The post What Are Ghanaians Spending On? Import Trends and Insights for a New Market Entrant in 2021 appeared first on Firmus Research.

]]>To take advantage of these opportunities, however, a new entrant or an existing business must have insights on spending and consumption patterns of consumers. Spending patterns are a defining factor in understanding demand and consumption levels within a country. Further, imports are a direct response to market demand and economic expansion. Hence over time, the spending and consumption patterns of Ghanaians inform the type of products that are imported into Ghana and also creates viable investment opportunities for prospective investors.

For the new market entrant starting a business in Ghana, wouldn’t it be great to know exactly what product(s) to import or produce in the country based on the demand patterns? For the manufacturer or importer already operating in Ghana, how are you positioned to be relevant to consumers as well as be competitive in the market? Knowing what Ghanaians are spending on will certainly be a useful insight.

So, what are Ghanaians spending on?

Ghanaians are spending on everything – from food products, healthcare products, apparels, electronics to building hardware.

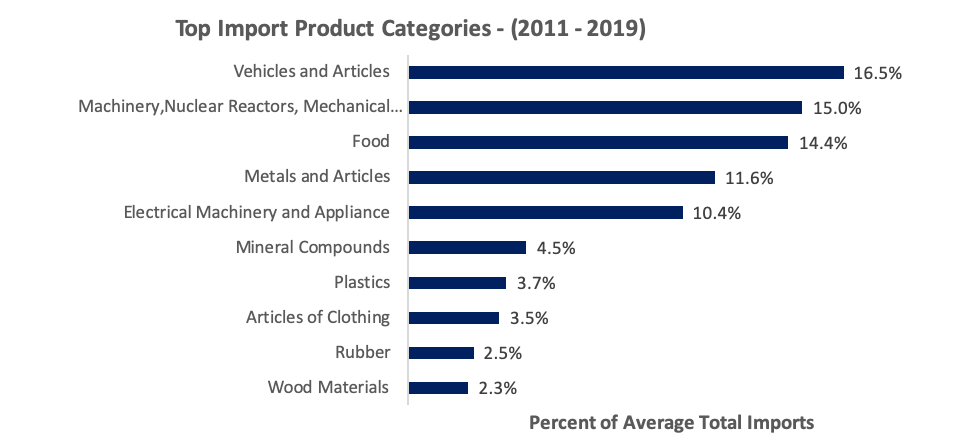

Analysis of trade data for the past 9 years (2011 -2019) reveal that food commodities, vehicles, machinery, electrical appliance, and plastics are among the leading imported products classes in Ghana. Actually, the top 10 imported products (excluding minerals and oil and gas) across the years constitute over 84% of the total imports, valued at an average of GHC 23 billion each year. The chart below highlights the top 10 import product categories and the percentage of total imports they constitute.

Source: Ghana Statistical Service

Vehicles, both used and new and all its articles, is the most dominant product category in Ghana’s imports, constituting as high as 16.5% of total non-oil imports every year. This is followed by machinery, nuclear reactors, and mechanical appliance with 15% and food with 14.4%. For each of these top product categories, there are different items that are imported by individuals and businesses in Ghana. Details of the specific products imported for the top 3 product categories is further emphasized.

