The post FMCG Market Watch: Consumer Electricals and Electronics in Ghana appeared first on Firmus Research.

]]>The consumer electricals and electronics market stands as a dynamic and ever-evolving sector, reflecting the rapid advancements in technology and the growing demands of an increasingly connected world. The rapid pace of innovations in technology is driving demand for newer and improved electrical and electronic products. Simultaneously, the expanding middle class of individuals and businesses are constantly replacing or upgrading older products with more advanced versions which has contributed to the growth in the market. This article explores the multifaceted landscape of the industry with a focus on electrical products and electronics such as air conditioning machines, refrigerators, freezers, washing machines, irons, electric burners, food processors, microwaves, blenders, microphones, speakers, rice cookers and kettles.

Market Segmentation

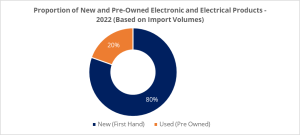

The electrical and electronics markets can be broadly divided into two main segments: new (first-hand) and pre-owned (second-hand) sectors. The second-hand market is primarily characterized by pre-owned items from well-renowned and high-end brands such as Samsung, Philips, and Sony. Players in this market d

istribute varieties of preowned electronics and electricals sourced from several countries. Generally, in Accra, Lapaz is recognized as the central hub for the distribution and retailing of pre-owned electrical and electronic items.

Figure 1: Proportion of New and Old Electrical and Electronic Products, 2022

Source: Ministry of Trade, MOTI

Conversely, the new market comprises companies and enterprises specializing in the sale of brand-new electrical and electronic items as well as franchise dealers representing international brands. Currently, newly manufactured electrical and electronic products control about 80% share of the market.

A Demand Shift from Pre-Owned to New Electricals and Electronics

Until the late 2000s, demand for pre-owned electronics was the order of the day. The new electronics market at the time largely constituted so-called high-end brands that were too expensive for most consumers to purchase as brand-new. The limited presence of affordable brand-new options and the general notion among consumers that used electrical products were just as reliable as the new ones fueled this preference. Historically, consumer demand for electronic products was largely influenced by considerations of product quality and brand reputation irrespective of whether the products were new or pre-owned. Established brands such as Sony, Philips, and Kenwood were regarded as durable and long-lasting prompting consumers who couldn’t afford new products from these brands to opt for pre-owned items over less popular brand-new alternatives.

Currently, demand for pre-owned electrical and electronic products is gradually declining. This trend is attributed to the fact that there are currently a lot of affordable brand-new electronic products in the market that are of competitive pricing and quality. Further, the influx of numerous new energy-efficient electrical products in the market at competitive prices with comparable quality to second-hand products has led to a heightened preference for new electrical and electronic products among consumers.

A Promising Import Market for Electricals and Electronic Products

In 2022, the market for imported electronics and electrical goods, including both new and pre-owned items, reached an estimated value of $124 million. Predominant among these imports were televisions, air conditioners, refrigerators, freezers, washing machines, and blenders, collectively accounting for approximately 60% of the market share. Other significant categories of imported electronic and electrical items are speakers, microwaves, irons, kettles, and electric cookers.

The recent announcement by the Energy Commission to ban selected used and substandard electrical appliances, set to take full effect by the end of 2023, will give a further boost to the market for brand-new electronic products, especially given the prevailing consumer preference for new products in the electronic and electrical sectors.

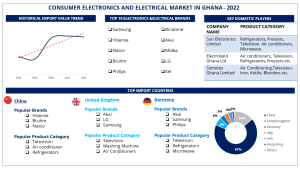

As of 2022, there were almost 100 electrical and electronic brands in the market. Prominent among them are brand names like Hisense, Nasco, Samsung, Midea, Binatone, and Philips dominating the landscape. The top importing countries for electronics and electrical goods, namely China, Turkey, the UK, the USA, and Italy, collectively contribute to around 80% of the total imports. The figure below provides an insightful overview of the electronics and electrical import market.

Figure 2: Electronics and Electricals Import Market, 2022

Source: Ministry of Trade, MOTI

Price is the Game Changer

Price has been a key driver of the electrical and electronics market. Given that prices of electrical and electronic products are on the rise, affordability has become a significant driver for consumer demand, especially when consumers are presented with several alternatives. The attention consumers give to the price of electronic products often outweighs considerations of product quality, especially with the increasingly difficult economic environment. In response to this market trend; there is intense competition among key players to reasonably price their products to attract more attention for their brands. Many market players have adopted unique pricing strategies to sell their brands coupled with effective and strategic marketing highlighting the advantages of their products over their competitors. Further, this pricing trend has opened up the market to refurbished models of well-established brands offering customers relatively cheaper options. The table below provides the prices of selected brands of electronics and electrical products in the Ghanaian market. Prices vary significantly depending on the brand and specifications considered by the customer.

