source: Ministry of Trade, MOTI

Conversely, the new market comprises companies and enterprises specializing in the sale of brand-new electrical and electronic items as well as franchise dealers representing international brands. Currently, newly manufactured electrical and electronic products control about 80% share of the market.

A Demand Shift from Pre-Owned to New Electricals and Electronics

Until the late 2000s, demand for pre-owned electronics was the order of the day. The new electronics market at the time largely constituted so-called high-end brands that were too expensive for most consumers to purchase as brand-new. The limited presence of affordable brand-new options and the general notion among consumers that used electrical products were just as reliable as the new ones fueled this preference. Historically, consumer demand for electronic products was largely influenced by considerations of product quality and brand reputation irrespective of whether the products were new or pre-owned. Established brands such as Sony, Philips, and Kenwood were regarded as durable and long-lasting prompting consumers who couldn’t afford new products from these brands to opt for pre-owned items over less popular brand-new alternatives.

Currently, demand for pre-owned electrical and electronic products is gradually declining. This trend is attributed to the fact that there are currently a lot of affordable brand-new electronic products in the market that are of competitive pricing and quality. Further, the influx of numerous new energy-efficient electrical products in the market at competitive prices with comparable quality to second-hand products has led to a heightened preference for new electrical and electronic products among consumers.

A Promising Import Market for Electricals and Electronic Products

In 2022, the market for imported electronics and electrical goods, including both new and pre-owned items, reached an estimated value of $124 million. Predominant among these imports were televisions, air conditioners, refrigerators, freezers, washing machines, and blenders, collectively accounting for approximately 60% of the market share. Other significant categories of imported electronic and electrical items are speakers, microwaves, irons, kettles, and electric cookers.

The recent announcement by the Energy Commission to ban selected used and substandard electrical appliances, set to take full effect by the end of 2023, will give a further boost to the market for brand-new electronic products, especially given the prevailing consumer preference for new products in the electronic and electrical sectors.

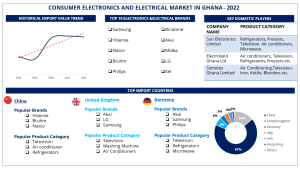

As of 2022, there were almost 100 electrical and electronic brands in the market. Prominent among them are brand names like Hisense, Nasco, Samsung, Midea, Binatone, and Philips dominating the landscape. The top importing countries for electronics and electrical goods, namely China, Turkey, the UK, the USA, and Italy, collectively contribute to around 80% of the total imports. The figure below provides an insightful overview of the electronics and electrical import market.

Figure 2: Electronics and Electricals Import Market, 2022

Source: Ministry of Trade, MOTI

Price is the Game Changer

Price has been a key driver of the electrical and electronics market. Given that prices of electrical and electronic products are on the rise, affordability has become a significant driver for consumer demand, especially when consumers are presented with several alternatives. The attention consumers give to the price of electronic products often outweighs considerations of product quality, especially with the increasingly difficult economic environment. In response to this market trend; there is intense competition among key players to reasonably price their products to attract more attention for their brands. Many market players have adopted unique pricing strategies to sell their brands coupled with effective and strategic marketing highlighting the advantages of their products over their competitors. Further, this pricing trend has opened up the market to refurbished models of well-established brands offering customers relatively cheaper options. The table below provides the prices of selected brands of electronics and electrical products in the Ghanaian market. Prices vary significantly depending on the brand and specifications considered by the customer.

| PRICES FOR BRAND-NEW ELECTRICAL AND ELECTRONIC PRODUCTS | |||||

| Product | Specification | Hisense | Nasco | Samsung | LG |

| Television | Smart TV 50” | GHC 4000 – GHC 5000 | GHC 4000 – GHC 4200 | GHC 6,600 – GHC 7000 | GHC 5,700 – GHC 6,300 |

| Refrigerator | 200 L – 208 L | GHC 3400 | GHC 3000 – GHC 3900 | GHC 5500 | GHC 7999 |

| Air conditioner | 2.5 HP | GHC 7300 – GHC 8800 | GHC 8000 – GHC 9500 | GHC 9900 – GHC 11000 | GHC 8700 – GHC 13000 |

| Washing Machine | 10 KG | GHC 5500 – GHC 6000 | GHC 5000 – GHC 7000 | GHC 5800 – GHC 7500 | GHC 5400 – GHC 8300 |

Source: Market Survey, 2023

The rise of E-Commerce Platforms has Heighten Demand for Electronics

The emergence of e-commerce platforms has played a pivotal role in reshaping the retail landscape for electronic and electrical products. These platforms offer a variety of electrical and electronic products with competitive pricing, and the convenience of doorstep delivery, contributing significantly to the market’s expansion. Further, with a 68% internet penetration rate in the country as of 2022, a larger proportion of the population now has access to online platforms resulting in increased engagement in e-commerce activities.

Several key players in the market have leveraged the growing internet penetration to deepen their market presence by establishing online platforms to sell their products. Companies such as Sun Electronic Limited, Electro land Ghana, KAB-FAM Ghana have developed user-friendly and interactive e-commerce platforms allowing customers to conveniently order electronic products and electricals online. Some even offer free deliveries to incentivize purchases through their digital platforms. Generally, the rise of e-commerce platforms has not only increased market reach but has also encouraged healthy competition among retailers, fostering innovation and competitive pricing.

Opportunities for Market Growth

The electronic and electrical market in Ghana holds considerable growth potential, with untapped markets and unexplored opportunities. Currently, electronic products such as washing machines, refrigerators, speakers, heaters, blenders, juicers, etc., are imported, creating an opportunity for investors to explore local production or assembly of these items. Government policies and initiatives such as the ‘one district one factory’ provide attractive incentives for manufacturing activities within the country.

Moreover, Ghana’s strategic position as an ECOWAS country positions it as a gateway to other West African markets, with preferential trade agreements facilitating smooth exports. Already, about $280,000 worth of electronic and electrical products are exported annually.

Potential investors could consider collaborating with local players as a strategic approach for foreign companies to navigate the market. Despite the presence of numerous brands and franchised dealers, the market remains open to new entrants, provided they offer competitive quality and pricing.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors. Read more on https://firmusadvisory.com/.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Rachael Dampson

Research Executive

Firmus Advisory Limited

The post FMCG Market Watch: Consumer Electricals and Electronics in Ghana appeared first on Firmus Research.

]]>The post FMCG MARKET WATCH: AN OVERVIEW OF GHANA PHARMACEUTICAL MARKET [COMPETITIVE LANDSCAPE, DISTRIBUTION CHANNEL, AND EXPORT ANALYSIS] appeared first on Firmus Research.

]]>MARKET OVERVIEW

Ghana’s pharmaceutical market is one of the most promising sectors in Sub-Saharan Africa experiencing a noticeable evolution in the past three years. As of 2021, the market’s value reached $433 million1 and it is projected to witness substantial growth in subsequent years. Approximately, 70% of the market is reliant on foreign medicines and raw materials 2. However, in recent times, local production of pharmaceuticals has seen a major boost owing to sector interventions as well as an improvement in domestic herbal medicine. Increasingly, new entrants are joining the pharmaceutical market in the areas of manufacturing and distribution. This has not only strengthened the local market but has also had a noticeable impact on the export market, marked by a significant increase in exports since 2020.

COMPETITIVE LANDSCAPE OF THE PHARMACEUTICAL MARKET

The pharmaceutical market comprises stakeholders that specialize in research, manufacturing, and distribution of pharmaceutical products. For the manufacturing segment, domestic production makes up about 30% of the market share. As of July 2022, there were 32 licensed local manufacturing facilities3 in the country specializing in the production of prescribed and over-the-counter drugs such as analgesics, anti-malarial, anti-biotics, antiretrovirals, antacids, antihistamines, dewormers, nutritional supplements, etc. catering to both the local and export markets. Notable manufacturers include Ayrton Drug Manufacturing Company, Letap Pharmaceutical Limited, M& G Pharmaceuticals, Kinapharma, Danadams, Entrance Pharmaceutical and Research Center, and Alhaji Yakubu Herbal Company. Some of these players have over 40 pharmaceutical product lines with several retail and distribution outlets nationwide. Aside from manufacturing, some of the local manufacturers are also involved in the importation of pharmaceutical products.

The import market plays a key role in supplementing the pharmaceutical market with varied brands of pharmaceutical products. In 2022, total import volumes for pharmaceuticals reached 21 million kg. India, China, the United Kingdom, France, and Germany are the top 5 import countries collectively controlling about 90% of total import volumes. Currently, the distribution of pharmaceutical products is facilitated by over 600 pharmaceutical importers including domestic manufacturers, public and private Institutions, Logistics and trading companies, and pharmacies. The charts below provide an overview of Ghana’s pharmaceutical import market.

Source: Ministry of Trade and Industry (MOTI)

DISTRIBUTION CHAIN

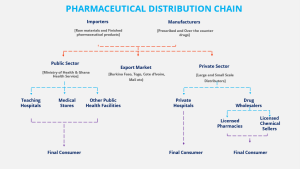

Distribution of pharmaceutical products is an important activity within the pharmaceutical market. There are appropriate guidelines to ensure the quality of pharmaceutical products from the premises of the manufacturer to the final consumer. The figure below represents an overview of the distribution landscape for the pharmaceutical market.

Figure 1: Pharmaceutical Distribution Chain

Domestic importers and manufacturers serve as the main sources of pharmaceutical products in the market. As of 2022, the pharmaceutical sector could boast 32 registered pharmaceutical manufacturing facilities and over 600 importers of pharmaceutical products in Ghana. The distribution of medicines from these manufacturers and importers to end consumers is channeled through two main avenues: the public sector and the private sector.

In the public sector, pharmaceutical products are distributed to Teaching Hospitals, Government Medical Stores, and Other Public health facilities through the Ministry of Health (MoH) and Ghana Health Service (GHS) acting as key regulators in the sector. The Ghana Health Service and the Ministry of Health follow distinct processes for procuring and distributing pharmaceutical products.

The Ghana Health Service procures pharmaceutical products through an annual National Competitive Tendering system. In this tendering process, the service publishes a list of pharmaceutical products with specific requirements for potential bidding by suppliers. Interested suppliers submit their bids and quotations and the Ghana Health Service selects the most suitable supplier for further contractual agreements. Additionally, the Ghana Health Service occasionally issues tenders for specific pharmaceutical products as the need arises. Similarly, the Ministry of Health (MoH) utilizes a centralized procurement system known as Framework contracting. Framework Contracting is usually a long-term agreement between the MoH and suppliers, outlining the general terms such as price and quantity for smaller recurrent purchasing orders over a specified period. Pharmaceutical suppliers express their interest by submitting bids for consideration, and the MoH reviews these bids, often sharing the contract among bidders to encourage competitive pricing. Framework Contracting is typically renewed annually. However, in cases of shortages within the public sector, Teaching hospitals, medical stores, and other public health facilities are permitted to procure drugs from the private sector. They do so by issuing tenders for bidding, bypassing the Ministry of Health and Ghana Health Service.