Vehicles and Articles

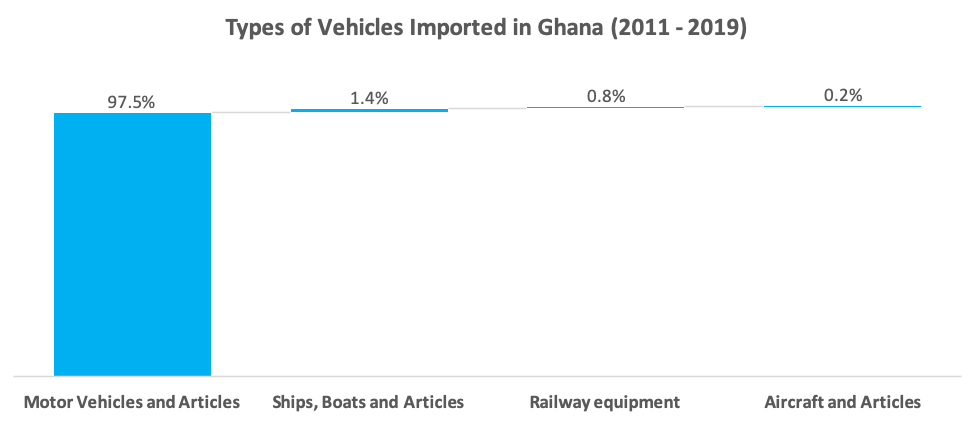

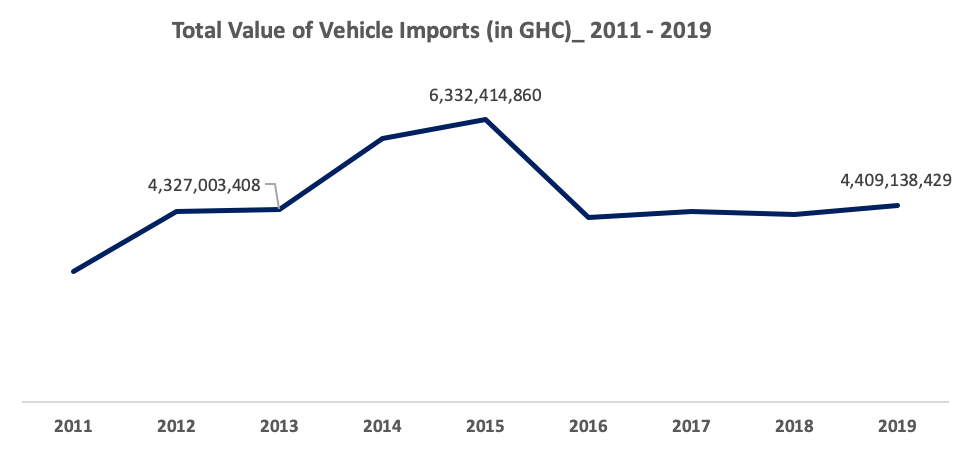

As seen in the chart above, vehicle imports top the list of primary products imported into Ghana. Between 2011 and 2019, an annual average of GHC 4.54 billion worth of different vehicles and its articles were imported into the country. Given that road transport is the primary means of transportation for passengers and goods in Ghana, motor vehicles and its articles (spare parts and accessories) tops vehicle imports, constituting about 97.5% of total vehicle imports. The remaining 2.5% is split between ship and boats (1.4%), railway equipment (0.8%) and aircraft and articles (0.2%). The government of Ghana through the Ghana Automotive Development Policy (GADP) seeks to develop a local automobile industry by given incentives (including restrictive incentives) to attract global Original Equipment Manufacturers (OEMs) and other component manufacturers into the country. Already, top OEMs like Volkswagen and Toyota has set up assembling plants in the country.

Source: Ghana Statistical Service

Source: Ghana Statistical Service

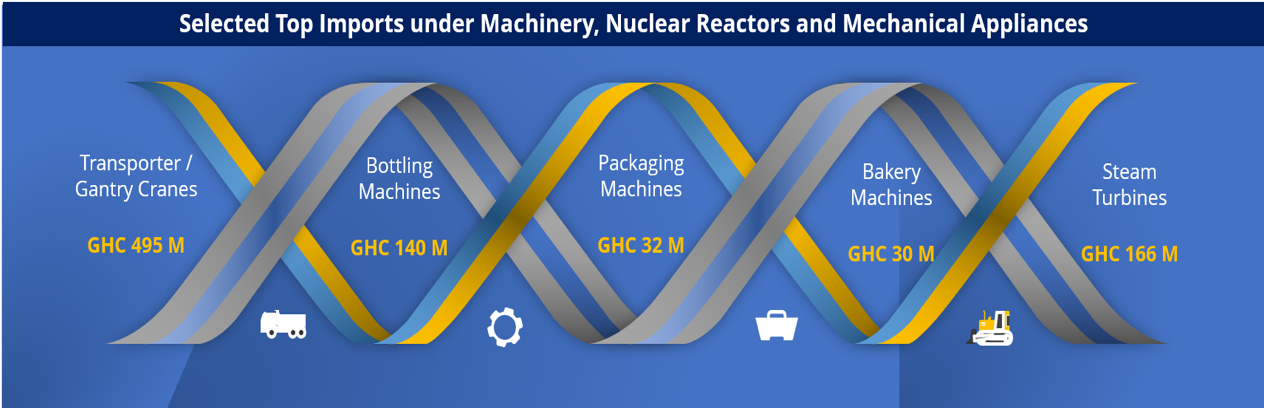

Machinery, Nuclear Reactors and Mechanical Appliances

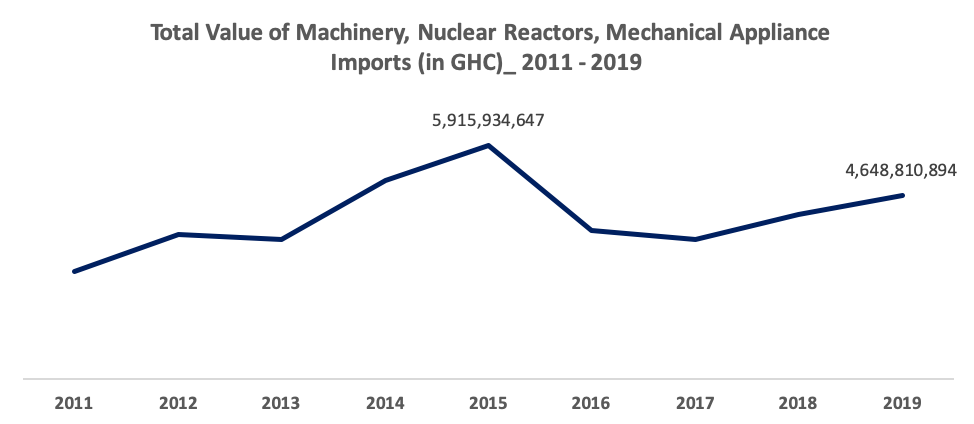

The next category of items imported most into Ghana are machinery, nuclear reactors and mechanical appliances. On average, machines and appliances worth GHC 4.3 billion are imported into the country each year. It includes both industrial and agricultural machines as well as nuclear reactors and other heavy machinery used in constructions.

Some top imported items under this category are transporter cranes or gantry cranes, team turbines for marine propulsion, machinery for filling and closing bottles, packaging or wrapping machines, bakery machines and other agriculture machines such as harvesting machines. The charts below provide more details.