| PRICES FOR BRAND-NEW ELECTRICAL AND ELECTRONIC PRODUCTS | |||||

| Product | Specification | Hisense | Nasco | Samsung | LG |

| Television | Smart TV 50” | GHC 4000 – GHC 5000 | GHC 4000 – GHC 4200 | GHC 6,600 – GHC 7000 | GHC 5,700 – GHC 6,300 |

| Refrigerator | 200 L – 208 L | GHC 3400 | GHC 3000 – GHC 3900 | GHC 5500 | GHC 7999 |

| Air conditioner | 2.5 HP | GHC 7300 – GHC 8800 | GHC 8000 – GHC 9500 | GHC 9900 – GHC 11000 | GHC 8700 – GHC 13000 |

| Washing Machine | 10 KG | GHC 5500 – GHC 6000 | GHC 5000 – GHC 7000 | GHC 5800 – GHC 7500 | GHC 5400 – GHC 8300 |

Source: Market Survey, 2023

The rise of E-Commerce Platforms has Heighten Demand for Electronics

The emergence of e-commerce platforms has played a pivotal role in reshaping the retail landscape for electronic and electrical products. These platforms offer a variety of electrical and electronic products with competitive pricing, and the convenience of doorstep delivery, contributing significantly to the market’s expansion. Further, with a 68% internet penetration rate in the country as of 2022, a larger proportion of the population now has access to online platforms resulting in increased engagement in e-commerce activities.

Several key players in the market have leveraged the growing internet penetration to deepen their market presence by establishing online platforms to sell their products. Companies such as Sun Electronic Limited, Electro land Ghana, KAB-FAM Ghana have developed user-friendly and interactive e-commerce platforms allowing customers to conveniently order electronic products and electricals online. Some even offer free deliveries to incentivize purchases through their digital platforms. Generally, the rise of e-commerce platforms has not only increased market reach but has also encouraged healthy competition among retailers, fostering innovation and competitive pricing.

Opportunities for Market Growth

The electronic and electrical market in Ghana holds considerable growth potential, with untapped markets and unexplored opportunities. Currently, electronic products such as washing machines, refrigerators, speakers, heaters, blenders, juicers, etc., are imported, creating an opportunity for investors to explore local production or assembly of these items. Government policies and initiatives such as the ‘one district one factory’ provide attractive incentives for manufacturing activities within the country.

Moreover, Ghana’s strategic position as an ECOWAS country positions it as a gateway to other West African markets, with preferential trade agreements facilitating smooth exports. Already, about $280,000 worth of electronic and electrical products are exported annually.

Potential investors could consider collaborating with local players as a strategic approach for foreign companies to navigate the market. Despite the presence of numerous brands and franchised dealers, the market remains open to new entrants, provided they offer competitive quality and pricing.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors. Read more on https://firmusadvisory.com/.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Rachael Dampson

Research Executive

Firmus Advisory Limited

The post FMCG Market Watch: Consumer Electricals and Electronics in Ghana appeared first on Firmus Research.

]]>The post FMCG MARKET WATCH: AN OVERVIEW OF GHANA PHARMACEUTICAL MARKET [COMPETITIVE LANDSCAPE, DISTRIBUTION CHANNEL, AND EXPORT ANALYSIS] appeared first on Firmus Research.

]]>MARKET OVERVIEW

Ghana’s pharmaceutical market is one of the most promising sectors in Sub-Saharan Africa experiencing a noticeable evolution in the past three years. As of 2021, the market’s value reached $433 million1 and it is projected to witness substantial growth in subsequent years. Approximately, 70% of the market is reliant on foreign medicines and raw materials 2. However, in recent times, local production of pharmaceuticals has seen a major boost owing to sector interventions as well as an improvement in domestic herbal medicine. Increasingly, new entrants are joining the pharmaceutical market in the areas of manufacturing and distribution. This has not only strengthened the local market but has also had a noticeable impact on the export market, marked by a significant increase in exports since 2020.

COMPETITIVE LANDSCAPE OF THE PHARMACEUTICAL MARKET

The pharmaceutical market comprises stakeholders that specialize in research, manufacturing, and distribution of pharmaceutical products. For the manufacturing segment, domestic production makes up about 30% of the market share. As of July 2022, there were 32 licensed local manufacturing facilities3 in the country specializing in the production of prescribed and over-the-counter drugs such as analgesics, anti-malarial, anti-biotics, antiretrovirals, antacids, antihistamines, dewormers, nutritional supplements, etc. catering to both the local and export markets. Notable manufacturers include Ayrton Drug Manufacturing Company, Letap Pharmaceutical Limited, M& G Pharmaceuticals, Kinapharma, Danadams, Entrance Pharmaceutical and Research Center, and Alhaji Yakubu Herbal Company. Some of these players have over 40 pharmaceutical product lines with several retail and distribution outlets nationwide. Aside from manufacturing, some of the local manufacturers are also involved in the importation of pharmaceutical products.