For the private sector, the distribution of pharmaceutical products is controlled by both large- and small-scale distributors. These distributors source domestically approved medicines directly from domestic manufacturers or external markets. They facilitate access to pharmaceutical products for private hospitals and drug wholesalers and ultimately reach the final consumer. Regarding the supply of pharmaceutical products to private hospitals, distributors either apply for tenders issued by various private health facilities or engage directly with these facilities to introduce their stock for consideration. Distributors are also responsible for supplying to wholesalers at bulk prices. These wholesalers, in turn, serve as the primary distributors to licensed pharmacies and licensed chemical sellers who retail their products to the final consumer at retail prices.

PHARMACEUTICAL EXPORT MARKET

Ghana’s pharmaceutical export market can be broadly categorized into medication and biological substances. In 2022, Ghana exported over 42 million kg worth of pharmaceutical products with biological substances constituting the greatest share of exports.

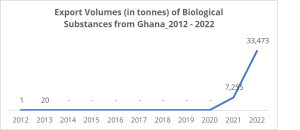

Export of Biological Substances

Biological substances specifically, blood and blood samples constituted about 78% of Ghana’s export market in 2022. The majority of these biological substances were exported to neighboring West African countries including Cote d’Ivoire, Togo, Burkina Faso, Mali, and Nigeria. Since 2021, biological substances have contributed substantially to the overall quantity of Ghana’s pharmaceutical exports. The chart below highlights export trends for biological substances;

Source: Ministry of Trade and Industry (MOTI)

Export of Medication

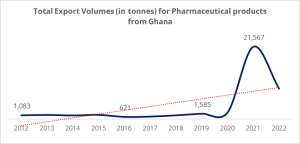

Since 2020, there has been a substantial improvement in the export activities for medication. Particularly, in 2021, the pharmaceutical market witnessed a drastic surge in export volumes. The total number of exporters increased significantly, rising from approximately 40 players in 2018 to over 150 players in 2021 and 2022. Existing players and new entrants also found new export markets within neighboring countries. For instance, companies like HomePro Company Limited have increased their export volumes by over 10X since 2021, now exporting a diverse range of medication to neighboring countries. Furthermore, there has been a broadening of the types of medicines exported from the country. Currently, Ghana exports over 80 different types of medication, primarily to West African markets. The chart below highlights the historical export trend for medications from Ghana.

Exported pharmaceutical products encompass both locally manufactured medicines and imported pharmaceutical products obtained from various countries. Notably, appetite stimulants like Amphetamine, Dynewell, Super Apetit, etc., dominate the export market. Other popular categories of exported medicines include cough medicine, antibiotics, nutrient supplements, and antimalarials, among others.

Cote d’Ivoire receives the largest share (28%) of exported pharmaceutical drugs from Ghana. The West African market, comprising countries such as Cote d’Ivoire, Togo, Burkina Faso, Benin, and Mali, serves as the primary destination for pharmaceutical exports from Ghana. The figure below illustrates the dominant exported pharmaceutical products from Ghana and the top pharmaceutical export destinations from the country.

Source: Ministry of Trade and Industry (MOTI)

CONCLUSION

The pharmaceutical market in Ghana is undergoing notable growth and displaying promising prospects, owing to collaborative efforts from various stakeholders aimed at improving domestic manufacturing and the distribution of pharmaceutical products. Notable interventions in the sector include the expansion of the list of raw materials exempt from VAT to boost the local industry, the imposition of a ban on over 40 medicines (such as aluminum hydroxide, aspirin, folic acid, amoxicillin, paracetamol, Ibru fen tablets, multivitamin tablets, etc.) to exclusively reserve production for local manufacturers. Further initiatives involving the allocation of funds to domestic pharmaceutical manufacturers for the establishment of facilities adhering to good manufacturing practices, and the creation of a pharmaceutical industrial park to facilitate large-scale production by pharmaceutical companies is expected to boost activities in the pharmaceutical sector. For entrepreneurs seeking to invest in the country’s pharmaceutical sector, establishing or expanding domestic pharmaceutical facilities can be a potentially lucrative opportunity given the increasing demand for locally manufactured pharmaceuticals both domestically and in international markets. Companies can take advantage of Ghana’s favorable export terms within the Free Zones policy to supply pharmaceutical products to international markets.

Additionally, there are opportunities to invest in the distribution networks and supply chain for pharmaceutical products. Entrepreneurs can explore avenues in logistics, distribution, and wholesale businesses to ensure the timely and widespread availability of medicines.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors. Read more on https://firmusadvisory.com/.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Research Executive

Firmus Advisory Limited

REFERENCES

[1] GCB Bank. 2022. “Pharmaceutical Industry”. Available at PHARMACEUTICAL INDUSTRY (gcbbank.com.gh)

[2] GCB Bank. 2022. “Pharmaceutical Industry”. Available at PHARMACEUTICAL INDUSTRY (gcbbank.com.gh)

[3] Food and Drugs Authority. “List of Local Pharmaceutical Manufacturing Facilities as at July 2022”. Available https://fdaghana.gov.gh/img/reports/LIST%20OF%20LICENSED%20LOCAL%20PHARMACEUTICAL%20MANUFACTURING%20FACILITIES.pdf

The post FMCG MARKET WATCH: AN OVERVIEW OF GHANA PHARMACEUTICAL MARKET [COMPETITIVE LANDSCAPE, DISTRIBUTION CHANNEL, AND EXPORT ANALYSIS] appeared first on Firmus Research.

]]>The post FMCG Market Watch; Ghana’s Dairy Market appeared first on Firmus Research.

]]>Ghana’s dairy market has shown remarkable growth signs in the past decade. The demand for dairy products continues to rise steadily owing to changes in consumer diets that have resulted from greater global integration. There is also a growing middle-income and urban population with better access to various forms of dairy products. Notwithstanding the growing demand, domestic supply is well below the effective market demand, creating a dependence on imports to close the deficit in the market. Greater exposure to foreign media has also made consumers more adventurous and aware of multiple product categories and brands and their different value offerings. Each year, several brands and categories of domestic and imported dairy products are introduced into the market creating a competitive landscape for the dairy sector.

Domestic Production of Dairy Products

Ghana’s domestic dairy market is heavy on the production of milk and cream products. A greater proportion of domestic players produce and distribute primarily milk and cream products, specifically; powdered milk, evaporated milk, fresh milk, and ice cream. Very few players manufacture fresh milk, with cheese and butter products usually produced on a small scale and mostly in informal settings. Locally, cow milk is the main source of fresh milk consumed in the country. About 45,000 tons of fresh milk is produced annually largely by pastoralists such as the Fulanis. Pastoral production of fresh milk is informal and accounts for more than 90% of total fresh milk produced in Ghana. Mostly, middle to high-income earners are cautious about patronizing local fresh milk because of concerns about their hygienic status.

Commercial production of dairy in Ghana falls under three broad categories based on scale and product coverage: large-scale production, medium-scale production, and small-scale production.

- Large-scale producers primarily produce dairy products such as powdered milk, evaporated milk, ice cream, and yogurt products for nationwide delivery and in some cases to other West African markets.

- Medium-scale producers are heavy on dairy products with relatively short shelf life such as yogurt and fresh milk. Their distribution chain usually stretches to a few major cities

- Small-scale producers also produce yogurt and the local cheese (also known as ‘wagashi’), distributing at the community levels.

Over the past five years, domestic dairy production has experienced remarkable growth signs. More local entrants have taken an interest in the market by establishing dairy production hubs while existing players continue to expand their production lines by introducing new ranges of dairy products into the market. Presently, despite competition from foreign brands, notable domestic players have capitalized on their understanding of the thriving market and their comparative advantage to gain a fair share of the market. These domestic players together with their brands have become household names, dominating the milk and cream market of the dairy sector. Notwithstanding, there are several foreign brands in the market. The table below provides details on the notable domestic players within the dairy market:

Key Domestic Players in Ghana’s Dairy Market

| Company Name | Year of Establishment | Business Outline | Dairy Product Line | Dairy Brands |

| Fan Milk Plc | 1959 | Produces and distributes milk-based and fruit-based milk, yogurt, and ice cream products. | · Ice cream

· Yoghurt |

Ice cream: Fan Ice

Yogurt: Fan Yoghurt, Super Yoghurt |

| Nestle Ghana | 1968 | Specializes in manufacturing and distributing dairy products, co-parkers, culinary, chocolate drinks and confectionery, baby foods, cereals, coffee, and drinking water. | · Evaporated Milk

· Milk Powder

|

Evaporated Milk: Ideal, Carnation

Milk Powder: Nido, Gloria

|

| Promasidor Ghana | 1999 | Manufactures and distributes dairy products, cereal, culinary, beverages, and non-dairy products. | · Milk Powder

· Cheese |

Milk Powder: Cowbel, Miksi, Mixwell, Loya

Cheese: Le Berbere |

| · | ||||

| Arla Foods | 2017 | Manufactures dairy products including milk and cream, butter, and cheese products | · Milk Powder

· UHT Milk · Butter · Cheese |

Milk Powder: Dano

UHT Milk: Dano Butter: Cheese: |

| · | ||||

| Mafricom Ghana Limited | 2020 | The company manufactures and distributes dairy products, grains, cereal, packaged and frozen foods, beverages, pharmaceuticals, and clothing. | · Powdered Milk

· Butter |

Powdered Milk: Momo

Butter: Alimo |

| Nature Farms Ghana Limited | Produces fresh milk | · Fresh Milk | Nature |

The Dairy Import Market

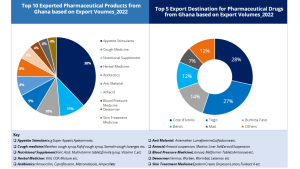

In 2022, about $ 115 million worth of dairy products were imported into Ghana, equivalent to some 50 thousand tons of products. The import volumes were however lower than the volumes in 2021 which was around 67 thousand tons of products, representing a decline of about 26%. The dominant dairy product categories imported are milk and cream products and Whey, usually used as raw materials by domestic dairy production units.

Figure 1: The Import Dairy Market in Ghana, 2022 [Source: Ministry of Trade and Industry]

- Milk and Cream Products: About 40 thousand tons were imported in 2022, constituting 80% of all dairy imports. The most common product under this category is milk powder, with about 17 thousand tons imported in 2022. Apart from being used as raw material for domestic dairy companies, milk powder is highly preferred among consumers because of its longevity and because it is consumed across different demographics. Dairy companies also use it as the main milk base for products such as evaporated milk, yogurts, etc. The top countries of origin for milk and cream imports are Belgium, New Zealand, Denmark, and Sweden. Known domestic dairy companies that import milk and cream products are Nestle Ghana Ltd., West Africa Refreshment Ltd., Fareast Mercantile Co. Ltd., Fanmilk Ghana Ltd., FNJ Investment Ltd. Promasidor Ghana Ltd., and Forewin Ghana Limited.

- Whey: Whey Powder is the dominant whey product imported into Ghana, used as raw material by Fanmilk, Promasidor, Cadbury, Nestle, and other dairy companies. About 7.5 thousand tons were imported in 2022, constituting 15% of all dairy imports. It is mostly imported from Italy, Poland, the United States of America, Denmark, and France.