Source: Ghana Statistical Service

Food

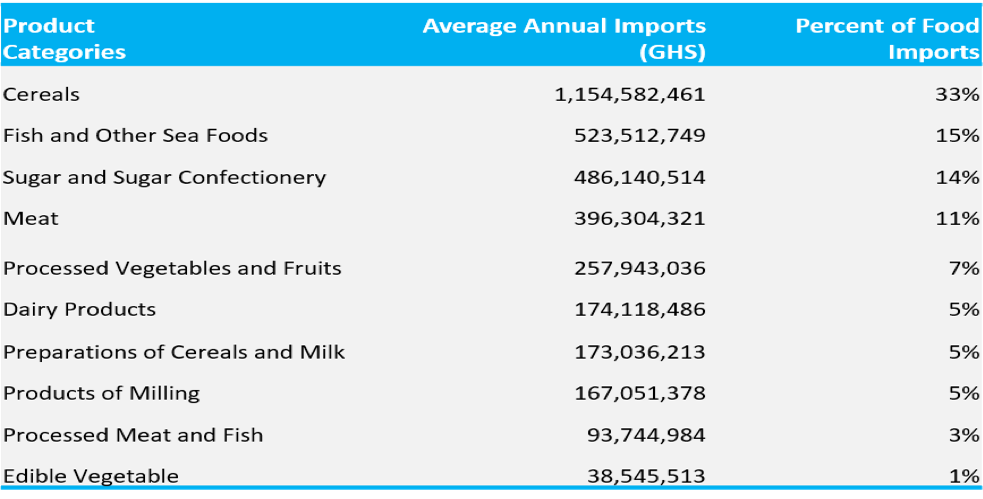

The third category of items imported most into Ghana is food (excluding beverages). Over 16 sub-categories of food are imported into the country including cereals, meat, fish, spices and fruits among others. Cereal is the primary food category imported with an average value of GHC 1.15 billion of different types of cereals imported annually. The most common cereals imported are maize, wheat, rice, oats and millet.

Ghanaians spending is also skewed towards other categories of food items imported that include fish and other sea foods, which constitute about 15% of total food imports.

Sugar and sugar confectionery also follows with an annual average value of GHC 486 million, constituting 14% of total food imports. Other important food imports are meat (11% of total food imports), processed vegetables and fruits (7% of total food imports), dairy products (5% of total food imports), preparations for cereals and milk (5% of total food imports) and food products for milling ((5% of total food imports). Preparations of cereals and milk include processed cereal items such as biscuits, waffles and pasta, while products of milling include various types of flour such as wheat flour, and maize flour. The table and chart below provides more details.

Source: Ghana Statistical Service

Source: Ghana Statistical Service

Market Entry Insights for New Businesses

Ghanaians are generally open to trying new brands, if the pricing is right and quality is good. There are three fundamental factors that a new market entrant should consider;

- Consumers in Ghana are very price sensitive – the pricing strategy adopted for your business or products should be backed by independent research.

- Have a strategy for credit for your B2B clients. Distributors or Agents love to have some form of credit from importers.

- Have a strong budget for marketing and promotion in the initial 3 years especially in the consumer and retail space – food, beverage, home and personal care segment.

Majority of Ghanaians fall within the low to lower-middle income class and so price comes first in deciding what to buy. There is a market for premium products, however, products targeting low to middle income consumers should consider price as a key factor in the market entry stage. Hence your ability to source the products (which must be of relatively good quality) at competitive prices and have a long-term strategy will determine your market success.

Further, a good amount of trading in consumable goods is carried out on credit basis in Ghana. Most medium to large distributors/wholesalers with good distribution channels will want to trade with you, but on credit, especially at the market entry stage. Whatever you do, have a strategy for credit.

However, as customers get to know your brand and you gain market share, you may tighten up your credit policy and even be able to have distributors/wholesales make advance deposits for their goods.

You definitely need to have a budget for marketing and promotions in order to penetrate the market. There is an influx of imported products on the Ghanaian market across all segments. There equally exist very strong local brands doing well in key segments like food, beverage and home and personal care. The Ghanaian consumer therefore has a lot of options, making achieving product visibility through effective marketing and promotion, a defining factor to success.

Looking Forward

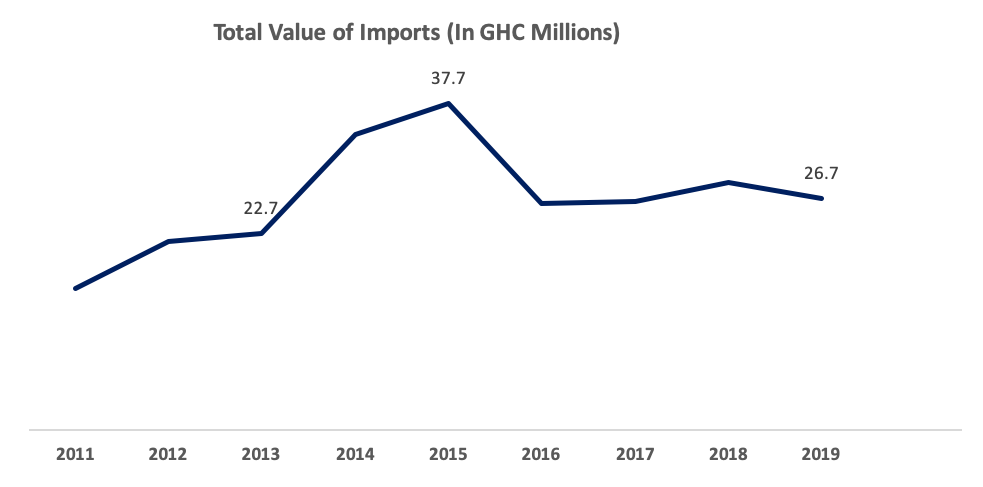

Total Import expected to decline further

We expect the downward trend in total imports to continue as the new local factories expand capacity and demand for local products increases. This is coupled with the fact that 3 global giants in the automobile industry are establishing assembly plants in Ghana and Government is expected to institute some restrictive measures on vehicle imports (which is the topmost product category imported into the country). Again, other new factories are expected to be commissioned under the Government’s One-District-One-Factory program. Overall, we expect the import volume to further decline.