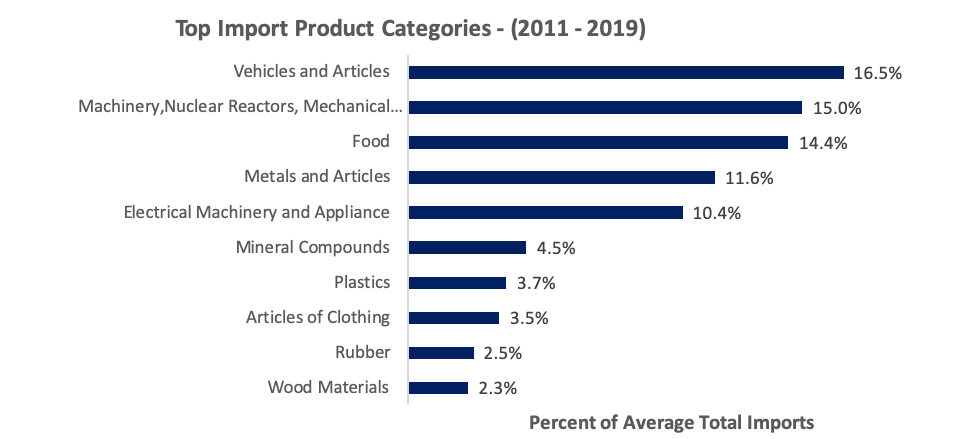

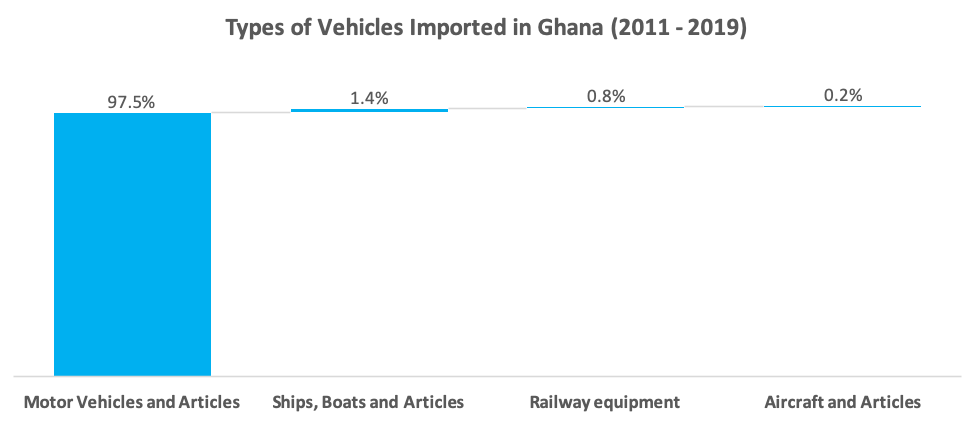

The import market plays a key role in supplementing the pharmaceutical market with varied brands of pharmaceutical products. In 2022, total import volumes for pharmaceuticals reached 21 million kg. India, China, the United Kingdom, France, and Germany are the top 5 import countries collectively controlling about 90% of total import volumes. Currently, the distribution of pharmaceutical products is facilitated by over 600 pharmaceutical importers including domestic manufacturers, public and private Institutions, Logistics and trading companies, and pharmacies. The charts below provide an overview of Ghana’s pharmaceutical import market.

Source: Ministry of Trade and Industry (MOTI)

DISTRIBUTION CHAIN

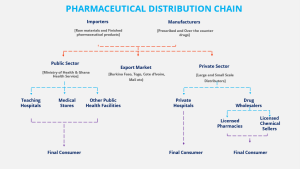

Distribution of pharmaceutical products is an important activity within the pharmaceutical market. There are appropriate guidelines to ensure the quality of pharmaceutical products from the premises of the manufacturer to the final consumer. The figure below represents an overview of the distribution landscape for the pharmaceutical market.

Figure 1: Pharmaceutical Distribution Chain

Domestic importers and manufacturers serve as the main sources of pharmaceutical products in the market. As of 2022, the pharmaceutical sector could boast 32 registered pharmaceutical manufacturing facilities and over 600 importers of pharmaceutical products in Ghana. The distribution of medicines from these manufacturers and importers to end consumers is channeled through two main avenues: the public sector and the private sector.