- Cheese: Cheese is imported in very small quantities. About 1.6 thousand tons were imported in 2022, constituting 3.2% of all dairy imports. Unlike other countries in the West, most local cuisines in Ghana do not require cheese as a primary ingredient. Consumers of cheese are usually expatriate communities, Ghanaians from the diaspora, and a few middle to upper-class elites. It is usually sold in big supermarkets and shopping malls. The local cheese, ‘wagashi’ is consumed mostly in Muslim and Fulani communities. Wagahsi’s preparation, which includes frying, tends to be significantly different from the use and preparation of imported cheese. Notable companies that import cheese are Skyline Investment Ltd., Transmed Limited, Fire Foods Ghana, Kwatson West Africa Ltd., Melcom, and CEQA Foods and Beverage. Notable countries of Origin for cheese imports include South Africa, Poland, Denmark, Ukraine, France, and Spain.

- Yogurt: A lot of yogurts are imported from countries such as Morocco, Spain, and Nigeria to supplement domestic production. About 1.3 thousand tons were imported in 2022, constituting 2.7% of all dairy imports. Notable companies that import yogurts are Transmed, Gold Coast Matcom, Rujmali Enterprise, and Soticam Ghana.

- Butter: Imports of butter in Ghana are significantly low. Ghanaians are used to margarine than butter and thus prefer it to butter. In addition, butter tends to be more expensive than margarine. About 0.5 thousand tons were imported in 2022, constituting 1.1% of all dairy imports. Most of the butter imports come from New Zealand, Ireland, Romania, France, and Belgium.

The Diary Export Market

Ghana exported some 9.4 thousand tons of dairy products in 2022, mostly to neighboring West African markets. The primary dairy exports are yogurt products, ice cream, evaporated milk, and milk powder. In 2022, about 3.2 thousand tons of yogurt products were exported from Ghana mainly to Cote d’Ivoire, Burkina Faso, Togo, and Benin. Likewise, about 3 thousand tons of ice cream was exported to neighboring Cote d’Ivoire and Togo. Evaporated milk and milk powder are mostly exported to Nigeria and Burkina Faso. The dominant exporting companies are Nestle, Fanmilk, Promasidor, and Tony Norvisi Supply.

Key Market Developments – A Growing Health Sense Among Consumers

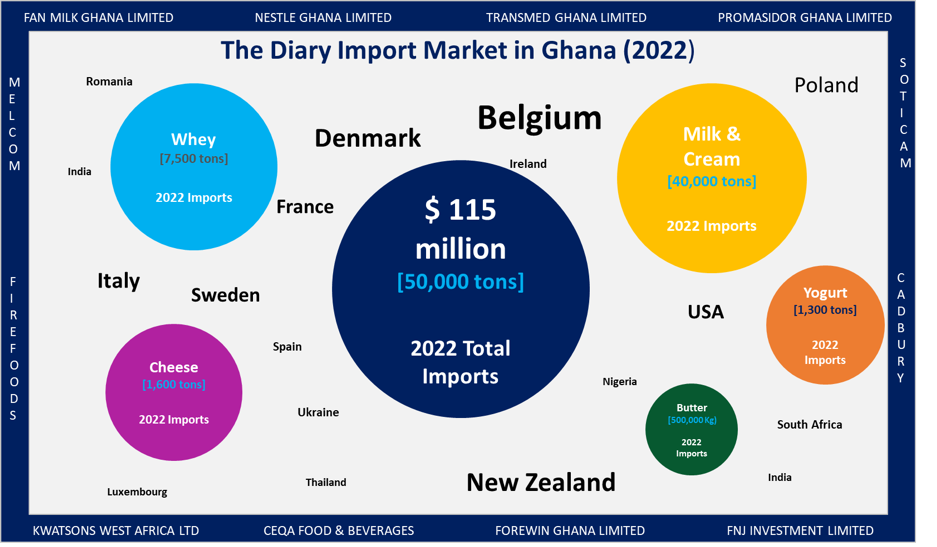

There has been an increasing draw towards healthy options in Ghana’s diary market largely due to the growing urbanization and greater media exposure. Specifically, there has been an increased demand for skimmed milk and non-dairy creamer options.

Increasing/ Growing Demand for Skimmed Milk

Growing health consciousness among consumers has led to an increasing preference for non-fat milk among consumers; skimmed milk, also known as fat-free milk contains less fat and, in some cases, no fat at all. Due to the wellness and health benefits of skimmed milk, demand for skimmed milk continues to rise, averaging 2.3 thousand tons per year in the past 5 years.

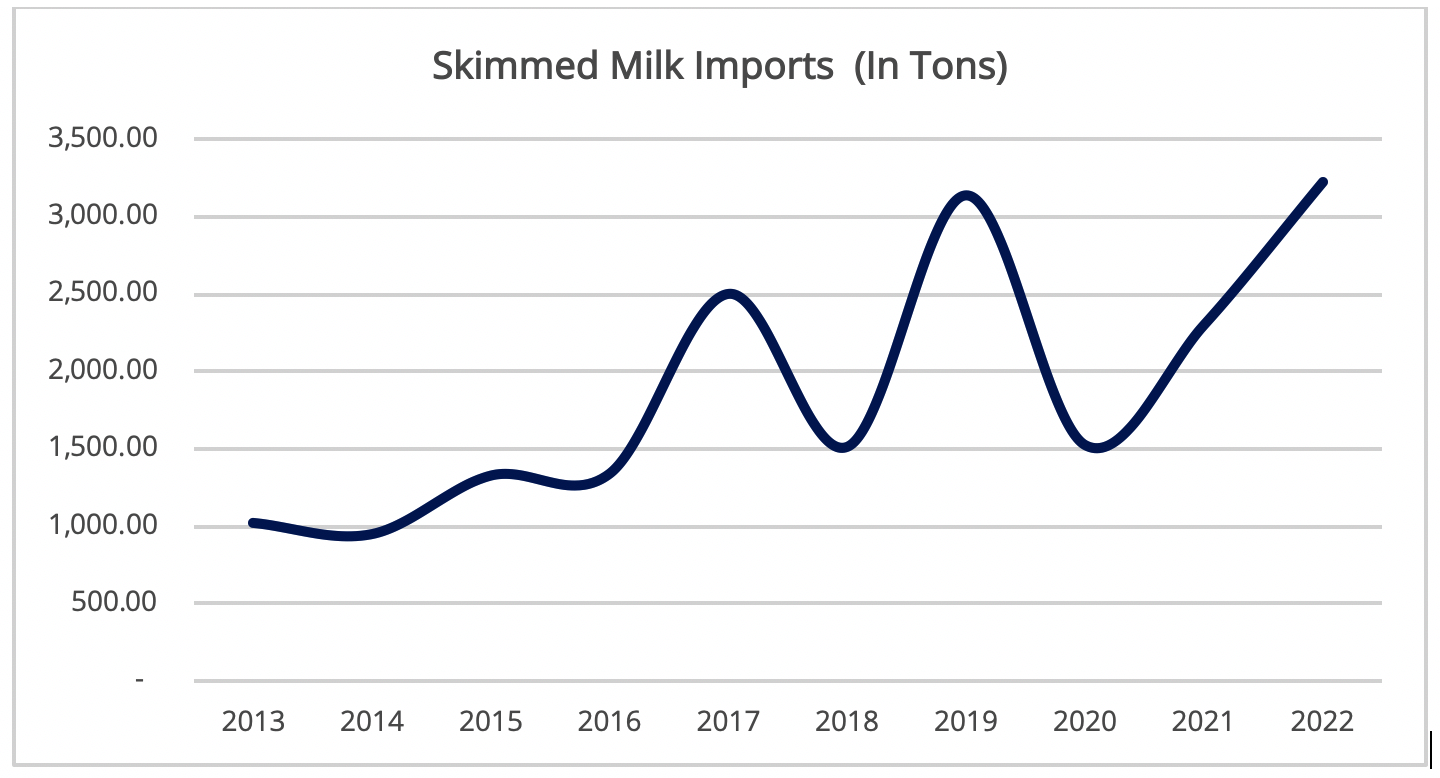

Growing Demand for Non-Diary Options

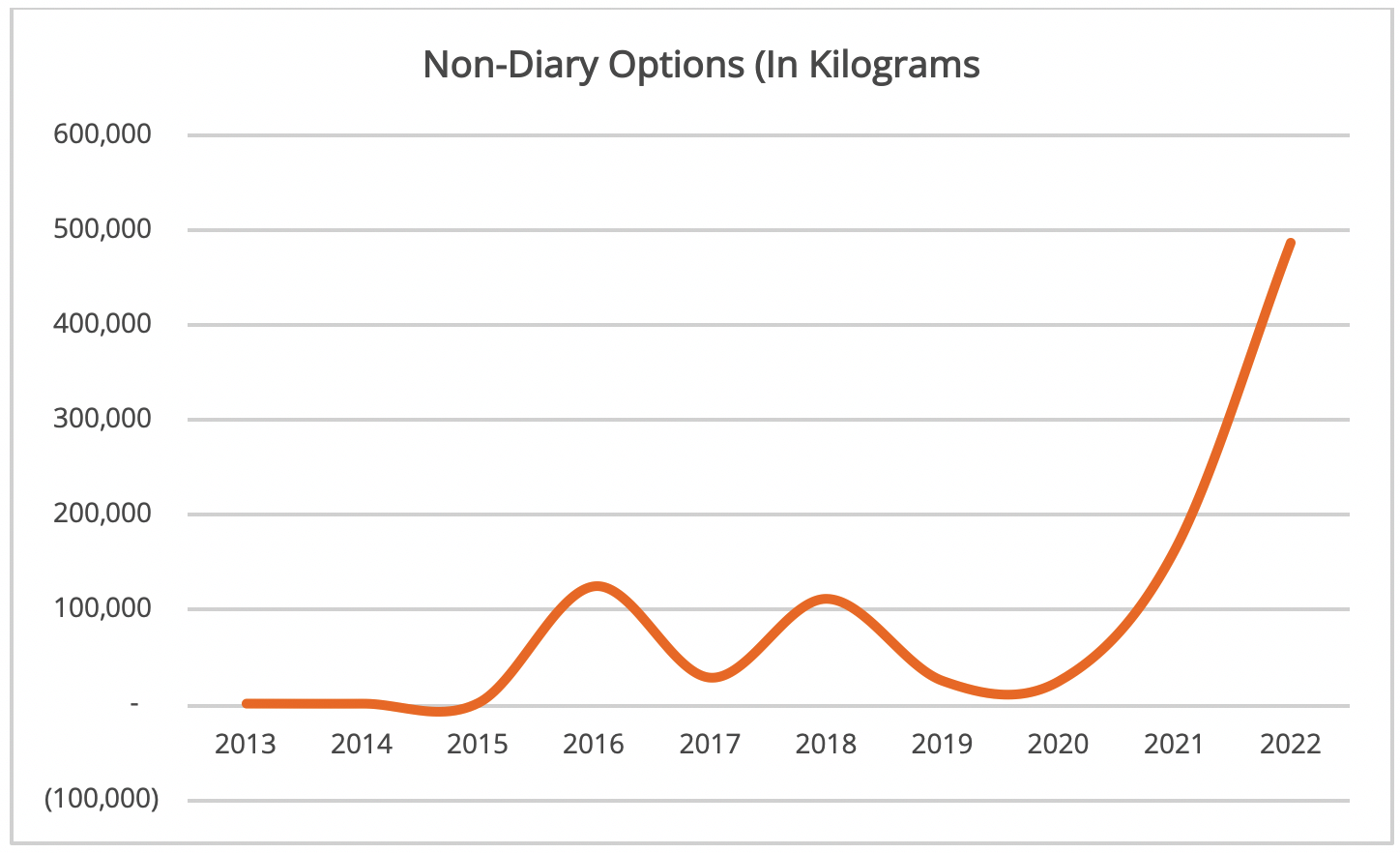

Like other healthy options, preference for non-dairy has been on the rise, especially in the past 3 years. Though the import volumes remain low compared to other milk and cream products, there is a stack difference between the average annual import levels during 2013-2017 (32 thousand kilograms) and 2018-2023 (162 thousand kilograms). The table below shows a steep rise in non-dairy options.