Source: Ghana Statistical Service

Have a long-term plan to add value

As a new market entrant, you may start with trading through some agents or distributors in Ghana to gain some market share. However, for long-term success and growth, have a plan to set up some processing, assembling or manufacturing plant in Ghana. Otherwise, your market share could be eroded as local production picks up. This trend has been seen in several sectors like the production of ceramic tiles, baby diapers, biscuits, tomato paste and happening now with the automobile industry.

The Retail space is expected to continue growing

Ghana’s retail sector is expected to continue on its growth trend. E-retail is catching up with the growing middle class. It is expected that this sector will grow as lifestyles keep changing and the working class keeps exploring more convenient ways of shopping.

Conclusion

In trying to explore innovative ways of reaching out to the Ghanaian consumer, it is important to consider, through research, the following market dynamics:

New entrant/investor:

- What product (brand, fragrance, flavour, packaging, design etc.) should you focus on?

- What is the price sensitivity, competition and demographic analysis for your product?

- Where can your target market be found and how do you reach them?

- What are the import duties, taxes etc. for your products and how does your final price compare with existing market prices for same products offered by competitors?

Existing business:

- How well do you understand your brand’s health?

- What will be the best approach to grow your market share?

- What is the competition doing differently and what marketing channels should you adopt?

With your knowledge of what Ghanaians are spending on, it’s time to dig further into these product segments, to carve out your own product and market entry strategy to drive success.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors.

The Authors

Alex Twumasi

Managing Partner

Firmus Advisory Limited

Anita Nkrumah

Head of Research

Firmus Advisory Limited

You can also Download a copy of this Research in PDF Below

See Other Research Publications: Ghana’s Disposable Baby Diaper Market in Focus 2021

The post What Are Ghanaians Spending On? Import Trends and Insights for a New Market Entrant in 2021 appeared first on Firmus Research.

]]>The post Ghana’s Disposable Baby Diaper Market in Focus 2021 appeared first on Firmus Research.

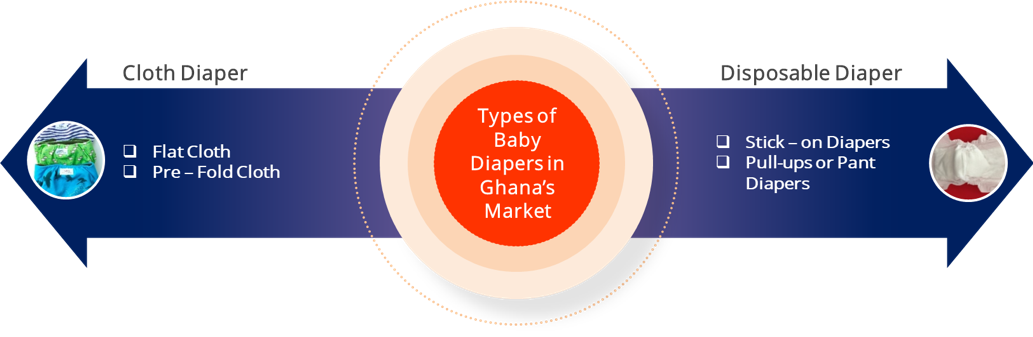

]]>Types of Baby Diapers in the Ghanaian Market

The diaper market in Ghana is showing growth signs and is broadly classified into cloth and disposable diapers based on product type, with greater demand for disposable diapers.

Figure 1: Types of baby diapers in the Ghanaian Market (Source: Market Survey. 2021)

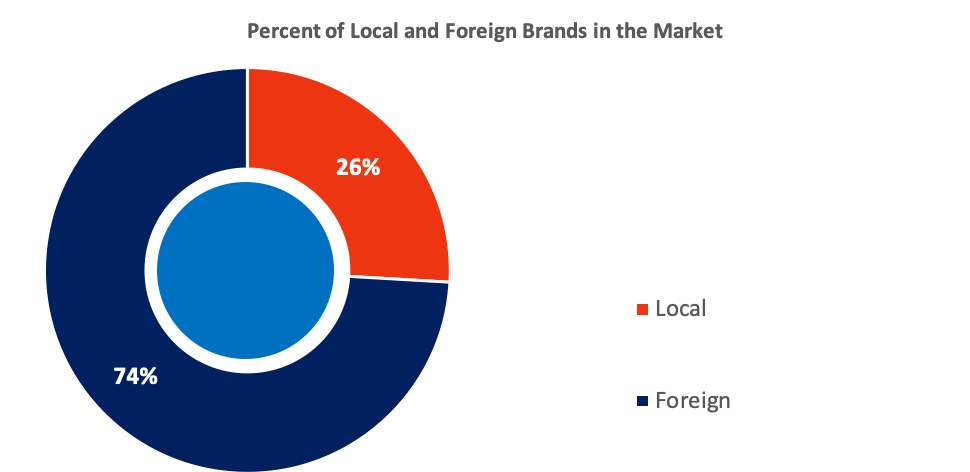

Share of local brands to foreign brands in the market

The market is flooded with different brands of diapers, both foreign and local, each gaining a fair share of the market due to their unique product characteristics and niche marketing. Currently, of the total number of brands in the market, about 74% of them are foreign brands, with just about 26% of brands being local.

Figure 2: Percent of Local and Foreign Baby Diaper Brands in the Market (Source: Firmus Market Survey, 2021)

Read Here Also : Increase in Supply, Marginal Decline in Demand [An Occupancy Analysis of Commercial Real Estate in Accra]

Foreign diaper brands have been the order of the day in the Ghanaian diaper market for a very long time: they have a varied range of product categories and are perceived to be of high quality. Domestic production of diapers on the other hand is fairly new in Ghana with the first production starting around 2016. However, in as much as foreign brands dominate the Ghanian market, demand for local brands has been on the rise and it’s set to take over demand from foreign brands largely due to price advantages as well as the growing visibility and popularity of the local brands.

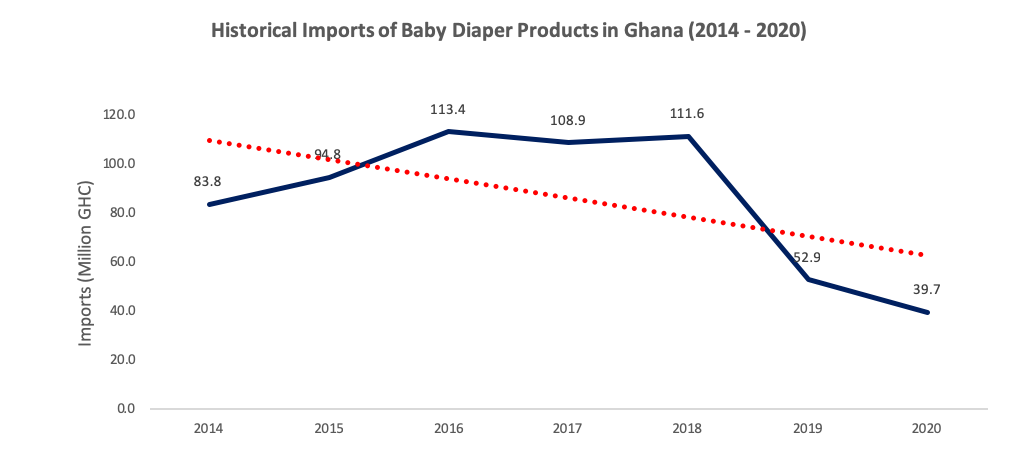

Further, import of baby diaper products have been on decline in the past 5 years, around the same time local manufacturing began to take root. Specifically in 2019, imports decreased by as high as 53% following the establishment of the Sunda Ghana baby diaper factory in 2018 – Sunda Ghana produces the fastest moving baby diaper brand in Ghana, the Softcare brand. Imports further declined by 25% in 2020.

Figure 3: Historical Imports of Baby Diaper Products in Ghana (Source: MOTI, Ghana)