Market Outlook and Opportunities

Presently, milk and cream products dominate Ghana’s dairy market and will continue to dominate the dairy market, especially powdered and evaporated milk because of its longevity as well as the fact that consumers have developed a deep taste preference for it. Notwithstanding, other dairy products such as non-dairy products, and skimmed milk are expected to become a staple in the homes of most middle and high-income earners.

Further, brand loyalty in Ghana’s dairy market among consumers will continue to weaken due to the economic downturns. As a result, several opportunities exist for existing players and new entrants to introduce more options for low-priced milk and cream products, especially powdered milk and evaporated milk. Powered and evaporated milk is widely consumed across the country especially among low to middle-income groups that are severely affected by the difficult economic conditions.

Also, there is an unexplored opportunity for standardizing the production of cheese in Ghana. The ‘wagashi’ cheese is the only known Ghanaian cheese type produced locally (and in commercial quantities) in Ghana and it is widely consumed across Ghana. However, several Ghanaians, especially the growing middle class, are not able to enjoy this product because of the lack of standardization in its production.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’s particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to several local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights, and brand tracking studies across multiple sectors. Contact us today for all your professional research needs.

About the Authors

Anita Nkrumah

Anita Nkrumah

Head, Research and Trade Development

Firmus Advisory

Rachel Dampson

Rachel Dampson

Research Executive

Firmus Advisory

The post FMCG Market Watch; Ghana’s Dairy Market appeared first on Firmus Research.

]]>The post What Are Ghanaians Spending On? Import Trends and Insights for a New Market Entrant in 2021 appeared first on Firmus Research.

]]>To take advantage of these opportunities, however, a new entrant or an existing business must have insights on spending and consumption patterns of consumers. Spending patterns are a defining factor in understanding demand and consumption levels within a country. Further, imports are a direct response to market demand and economic expansion. Hence over time, the spending and consumption patterns of Ghanaians inform the type of products that are imported into Ghana and also creates viable investment opportunities for prospective investors.

For the new market entrant starting a business in Ghana, wouldn’t it be great to know exactly what product(s) to import or produce in the country based on the demand patterns? For the manufacturer or importer already operating in Ghana, how are you positioned to be relevant to consumers as well as be competitive in the market? Knowing what Ghanaians are spending on will certainly be a useful insight.

So, what are Ghanaians spending on?

Ghanaians are spending on everything – from food products, healthcare products, apparels, electronics to building hardware.

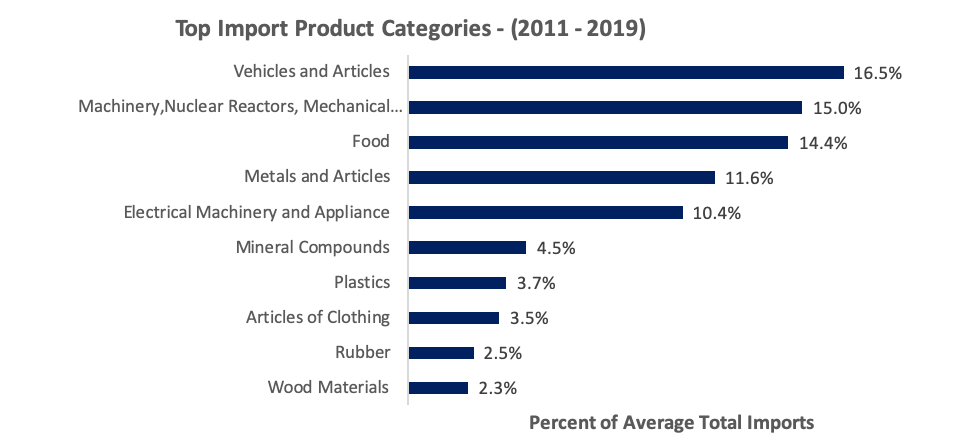

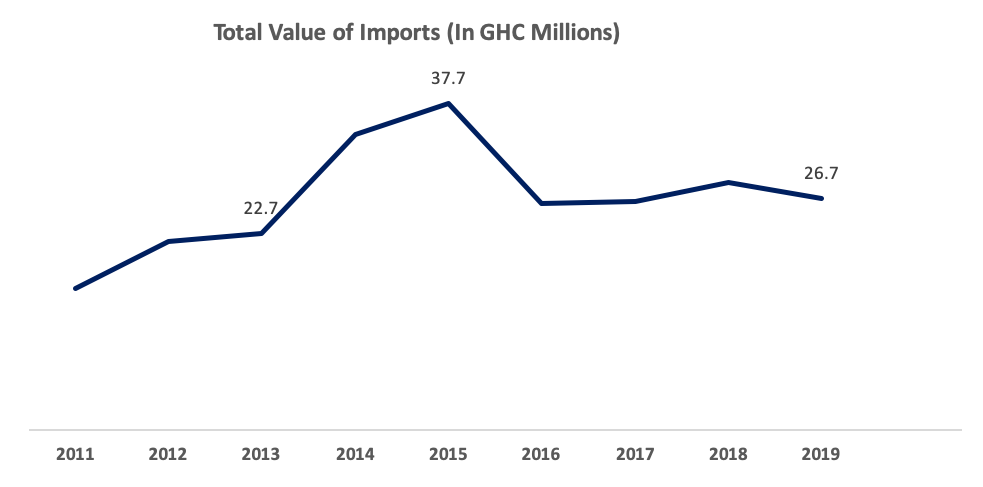

Analysis of trade data for the past 9 years (2011 -2019) reveal that food commodities, vehicles, machinery, electrical appliance, and plastics are among the leading imported products classes in Ghana. Actually, the top 10 imported products (excluding minerals and oil and gas) across the years constitute over 84% of the total imports, valued at an average of GHC 23 billion each year. The chart below highlights the top 10 import product categories and the percentage of total imports they constitute.

Source: Ghana Statistical Service

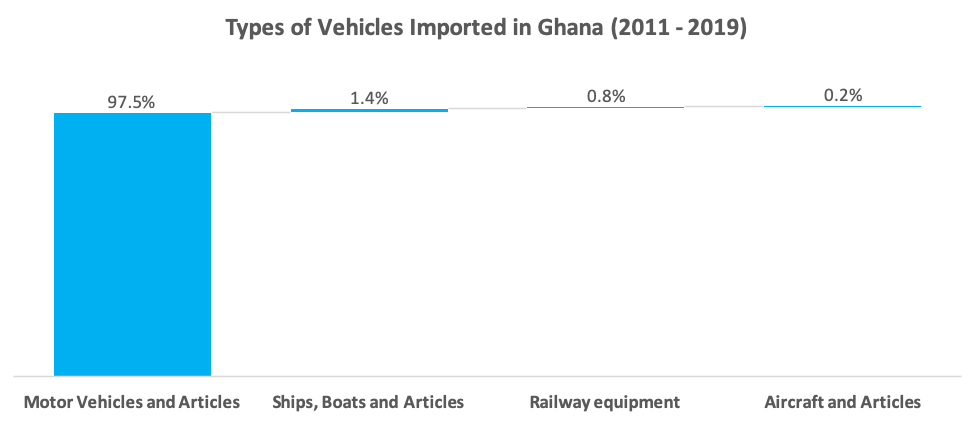

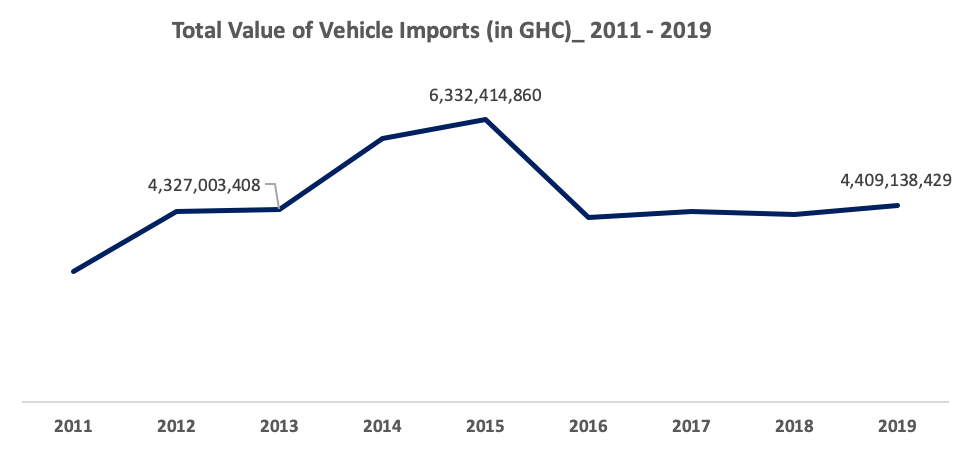

Vehicles, both used and new and all its articles, is the most dominant product category in Ghana’s imports, constituting as high as 16.5% of total non-oil imports every year. This is followed by machinery, nuclear reactors, and mechanical appliance with 15% and food with 14.4%. For each of these top product categories, there are different items that are imported by individuals and businesses in Ghana. Details of the specific products imported for the top 3 product categories is further emphasized.

Vehicles and Articles

As seen in the chart above, vehicle imports top the list of primary products imported into Ghana. Between 2011 and 2019, an annual average of GHC 4.54 billion worth of different vehicles and its articles were imported into the country. Given that road transport is the primary means of transportation for passengers and goods in Ghana, motor vehicles and its articles (spare parts and accessories) tops vehicle imports, constituting about 97.5% of total vehicle imports. The remaining 2.5% is split between ship and boats (1.4%), railway equipment (0.8%) and aircraft and articles (0.2%). The government of Ghana through the Ghana Automotive Development Policy (GADP) seeks to develop a local automobile industry by given incentives (including restrictive incentives) to attract global Original Equipment Manufacturers (OEMs) and other component manufacturers into the country. Already, top OEMs like Volkswagen and Toyota has set up assembling plants in the country.