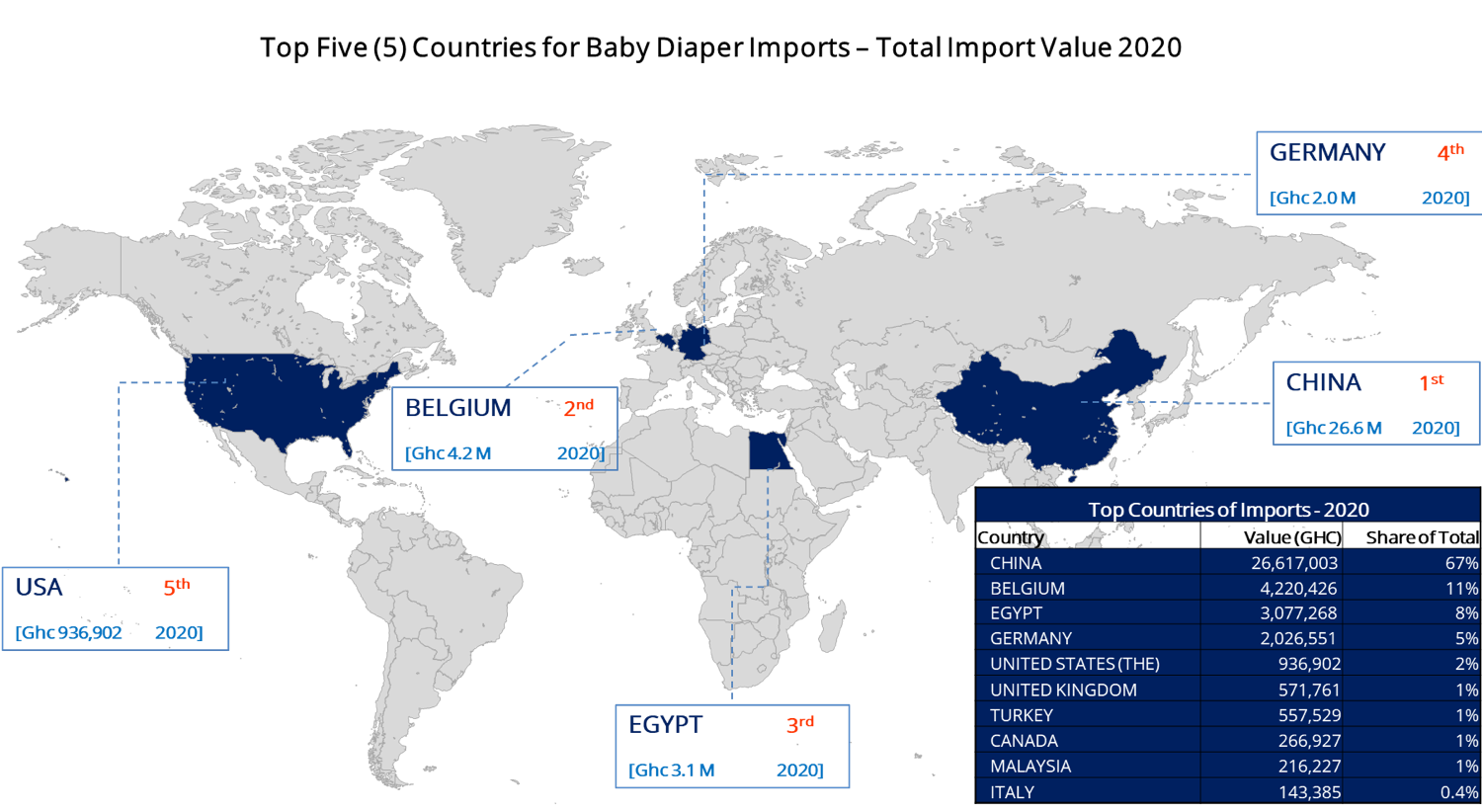

Top Countries of Imports

China has dominated the import market for baby diaper products over the past decade. Presently, China controls about 67% of the total imports into the country, followed by imports from Belgium which constituted 11% of total imports in 2020. Overall, imports from the top 5 countries accounted for 93% of total imports in 2020. The chart below provides further details.

Figure 4: Top Countries of Import for Baby Diapers (Source: MOTI, Ghana)

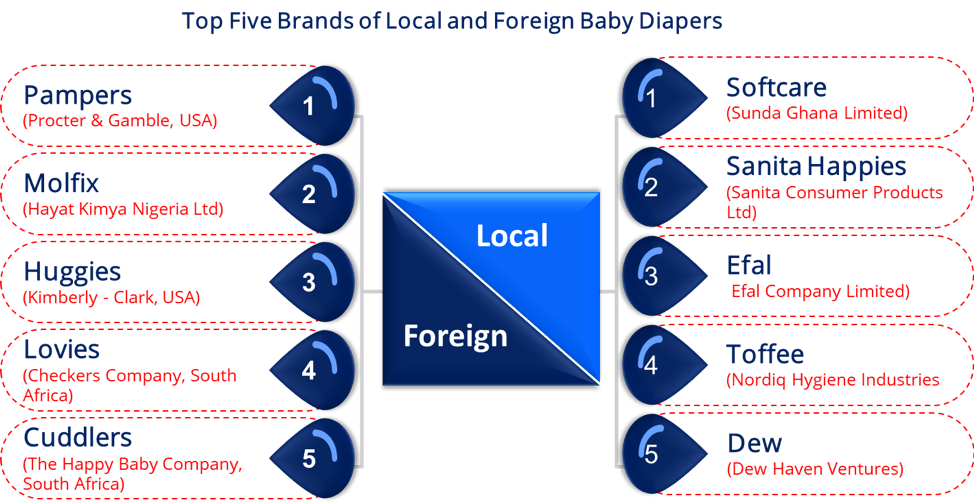

The Competitive Landscape

The baby diaper market is highly competitive with a considerable number of local and foreign players. Over the years, these players have adopted strategic marketing initiatives to develop a niche for their brands and to also capture a fair share of the market. The market is predominantly dominated by Sunda Ghana Limited, Procter and Gamble, Sanita Consumer Products Limited and Kimberly-Clerk. Increasing preference for locally manufactured brands is expected to scale-up demand for baby diapers with local brands dominating the market over time.

However, foreign brands such as Pampers, Molfix, Little Angels, Huggies and among other brands are also demanded by a section of the middle to higher income earners owing to its high price points as well as the selective distribution channels used, which is mostly favorable to that section of the population.

The figure below highlights top competitive brands and the major key players behind these brands.

Figure 5: Top Local and Foreign Baby Diaper Brands in the Ghanaian Market (Source: Firmus Market Survey, 2021)

Drivers of Demand

Effective and strategic advertisement is crucial

Increasing advertisement is a major strategic marketing initiative fueling demand for baby diapers in the market. Due to the nature of competition in the market, advertisement controls demand trends and market acceptance of a brand; strategic advertisement creates market awareness and deepens market penetration. Brand visibility and popularity which is achieved with strategic advertisement influences 45.5% of market demand for baby diapers in the Ghanaian market. This is followed by other factors including product quality, price and packaging recording 27%, 18.2% and 9.1% respectively. Key stakeholders such as Sunda Ghana Limited, Pampers Ghana and Sanita Consumer Products Limited are growing on consumers due to effective marketing across both urban and rural cities in the country. These brands effectively advertise on both traditional and digital platforms.

Increasing health and hygiene awareness

Increasing concern for the health and hygiene of infants is also a predominant driver of demand for baby diapers in Ghana. This primary concern among consumers has led to the infiltration of different brands of baby diaper products from different part of the world in the quest to meet the health and hygienic standards consumers’ desire. Also, consistent education via digital and traditional media by key players in the disposable industry reiterates the need to practice general hygiene for infants. The key message – baby diapers provide comfort, breathability and absorbency that are beneficial for the health of infants compared to other substitutes – has resonated with most consumers.