Source: Ghana Statistical Service

Source: Ghana Statistical Service

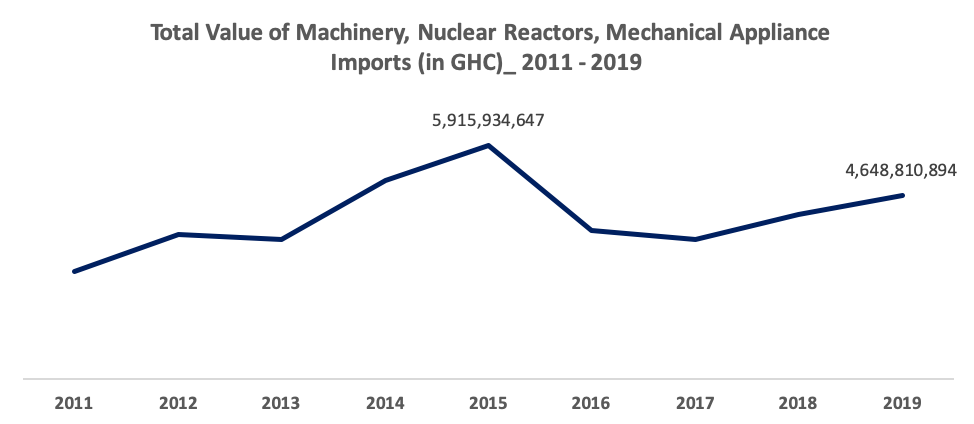

Machinery, Nuclear Reactors and Mechanical Appliances

The next category of items imported most into Ghana are machinery, nuclear reactors and mechanical appliances. On average, machines and appliances worth GHC 4.3 billion are imported into the country each year. It includes both industrial and agricultural machines as well as nuclear reactors and other heavy machinery used in constructions.

Some top imported items under this category are transporter cranes or gantry cranes, team turbines for marine propulsion, machinery for filling and closing bottles, packaging or wrapping machines, bakery machines and other agriculture machines such as harvesting machines. The charts below provide more details.

Source: Ghana Statistical Service

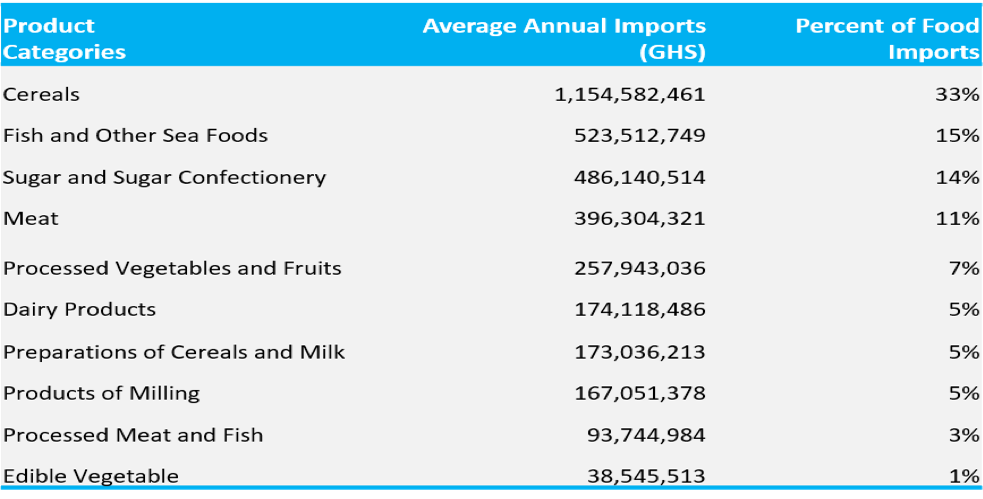

Food

The third category of items imported most into Ghana is food (excluding beverages). Over 16 sub-categories of food are imported into the country including cereals, meat, fish, spices and fruits among others. Cereal is the primary food category imported with an average value of GHC 1.15 billion of different types of cereals imported annually. The most common cereals imported are maize, wheat, rice, oats and millet.

Ghanaians spending is also skewed towards other categories of food items imported that include fish and other sea foods, which constitute about 15% of total food imports.

Sugar and sugar confectionery also follows with an annual average value of GHC 486 million, constituting 14% of total food imports. Other important food imports are meat (11% of total food imports), processed vegetables and fruits (7% of total food imports), dairy products (5% of total food imports), preparations for cereals and milk (5% of total food imports) and food products for milling ((5% of total food imports). Preparations of cereals and milk include processed cereal items such as biscuits, waffles and pasta, while products of milling include various types of flour such as wheat flour, and maize flour. The table and chart below provides more details.

Source: Ghana Statistical Service

Source: Ghana Statistical Service

Market Entry Insights for New Businesses

Ghanaians are generally open to trying new brands, if the pricing is right and quality is good. There are three fundamental factors that a new market entrant should consider;

- Consumers in Ghana are very price sensitive – the pricing strategy adopted for your business or products should be backed by independent research.

- Have a strategy for credit for your B2B clients. Distributors or Agents love to have some form of credit from importers.

- Have a strong budget for marketing and promotion in the initial 3 years especially in the consumer and retail space – food, beverage, home and personal care segment.

Majority of Ghanaians fall within the low to lower-middle income class and so price comes first in deciding what to buy. There is a market for premium products, however, products targeting low to middle income consumers should consider price as a key factor in the market entry stage. Hence your ability to source the products (which must be of relatively good quality) at competitive prices and have a long-term strategy will determine your market success.

Further, a good amount of trading in consumable goods is carried out on credit basis in Ghana. Most medium to large distributors/wholesalers with good distribution channels will want to trade with you, but on credit, especially at the market entry stage. Whatever you do, have a strategy for credit.

However, as customers get to know your brand and you gain market share, you may tighten up your credit policy and even be able to have distributors/wholesales make advance deposits for their goods.

You definitely need to have a budget for marketing and promotions in order to penetrate the market. There is an influx of imported products on the Ghanaian market across all segments. There equally exist very strong local brands doing well in key segments like food, beverage and home and personal care. The Ghanaian consumer therefore has a lot of options, making achieving product visibility through effective marketing and promotion, a defining factor to success.

Looking Forward

Total Import expected to decline further

We expect the downward trend in total imports to continue as the new local factories expand capacity and demand for local products increases. This is coupled with the fact that 3 global giants in the automobile industry are establishing assembly plants in Ghana and Government is expected to institute some restrictive measures on vehicle imports (which is the topmost product category imported into the country). Again, other new factories are expected to be commissioned under the Government’s One-District-One-Factory program. Overall, we expect the import volume to further decline.

Source: Ghana Statistical Service

Have a long-term plan to add value

As a new market entrant, you may start with trading through some agents or distributors in Ghana to gain some market share. However, for long-term success and growth, have a plan to set up some processing, assembling or manufacturing plant in Ghana. Otherwise, your market share could be eroded as local production picks up. This trend has been seen in several sectors like the production of ceramic tiles, baby diapers, biscuits, tomato paste and happening now with the automobile industry.

The Retail space is expected to continue growing

Ghana’s retail sector is expected to continue on its growth trend. E-retail is catching up with the growing middle class. It is expected that this sector will grow as lifestyles keep changing and the working class keeps exploring more convenient ways of shopping.

Conclusion

In trying to explore innovative ways of reaching out to the Ghanaian consumer, it is important to consider, through research, the following market dynamics:

New entrant/investor:

- What product (brand, fragrance, flavour, packaging, design etc.) should you focus on?

- What is the price sensitivity, competition and demographic analysis for your product?

- Where can your target market be found and how do you reach them?

- What are the import duties, taxes etc. for your products and how does your final price compare with existing market prices for same products offered by competitors?

Existing business:

- How well do you understand your brand’s health?

- What will be the best approach to grow your market share?

- What is the competition doing differently and what marketing channels should you adopt?

With your knowledge of what Ghanaians are spending on, it’s time to dig further into these product segments, to carve out your own product and market entry strategy to drive success.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors.

The Authors

Alex Twumasi

Managing Partner

Firmus Advisory Limited

Anita Nkrumah

Head of Research

Firmus Advisory Limited

You can also Download a copy of this Research in PDF Below

See Other Research Publications: Ghana’s Disposable Baby Diaper Market in Focus 2021

The post What Are Ghanaians Spending On? Import Trends and Insights for a New Market Entrant in 2021 appeared first on Firmus Research.

]]>The post Ghana’s Disposable Baby Diaper Market in Focus 2021 appeared first on Firmus Research.

]]>Types of Baby Diapers in the Ghanaian Market

The diaper market in Ghana is showing growth signs and is broadly classified into cloth and disposable diapers based on product type, with greater demand for disposable diapers.

Figure 1: Types of baby diapers in the Ghanaian Market (Source: Market Survey. 2021)

Share of local brands to foreign brands in the market

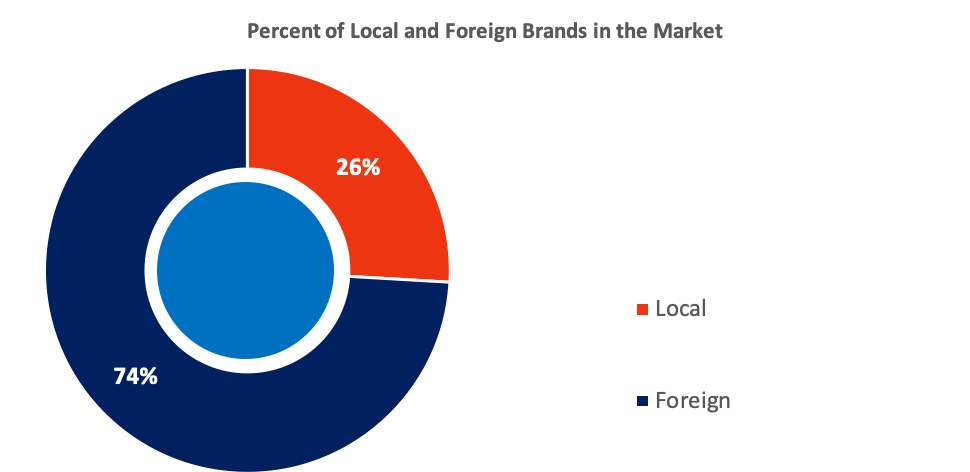

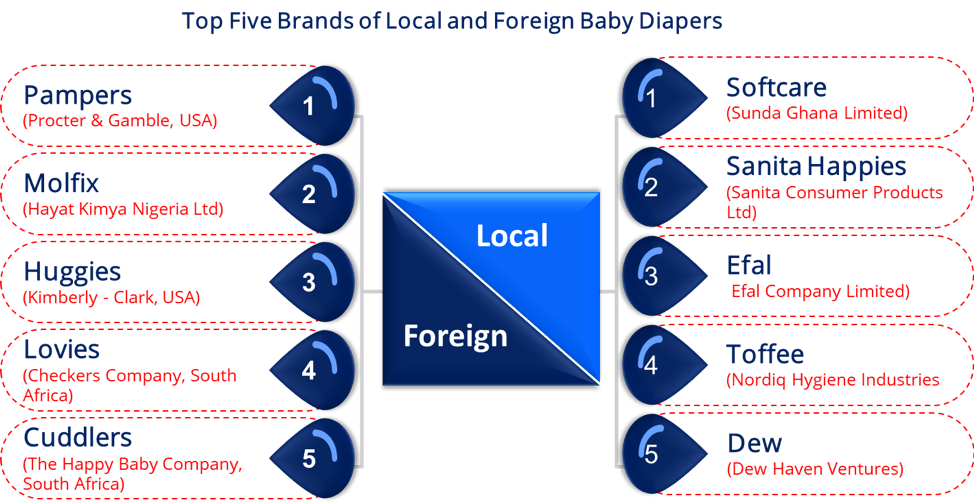

The market is flooded with different brands of diapers, both foreign and local, each gaining a fair share of the market due to their unique product characteristics and niche marketing. Currently, of the total number of brands in the market, about 74% of them are foreign brands, with just about 26% of brands being local.