General preference for local brands

Ghana’s baby diaper market has seen a major boost owing to market penetration of local brands which are manufactured and packaged in the country. Since the inception of local production of baby diapers in the 2000s, the diaper market has witnessed a remarkable growth. Domestic companies have capitalized on increasing consumer preference for local brands to meet the market demand for baby diapers in the country with each brand developing a market niche for their products. Consumer preference for locally manufactured brands can be attributed to price, accessibility, and availability, as well as a conscious acceptance of local products.

Increasing disposable Income

Generally, increasing disposable income leads to a simultaneous increase in either consumer purchasing power or savings. Ghana’s move to middle-income country implies increasing disposable income and a simultaneous increase in standard of living. A 6.5% average annual growth rate in Ghana’s Gross Domestic Product[2] (GDP) over the past decade has had a positive influence on the spending power and socio-economic development of consumers, hence expenditure on baby care products have equally increased.

Diverging Trends in the Baby Diapers Market

Consumers are becoming price sensitive

Baby diapers just like other FMCGs are highly price driven. Brand loyalty in the baby diaper market is generally low due to the price-sensitive nature of the market. Consumers place high importance on price causing the demand to be somewhat elastic in nature – For 18.2% of consumers, price is the most important factor influencing their demand for baby diapers. Typically, in Ghana, there is a high preference for stick-on diapers to pant diapers due to its relatively lower prices in addition to the fact that it is easy to use. The forces of price and demand cannot be downplayed in the market with all other things being constant.

Digital marketing is the turning point

The relationship between digital marketing and its impact on consumer demand is positive. Growing market dynamics has contributed to the exploration of different marketing initiatives within the baby diaper market. Major players have adopted digital marketing via influencer marketing – social and non-social media marketing by associating their brands with celebrities and influencers – to encourage brand demand and usage. Content marketing, affiliate marketing, video marketing among others cannot be underestimated. Market competitiveness has led to key players endorsing different digital marketing strategies to draw attention to their brands. Growing online marketing of baby diapers is the new drive for the baby diaper market.

Potential For Investment

The potential for investment in the disposable diaper market is still great. Demand for diapers is high with an estimated 500 million units plus consumed annually. Greater health awareness and consciousness is also set to further increase demand for baby diapers in the medium to long term, with a significant portion of this demand allotted to locally manufactured brands.

Presently there are about 5 local manufacturers with just one of them gaining significant presence in the market. Further, almost 40 million Ghana Cedis worth of baby diaper products are still imported into the country at a time when there is greater acceptance for locally manufactured brands. Moreover, any production facility set up to produce baby diapers can easily be adopted to producing other fast moving consumer products such as sanitary towels.

There are also several incentives such as tax holidays set out by the government of Ghana to attract investors into the manufacturing sector under the ‘One District One Factory’ policy. Opportunities also exist to export to other countries within the West African sub-region, especially landlocked countries such as Mali and Burkina Faso, facilitated by the African Continental Free Trade Agreement.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors. Read more on https://firmusadvisory.com/.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Rachael Dampson

Research Executive

Firmus Advisory Limited

References

[1] Pulp &Paper Africa “West Africa: Disposable Baby Diapers Industry” [Online]. Available at http://africapulpaper.com/en/articles/west-africa–disposable-baby-diapers-industry–

[2] MoFEP. 2021. Ministry of Finance and Economic Planning. https://www.mofep.gov.gh/

The post Ghana’s Disposable Baby Diaper Market in Focus 2021 appeared first on Firmus Research.

]]>The post Increase in Supply, Marginal Decline in Demand [An Occupancy Analysis of Commercial Real Estate in Accra] appeared first on Firmus Research.

]]>In the early part of the 21st century, successive governments placed emphasis on the development of Ghana’s private sector, fueling the influx of foreign investors and multinational firms into several sectors of the economy, including insurance, financial, oil and gas, telecommunications as well as healthcare services. This led to increased demand for not just office spaces but for an improved office stock. As demand increased, local and foreign construction companies began to invest in commercial real estate across various areas in Accra.

Commercial real estate in Accra is generally concentrated in the Accra Central Business District and the Airport areas – these areas have seen massive development of Grade A and B spaces. In as much as there has been an increase in demand for office spaces over the years, the rate of occupancy, relative to the supply, is low. The impact of COVID-19 will not be brushed aside as it has also played a role in the reduced levels of occupancy. As companies continue to work remotely, the probability of some returning to physical working spaces is low, which may further reduce occupancy rates in the market.

The Office Grading Structure in Ghana

Ghana’s office grading structure follow global standards created to aid estate agents, investors and other stakeholders in the property market justify property prices and to support thorough analysis of the sector in terms of the level of demand among others. Just as on the global scene, office buildings in Ghana are classified into Grade A, Grade B and Grade C. The figure below defines the elements considered for each grade.

Figure 1: Grade Specifications in Ghana’s Commercial Real Estate Market

Grade A and B offices have better conditions and are more competitive, thus attracting high-end clientele and resulting in high rental rates.

Office supply in Accra is centralized in two main areas; Accra’s Central Business District (CBD) and the Airport Area. Commercial real estate in the Accra CBD covers the West Ridge and North Ridge districts and is typically occupied by large financial institutions as well as government offices. Whereas, offices in the Airport Area covers the north of Accra and is occupied by professional services and the oil and gas industry. Further, the Airport area benefits from its accessibility, both in regards to the airport and residential areas and has recently seen an improvement in the quality of offices. Most of the offices in the Accra CBD area are of Grade B quality, while most Grade A offices are located in the Airport Area.