Figure 2: Percent of Local and Foreign Baby Diaper Brands in the Market (Source: Firmus Market Survey, 2021)

Read Here Also : Increase in Supply, Marginal Decline in Demand [An Occupancy Analysis of Commercial Real Estate in Accra]

Foreign diaper brands have been the order of the day in the Ghanaian diaper market for a very long time: they have a varied range of product categories and are perceived to be of high quality. Domestic production of diapers on the other hand is fairly new in Ghana with the first production starting around 2016. However, in as much as foreign brands dominate the Ghanian market, demand for local brands has been on the rise and it’s set to take over demand from foreign brands largely due to price advantages as well as the growing visibility and popularity of the local brands.

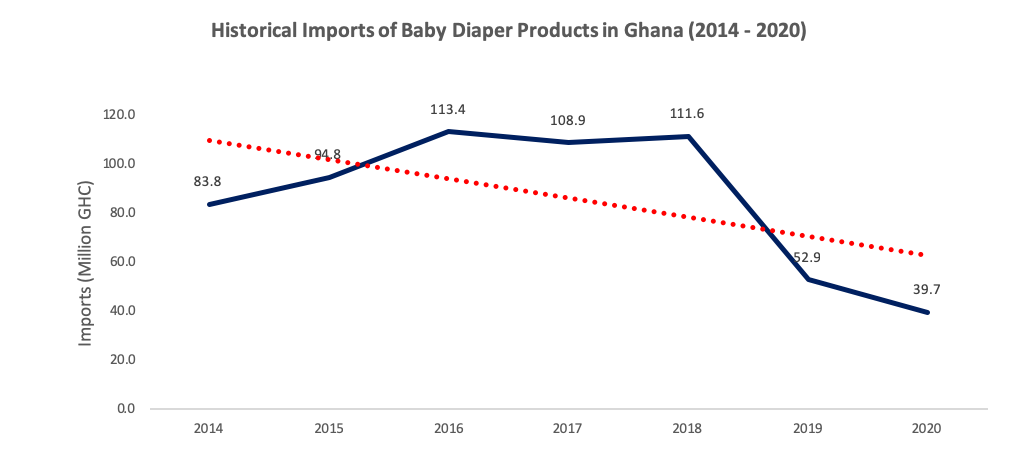

Further, import of baby diaper products have been on decline in the past 5 years, around the same time local manufacturing began to take root. Specifically in 2019, imports decreased by as high as 53% following the establishment of the Sunda Ghana baby diaper factory in 2018 – Sunda Ghana produces the fastest moving baby diaper brand in Ghana, the Softcare brand. Imports further declined by 25% in 2020.

Figure 3: Historical Imports of Baby Diaper Products in Ghana (Source: MOTI, Ghana)

Top Countries of Imports

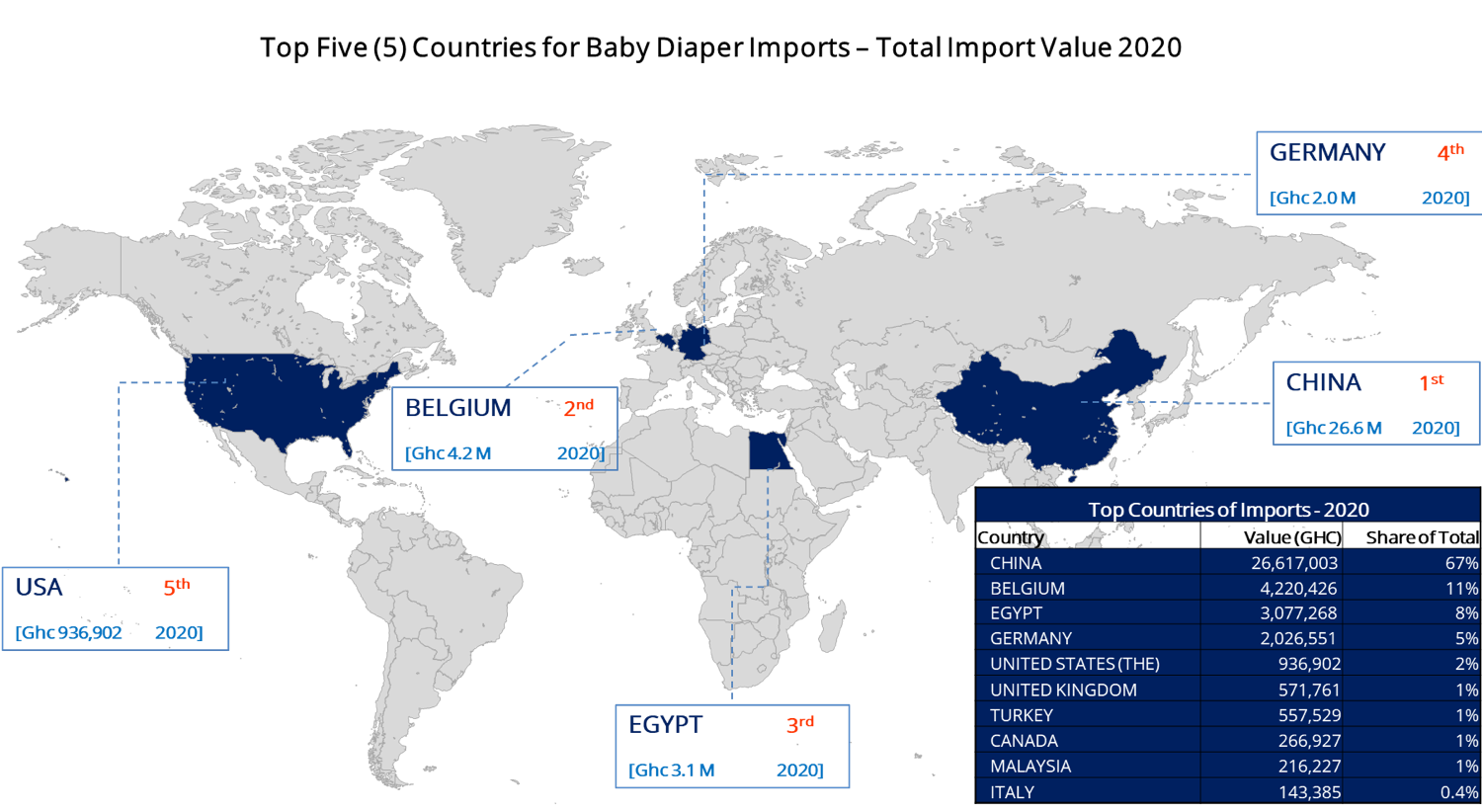

China has dominated the import market for baby diaper products over the past decade. Presently, China controls about 67% of the total imports into the country, followed by imports from Belgium which constituted 11% of total imports in 2020. Overall, imports from the top 5 countries accounted for 93% of total imports in 2020. The chart below provides further details.

Figure 4: Top Countries of Import for Baby Diapers (Source: MOTI, Ghana)

The Competitive Landscape

The baby diaper market is highly competitive with a considerable number of local and foreign players. Over the years, these players have adopted strategic marketing initiatives to develop a niche for their brands and to also capture a fair share of the market. The market is predominantly dominated by Sunda Ghana Limited, Procter and Gamble, Sanita Consumer Products Limited and Kimberly-Clerk. Increasing preference for locally manufactured brands is expected to scale-up demand for baby diapers with local brands dominating the market over time.

However, foreign brands such as Pampers, Molfix, Little Angels, Huggies and among other brands are also demanded by a section of the middle to higher income earners owing to its high price points as well as the selective distribution channels used, which is mostly favorable to that section of the population.

The figure below highlights top competitive brands and the major key players behind these brands.

Figure 5: Top Local and Foreign Baby Diaper Brands in the Ghanaian Market (Source: Firmus Market Survey, 2021)

Drivers of Demand

Effective and strategic advertisement is crucial

Increasing advertisement is a major strategic marketing initiative fueling demand for baby diapers in the market. Due to the nature of competition in the market, advertisement controls demand trends and market acceptance of a brand; strategic advertisement creates market awareness and deepens market penetration. Brand visibility and popularity which is achieved with strategic advertisement influences 45.5% of market demand for baby diapers in the Ghanaian market. This is followed by other factors including product quality, price and packaging recording 27%, 18.2% and 9.1% respectively. Key stakeholders such as Sunda Ghana Limited, Pampers Ghana and Sanita Consumer Products Limited are growing on consumers due to effective marketing across both urban and rural cities in the country. These brands effectively advertise on both traditional and digital platforms.

Increasing health and hygiene awareness

Increasing concern for the health and hygiene of infants is also a predominant driver of demand for baby diapers in Ghana. This primary concern among consumers has led to the infiltration of different brands of baby diaper products from different part of the world in the quest to meet the health and hygienic standards consumers’ desire. Also, consistent education via digital and traditional media by key players in the disposable industry reiterates the need to practice general hygiene for infants. The key message – baby diapers provide comfort, breathability and absorbency that are beneficial for the health of infants compared to other substitutes – has resonated with most consumers.

General preference for local brands

Ghana’s baby diaper market has seen a major boost owing to market penetration of local brands which are manufactured and packaged in the country. Since the inception of local production of baby diapers in the 2000s, the diaper market has witnessed a remarkable growth. Domestic companies have capitalized on increasing consumer preference for local brands to meet the market demand for baby diapers in the country with each brand developing a market niche for their products. Consumer preference for locally manufactured brands can be attributed to price, accessibility, and availability, as well as a conscious acceptance of local products.

Increasing disposable Income

Generally, increasing disposable income leads to a simultaneous increase in either consumer purchasing power or savings. Ghana’s move to middle-income country implies increasing disposable income and a simultaneous increase in standard of living. A 6.5% average annual growth rate in Ghana’s Gross Domestic Product[2] (GDP) over the past decade has had a positive influence on the spending power and socio-economic development of consumers, hence expenditure on baby care products have equally increased.

Diverging Trends in the Baby Diapers Market

Consumers are becoming price sensitive

Baby diapers just like other FMCGs are highly price driven. Brand loyalty in the baby diaper market is generally low due to the price-sensitive nature of the market. Consumers place high importance on price causing the demand to be somewhat elastic in nature – For 18.2% of consumers, price is the most important factor influencing their demand for baby diapers. Typically, in Ghana, there is a high preference for stick-on diapers to pant diapers due to its relatively lower prices in addition to the fact that it is easy to use. The forces of price and demand cannot be downplayed in the market with all other things being constant.

Digital marketing is the turning point

The relationship between digital marketing and its impact on consumer demand is positive. Growing market dynamics has contributed to the exploration of different marketing initiatives within the baby diaper market. Major players have adopted digital marketing via influencer marketing – social and non-social media marketing by associating their brands with celebrities and influencers – to encourage brand demand and usage. Content marketing, affiliate marketing, video marketing among others cannot be underestimated. Market competitiveness has led to key players endorsing different digital marketing strategies to draw attention to their brands. Growing online marketing of baby diapers is the new drive for the baby diaper market.

Potential For Investment

The potential for investment in the disposable diaper market is still great. Demand for diapers is high with an estimated 500 million units plus consumed annually. Greater health awareness and consciousness is also set to further increase demand for baby diapers in the medium to long term, with a significant portion of this demand allotted to locally manufactured brands.

Presently there are about 5 local manufacturers with just one of them gaining significant presence in the market. Further, almost 40 million Ghana Cedis worth of baby diaper products are still imported into the country at a time when there is greater acceptance for locally manufactured brands. Moreover, any production facility set up to produce baby diapers can easily be adopted to producing other fast moving consumer products such as sanitary towels.

There are also several incentives such as tax holidays set out by the government of Ghana to attract investors into the manufacturing sector under the ‘One District One Factory’ policy. Opportunities also exist to export to other countries within the West African sub-region, especially landlocked countries such as Mali and Burkina Faso, facilitated by the African Continental Free Trade Agreement.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors. Read more on https://firmusadvisory.com/.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Rachael Dampson

Research Executive

Firmus Advisory Limited

References

[1] Pulp &Paper Africa “West Africa: Disposable Baby Diapers Industry” [Online]. Available at http://africapulpaper.com/en/articles/west-africa–disposable-baby-diapers-industry–

[2] MoFEP. 2021. Ministry of Finance and Economic Planning. https://www.mofep.gov.gh/

The post Ghana’s Disposable Baby Diaper Market in Focus 2021 appeared first on Firmus Research.

]]>The post Increase in Supply, Marginal Decline in Demand [An Occupancy Analysis of Commercial Real Estate in Accra] appeared first on Firmus Research.

]]>In the early part of the 21st century, successive governments placed emphasis on the development of Ghana’s private sector, fueling the influx of foreign investors and multinational firms into several sectors of the economy, including insurance, financial, oil and gas, telecommunications as well as healthcare services. This led to increased demand for not just office spaces but for an improved office stock. As demand increased, local and foreign construction companies began to invest in commercial real estate across various areas in Accra.

Commercial real estate in Accra is generally concentrated in the Accra Central Business District and the Airport areas – these areas have seen massive development of Grade A and B spaces. In as much as there has been an increase in demand for office spaces over the years, the rate of occupancy, relative to the supply, is low. The impact of COVID-19 will not be brushed aside as it has also played a role in the reduced levels of occupancy. As companies continue to work remotely, the probability of some returning to physical working spaces is low, which may further reduce occupancy rates in the market.

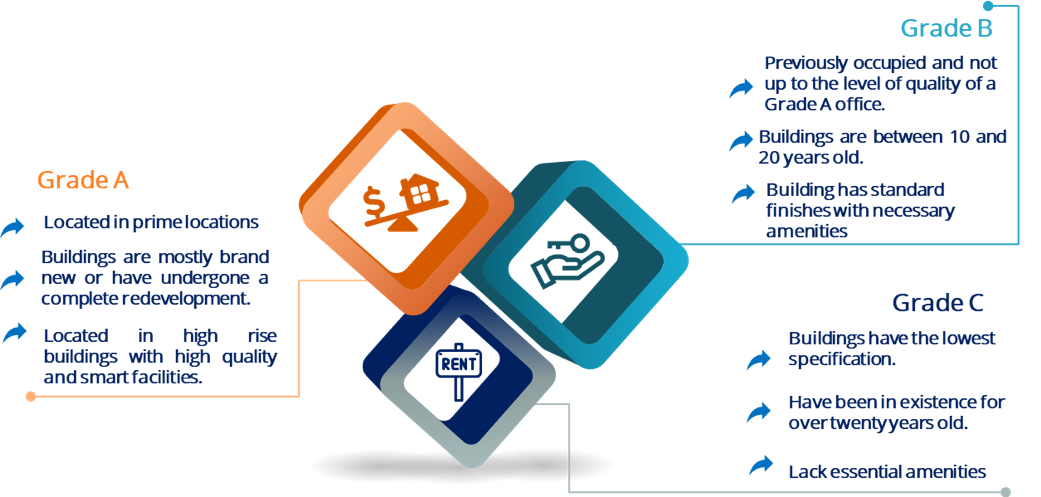

The Office Grading Structure in Ghana

Ghana’s office grading structure follow global standards created to aid estate agents, investors and other stakeholders in the property market justify property prices and to support thorough analysis of the sector in terms of the level of demand among others. Just as on the global scene, office buildings in Ghana are classified into Grade A, Grade B and Grade C. The figure below defines the elements considered for each grade.

Figure 1: Grade Specifications in Ghana’s Commercial Real Estate Market

Grade A and B offices have better conditions and are more competitive, thus attracting high-end clientele and resulting in high rental rates.

Office supply in Accra is centralized in two main areas; Accra’s Central Business District (CBD) and the Airport Area. Commercial real estate in the Accra CBD covers the West Ridge and North Ridge districts and is typically occupied by large financial institutions as well as government offices. Whereas, offices in the Airport Area covers the north of Accra and is occupied by professional services and the oil and gas industry. Further, the Airport area benefits from its accessibility, both in regards to the airport and residential areas and has recently seen an improvement in the quality of offices. Most of the offices in the Accra CBD area are of Grade B quality, while most Grade A offices are located in the Airport Area.

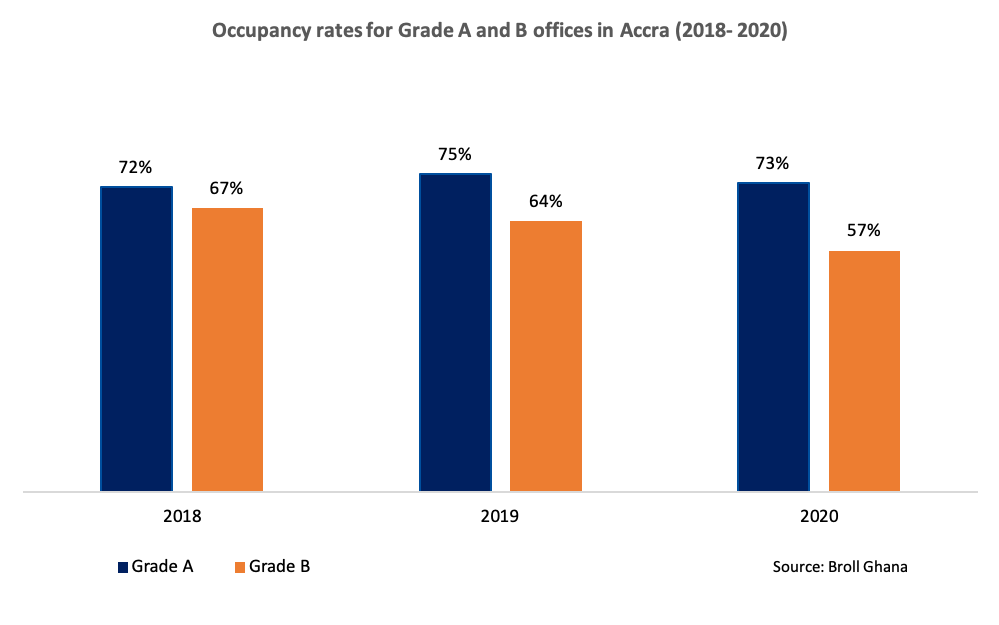

Occupancy Rates for Grade A and B Offices in Accra

Occupancy or vacancy rates are relevant metrics in the property market, as occupancy rates have a positive correlation with prices. Occupancy rate is the ratio of rented or used space to the total number of available spaces, while vacancy rates is the opposite of it.

Generally, in Accra, occupancy in Grade A offices tend to be higher than occupancy in Grade B offices indicating a higher preference for the former. Grade A offices are mostly occupied by large firms and multinational companies who have a steadier revenue flow, whereas Grade B offices are mostly occupied by SME’s with relatively less stability in their income flows. Over the past three (3) years, the occupancy level in Grade A offices have remained relatively stable, averaging 73% between 2018 and 2020. On the other hand, occupancy rate in Grade B buildings have been on decline since 2018 with the greatest decline being in 2020, partly due to the effects of the Covid-19 pandemic.

Figure 2: Occupancy Rates in Grade A and B Offices in Accra (Source: Broll Ghana)

Trends Shaping the Market

Impact of Covid-19 on Commercial Real Estate in Accra

The Covid-19 pandemic has significantly affected the commercial real estate market in Accra as it has led to delays in potential transactions. Most property viewing appointments were cancelled due to border closures and lockdown restrictions. Some occupiers, including both local and international businesses, exited their spaces due to the negative effects of the pandemic on their businesses; office spaces were severely hit by the pandemic, as several businesses adopted to working remotely. Going forward, most businesses are set to re-order their work structure to accommodate remote working thus, saving on rent and electricity costs in the long run. As the effect of the pandemic reduces, occupancy rates may stabilize though the long run effects of the pandemic may linger.[1]

Supply Increases Meets Decline in Demand

On aggregate, demand for office spaces has declined over the years, though supply has increased, thus forcing marginal reductions in prices. For instance, grade A spaces attracted rent between USD25 to USD35 per sqm per month in 2019 as compared to USD30 to USD45 per sqm per month in 2018, as more than 41,000 sq meters of additional space came onto the market in 2018 in locations such as Atlantic Towers, SCB Towers and 335 Place. Notwithstanding, Grade A office buildings have higher demand compared to other office grades due to the availability of modern amenities and the location of these offices. New developments such as Atlantic Tower have recorded higher occupancy rates even though generally demand remains low. Grade B offices however experienced low demand, most likely due to their outdated amenities. [2]

Large Corporations Move to Build Their Own Offices

A notable observation is the fact that large corporate institutions are transitioning to building their own headquarters, thus causing vacancies in rental properties. Companies that have made this move include Ecobank Ghana Limited, MTN Ghana, VIVO Energy Ghana Ltd, PricewaterhouseCoopers (PwC Ghana) and Toyota Ghana Company Ltd. This trend is expected to continue, which will further deepen the demand slump over the long term.

About Firmus Advisory Limited

Firmus Advisory offer a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Laudina Adjei-Boatey

Research Executive

Firmus Advisory Limited

References

[1] Devtraco Limited. 2020. “Implications of COVID-19 on Real Estate in Ghana”. Available at: https://devtraco.com

[2] Broll Property Intel. “Ghana Market Barometer” Available at: https://www.brollghana.com/publications/

Read or Download the PDF Version of this Report Below

Increase in Supply, Marginal Decline in Demand (An Occupancy Analysis of Commercial Real Estate in Accra)_Firmus_ResearchThe post Increase in Supply, Marginal Decline in Demand [An Occupancy Analysis of Commercial Real Estate in Accra] appeared first on Firmus Research.

]]>The post Market Research on Fish Farming and Aquaculture in Ghana appeared first on Firmus Research.

]]>Before you read more, Click here to download full Market Research Report on Fish Farming in Ghana

Market Growth/ Industry Structure

The fishing industry in Ghana is generally made up of the marine, inland (freshwater) and aquaculture. The sector is dominated by the marine subsector which has the highest level of production, followed by the lagoon and inland subsectors and then the aquaculture sub-sector. The marine and inland fisheries have recently reached maximum sustainability and have led to declining stocks. In an effort to compensate for the declining marine catches and to meet the demand, aquaculture has been widely promoted with the hope of bridging the gap.