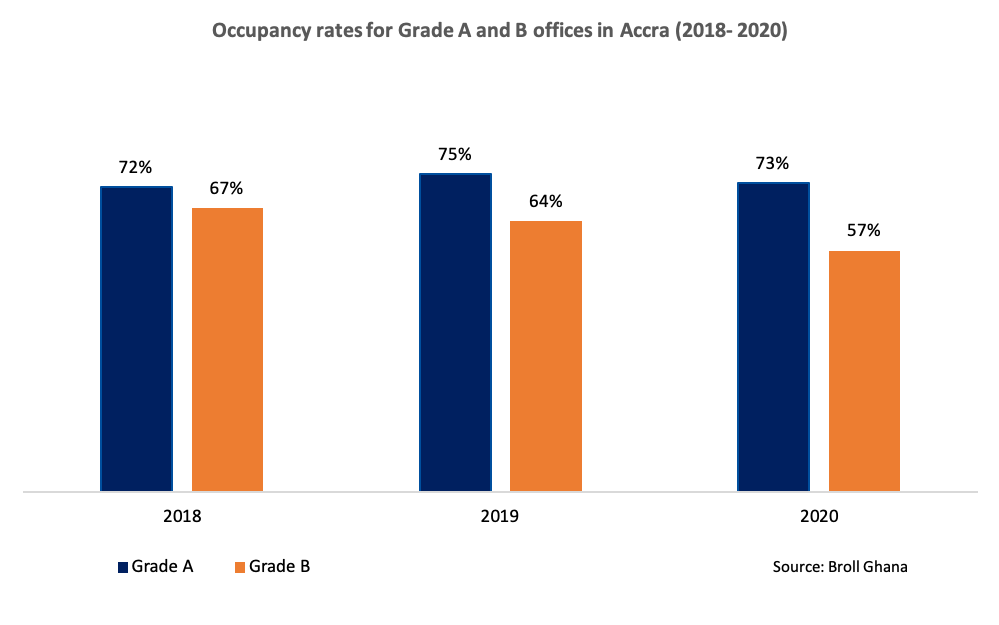

Occupancy Rates for Grade A and B Offices in Accra

Occupancy or vacancy rates are relevant metrics in the property market, as occupancy rates have a positive correlation with prices. Occupancy rate is the ratio of rented or used space to the total number of available spaces, while vacancy rates is the opposite of it.

Generally, in Accra, occupancy in Grade A offices tend to be higher than occupancy in Grade B offices indicating a higher preference for the former. Grade A offices are mostly occupied by large firms and multinational companies who have a steadier revenue flow, whereas Grade B offices are mostly occupied by SME’s with relatively less stability in their income flows. Over the past three (3) years, the occupancy level in Grade A offices have remained relatively stable, averaging 73% between 2018 and 2020. On the other hand, occupancy rate in Grade B buildings have been on decline since 2018 with the greatest decline being in 2020, partly due to the effects of the Covid-19 pandemic.

Figure 2: Occupancy Rates in Grade A and B Offices in Accra (Source: Broll Ghana)

Trends Shaping the Market

Impact of Covid-19 on Commercial Real Estate in Accra

The Covid-19 pandemic has significantly affected the commercial real estate market in Accra as it has led to delays in potential transactions. Most property viewing appointments were cancelled due to border closures and lockdown restrictions. Some occupiers, including both local and international businesses, exited their spaces due to the negative effects of the pandemic on their businesses; office spaces were severely hit by the pandemic, as several businesses adopted to working remotely. Going forward, most businesses are set to re-order their work structure to accommodate remote working thus, saving on rent and electricity costs in the long run. As the effect of the pandemic reduces, occupancy rates may stabilize though the long run effects of the pandemic may linger.[1]

Supply Increases Meets Decline in Demand

On aggregate, demand for office spaces has declined over the years, though supply has increased, thus forcing marginal reductions in prices. For instance, grade A spaces attracted rent between USD25 to USD35 per sqm per month in 2019 as compared to USD30 to USD45 per sqm per month in 2018, as more than 41,000 sq meters of additional space came onto the market in 2018 in locations such as Atlantic Towers, SCB Towers and 335 Place. Notwithstanding, Grade A office buildings have higher demand compared to other office grades due to the availability of modern amenities and the location of these offices. New developments such as Atlantic Tower have recorded higher occupancy rates even though generally demand remains low. Grade B offices however experienced low demand, most likely due to their outdated amenities. [2]

Large Corporations Move to Build Their Own Offices

A notable observation is the fact that large corporate institutions are transitioning to building their own headquarters, thus causing vacancies in rental properties. Companies that have made this move include Ecobank Ghana Limited, MTN Ghana, VIVO Energy Ghana Ltd, PricewaterhouseCoopers (PwC Ghana) and Toyota Ghana Company Ltd. This trend is expected to continue, which will further deepen the demand slump over the long term.

About Firmus Advisory Limited

Firmus Advisory offer a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Laudina Adjei-Boatey

Research Executive

Firmus Advisory Limited

References

[1] Devtraco Limited. 2020. “Implications of COVID-19 on Real Estate in Ghana”. Available at: https://devtraco.com

[2] Broll Property Intel. “Ghana Market Barometer” Available at: https://www.brollghana.com/publications/

Read or Download the PDF Version of this Report Below

Increase in Supply, Marginal Decline in Demand (An Occupancy Analysis of Commercial Real Estate in Accra)_Firmus_ResearchThe post Increase in Supply, Marginal Decline in Demand [An Occupancy Analysis of Commercial Real Estate in Accra] appeared first on Firmus Research.

]]>