Investment Opportunities in fish farming

Investment opportunities exist in fish farming such as the production of fish feed, rearing, and stocking of high-quality fingerlings and training and capacity building in fish farming.

- Ghana is currently running a monopoly market in fish feed production, but the introduction of another feed mill would promote competitive pricing of fish feed. Presently, Raanan Feeds (Indian company) which is one of the largest feed mills in Ghana, is responsible for 70 percent of total production. Some farmers may opt to import fish feed but it is estimated at a 30 percent increment after import dues and charges.

- There has been an increase in private hatcheries to aid the development of aquaculture, however, there is still a deficit of 50 million fingerlings annually. The deficit supply of fingerlings limits the number of potential fish farmers in Ghana and further leads existing farmers to resort to undesired species to reproduce. There is a market need for a reliable hatchery which can produce fry and fingerlings of high quality.

- Training and education are of the need for the youth across the entire value chain; new fish farming methods, technology, harvesting, draining ponds, stocking cages and ponds and fish farm maintenance are key industry skill requirements. There are numerous opportunities existing for the private sector to fill this gap.

Drivers of the fish farming market

- Increase in Demand for Fish

The increasing demand for fish globally and nationally and the declining supplies facing Ghana’s economy is another reason for the development of aquaculture. In Ghana, more and more people are shying away from red meat as a source of protein due to health implications and are resorting to fish.

- Alleviation of Poverty & Provision of Food Security

These are the major drivers of the market and the development of the sector in general. Also due to the role fishery plays in its contribution to GDP, the government has promoted aquaculture as a means of augmenting the declining marine catches yearly to provide food and employment for the populace.

Market Challenges

The aquaculture development in Ghana is constrained by several factors, characterized by two components:

Limited Availability of Inputs

- Lack of fingerling production in Ghana

- Lack of affordable feed throughout Ghana for startups

Lack of Support for Farmers

- Lack of investors due to inadequate information on the profitability of the sector.

- Lack of financial support for small-scale fish farmers

- Absence of research on fish farming practices in Ghana

Forecast Market Growth

From 2009 to 2016, available data collated from the Ministry of Food and Agriculture shows aquaculture’s steady rise in yearly fish production. In comparison to catches of marine and inland fisheries, the output of aquaculture rises steadily every year.

Regulatory and Legal Framework Governing the Fishing Sector

- The Fisheries Act (2002) is the main statute concerning the development and sustainability of fishery within Ghana.

- To ensure the growth of the sector the government has banned the import of fish, in order to encourage local production.

- There is also a 15 percent tax on imported seafood of any kind.

Tax Incentives for the Fish Farming

Some businesses enjoy tax holidays or exemption periods. During these exemption periods, income is not taxable. Fish farming enjoys a five-year tax exemption period, as a tax incentive.

Also, all farming inputs are duty-exempt to promote the industry.

National Policy / Government program for Fish Farming

- In 2017, the government officially launched a $53 million programme at Libga in the Savelugu/Nantong Municipality of the Northern Region to boost aquaculture.

- “West Africa Regional Fisheries Programme” (WARFP) was formed in fulfillment of the objective of the Ministry of Fisheries and Aquaculture Development and the Fisheries Commission’s objective to restock dams and dugouts in the Northern Region. The International Development Association (IDA) of the World Bank presented US$50.3 million funding while the Global Environment Facility (GEF) provided US$3.5 million for its implementation (citifmonline, 2017).

- The programme is expected to directly benefit an estimated 206,000 Marine and Lake Volta fishers, at least 27,000 women fish processors and over 3,000 fish farmers. They also intend to build 100 dams and dugouts with a total water surface area of about 2,860 hectares in 35 districts nationwide.

Market Analysis and Trends

Market Characteristics, Demand, Size, Growth

- Ghana has a high domestic demand for fish and has one of the highest consumption per capita in the world (20 – 25kg/year). UN-Habitat predicts that the growing population and increasing urbanization means the market for Ghanaian aquaculture is also expanding.

- Currently, 87 percent of households in Ghana are recorded to be consumers of Tilapia, especially in the smoked form. It also largely consumed by hotels, restaurants and other food services are in Ghana.

- Typically, for small-scale fish farmers especially, Tilapia is sold directly to consumers or to local processors normally they at subsidized prices. Larger scale farmers, on the other hand, try to dispel the middle women and sell directly to consumers.

- Transportation of fish in Ghana is a major headache for small-scale farmers, especially inland. These farmers may not be close to their ideal consumption sites and so must rely on middlemen to do the sales and distribution else, risk losses.

- A solution here that some farming associations have introduced is to pool their fish and pay for transport collectively to get their fish closer to the consumption centers. Larger scale farmers have no problems sending their produce to outlets in urban centers to sell as they sell on demand to hotels, restaurants and the like.

Consumer Analysis and Key Buying Criteria

About 10,000 MT of fresh fish is harvested from other smaller rivers and lakes each year and processed for sale in urban markets. Inland fishing centers in remote areas are not easily accessible to the major consuming centers. This results in expensive inland fish products and deterioration in quality during distribution.

During the main fishing season, the consumption of fish and in particular fresh fish increases in coastal and inland areas. In the lean season, fish is mostly sold and purchased for consumption in smoked form from local sources.

Conclusion

Ghana’s fish consumption requirement is about 720,000 metric tonnes however, fish supply stands at 400,000 annually. Ghana has a natural potential for aquaculture, yet after years of adoption, aquaculture’s contribution to the economy has been quite low. According to Ghana’s 2018 budget statement, aquaculture contributed 3.5% to Ghana’s Real GDP, a decline in the 5.7% recorded in 2016. The growing population and increasing urbanization in Ghana mean the market for Ghanaian aquaculture is also expanding, hence the need to revamp the sector.

The post Market Research on Fish Farming and Aquaculture in Ghana appeared first on Firmus Research.

]]>The post Technologies and Innovations: The Rise of the Digital Ghana appeared first on Firmus Research.

]]>The growth of this space has been greatly influenced by the increased levels of mobile connections across the continent. Rapid smartphone adoption in large mobile phone markets like Nigeria and Kenya significantly changed the continent’s tech-savvy youth, ushering in revolutions in a myriad of sectors. the impact of Internet access via mobile devices on the continent has been a game changer. This has given birth to the growth of e-commerce, fintech, educatech, healthtech, and agritech across the continent.

The successful growth of the sector has also seen an increase in funding activities for most startups. In 2016, a total of 146 tech startups from across Africa raised funding totalling US$129.1 million. This demonstrated significant growth in the previous year in the number of companies raising money. South Africa, Nigeria and Kenya remained the three most popular investment destinations, followed by Egypt and Ghana. It is clear which countries are the most attractive to investors[1].

Venture Capital for Africa

Ghana’s digital revolution began with the establishment of the Meltwater Entrepreneurial School of Technology in 2008. The school also has an incubator. The school started the rise of tech entrepreneurs in the country though prior to its establishment, there were pockets of tech entrepreneurs. Ghana’s digital growth has been largely influenced by high mobile penetration. By the end of April 2017, the total number of mobile voice subscriptions was 35,984,280 while the total subscriptions of mobile data in the country were 21,584,899 with a penetration rate of 76.22%[2].

Of the various sub-sectors of the digital revolution, the fintech space in Ghana has been the most vibrant. Dominated by start-ups, these companies are rapidly changing the way money and financial services are handled by both individuals and corporates. From the simple payment gateway that allows customers to buy mobile phone airtime from their bank account through to apps that help customers send and receive remittances to their mobile wallets, these companies are having a massive impact on Ghana’s payment sector[3]. This sector is dominated by the likes of Mpower, Slydepay, Zeepay, ExpressPay. This has led into collaborations between banks and insurance companies and most members in the payment sector.

E-commerce has not made a huge impact as most shopping is still done physically. Online shops like Jumia.com, Dziffa.com, obrapamall.com, Zoobashop etc promise the best quality products at affordable prices and delivered to a customer’s preferred destination.

Aside fintech and e-commerce, tech innovations have helped improve the process in other aspects of livelihood, especially in agritech. One notable product has been Farmerline. Farmerline, which delivers weather updates, the latest market prices and other details to his second-generation mobile phone is being used by farmers all over and this has helped improved their practice. There are others like Ghalani, which was set up in late 2016, which does data-collection as a key focus, digitizing any manual records farmers may have. It also gives farmers access to software to keep better records and make reports that could put them in a better position to get funding. Another CowTribe, uses mobile technology to connect livestock farmers in the Northern Ghana with veterinaries, while the start-up Hover uses drones to help farmers map out their land.

What do we think of the sector?

- We believe the game is just starting and there are several opportunities waiting to explode. The fintech space will get bigger. There will be increase innovations by banks and insurance companies in the coming years. Once a solution works in Ghana it can be tried in other countries in the region.

- E-commerce will pick up significantly as the middle class continues to grow. Electronic payments and Electronic fulfillments will play a major in the revolution. There will be a need to improve the infrastructure.

- There will be increased activities from VC funds and PE funds for start-ups in the coming years. Other stage funding will also be active especially for solutions that can work other parts of the world.

[1] Venture Capital for Africa

[2] National Communication Authority Ghana

[3] KPMG, Payments Development in Africa

The post Technologies and Innovations: The Rise of the Digital Ghana appeared first on Firmus Research.

]]>The post It is still viable to Invest in Commercial Office Properties in Accra?? appeared first on Firmus Research.

]]>READ ALSO: How to Register a Business in Ghana

Ghana hasn’t been left out of the real estate boom. Ghana is one of the major economies on the continent and the real estate sector plays a major role. In 2015 and 2016, the business, real estate and other service activities sector contributed 7.7% and 6.9% respectively to the economy’s annual Real GDP. The sector has grown strongly over the past decade, up from $280.3m in 2006, and has become of increasing importance to the broader economy in recent years.

Ghana is home to over 27m people and is growing at a rate of more than 2% annually. Urbanization in Ghana has already reached roughly 54% and is growing at an average rate of 3.4% per year. This is being most particularly felt in the capital, Accra, and the northern city of Kumasi.

Real Estate sector- Commercial Office Rental

One aspect of real estate that has benefited from the flourishing economy is commercial /office buildings. There has been an increase in demand for grade ‘A’ office space in the capital. This has been largely attributed to demands from sectors such as the banking, telecommunication, professional and diplomatic or aid sectors. New office space in Accra is delivered to a ‘shell and core’ finish, although tenants may now demand fit-out as part of lease negotiation as more office developments are released to the market and competition for new tenants increases.

MUST READ: WHAT ARE GHANAIANS SPENDING ON? 35 PRODUCTS TO TRADE IN

Developments such as The Octagon, the World Trade Centre, the Accra Financial Centre, The One Airport Square, Stanbic Heights among others are changing the skylines of Accra especially in areas such as Ridge, Cantonments, Labone, Airport.

Declining demand, falling prices for Grade ‘A’ office rental in Accra

All has not been rosy in recent times. Demand for office space has declined, mostly due to the economic crisis the country went through. According to Broll Properties, there has been a decrease in enquiries from multinationals and large corporates looking for space measuring over 1,000m². Achieved commercial rentals have declined by as much as around 6% as a result of challenging economic environment and oversupply of office space in some locations.