In the public sector, pharmaceutical products are distributed to Teaching Hospitals, Government Medical Stores, and Other Public health facilities through the Ministry of Health (MoH) and Ghana Health Service (GHS) acting as key regulators in the sector. The Ghana Health Service and the Ministry of Health follow distinct processes for procuring and distributing pharmaceutical products.

The Ghana Health Service procures pharmaceutical products through an annual National Competitive Tendering system. In this tendering process, the service publishes a list of pharmaceutical products with specific requirements for potential bidding by suppliers. Interested suppliers submit their bids and quotations and the Ghana Health Service selects the most suitable supplier for further contractual agreements. Additionally, the Ghana Health Service occasionally issues tenders for specific pharmaceutical products as the need arises. Similarly, the Ministry of Health (MoH) utilizes a centralized procurement system known as Framework contracting. Framework Contracting is usually a long-term agreement between the MoH and suppliers, outlining the general terms such as price and quantity for smaller recurrent purchasing orders over a specified period. Pharmaceutical suppliers express their interest by submitting bids for consideration, and the MoH reviews these bids, often sharing the contract among bidders to encourage competitive pricing. Framework Contracting is typically renewed annually. However, in cases of shortages within the public sector, Teaching hospitals, medical stores, and other public health facilities are permitted to procure drugs from the private sector. They do so by issuing tenders for bidding, bypassing the Ministry of Health and Ghana Health Service.

For the private sector, the distribution of pharmaceutical products is controlled by both large- and small-scale distributors. These distributors source domestically approved medicines directly from domestic manufacturers or external markets. They facilitate access to pharmaceutical products for private hospitals and drug wholesalers and ultimately reach the final consumer. Regarding the supply of pharmaceutical products to private hospitals, distributors either apply for tenders issued by various private health facilities or engage directly with these facilities to introduce their stock for consideration. Distributors are also responsible for supplying to wholesalers at bulk prices. These wholesalers, in turn, serve as the primary distributors to licensed pharmacies and licensed chemical sellers who retail their products to the final consumer at retail prices.

PHARMACEUTICAL EXPORT MARKET

Ghana’s pharmaceutical export market can be broadly categorized into medication and biological substances. In 2022, Ghana exported over 42 million kg worth of pharmaceutical products with biological substances constituting the greatest share of exports.

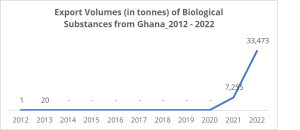

Export of Biological Substances

Biological substances specifically, blood and blood samples constituted about 78% of Ghana’s export market in 2022. The majority of these biological substances were exported to neighboring West African countries including Cote d’Ivoire, Togo, Burkina Faso, Mali, and Nigeria. Since 2021, biological substances have contributed substantially to the overall quantity of Ghana’s pharmaceutical exports. The chart below highlights export trends for biological substances;

Source: Ministry of Trade and Industry (MOTI)

Export of Medication

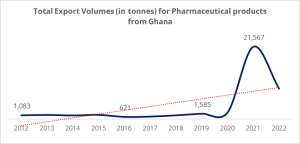

Since 2020, there has been a substantial improvement in the export activities for medication. Particularly, in 2021, the pharmaceutical market witnessed a drastic surge in export volumes. The total number of exporters increased significantly, rising from approximately 40 players in 2018 to over 150 players in 2021 and 2022. Existing players and new entrants also found new export markets within neighboring countries. For instance, companies like HomePro Company Limited have increased their export volumes by over 10X since 2021, now exporting a diverse range of medication to neighboring countries. Furthermore, there has been a broadening of the types of medicines exported from the country. Currently, Ghana exports over 80 different types of medication, primarily to West African markets. The chart below highlights the historical export trend for medications from Ghana.

Exported pharmaceutical products encompass both locally manufactured medicines and imported pharmaceutical products obtained from various countries. Notably, appetite stimulants like Amphetamine, Dynewell, Super Apetit, etc., dominate the export market. Other popular categories of exported medicines include cough medicine, antibiotics, nutrient supplements, and antimalarials, among others.

Cote d’Ivoire receives the largest share (28%) of exported pharmaceutical drugs from Ghana. The West African market, comprising countries such as Cote d’Ivoire, Togo, Burkina Faso, Benin, and Mali, serves as the primary destination for pharmaceutical exports from Ghana. The figure below illustrates the dominant exported pharmaceutical products from Ghana and the top pharmaceutical export destinations from the country.

Source: Ministry of Trade and Industry (MOTI)

CONCLUSION

The pharmaceutical market in Ghana is undergoing notable growth and displaying promising prospects, owing to collaborative efforts from various stakeholders aimed at improving domestic manufacturing and the distribution of pharmaceutical products. Notable interventions in the sector include the expansion of the list of raw materials exempt from VAT to boost the local industry, the imposition of a ban on over 40 medicines (such as aluminum hydroxide, aspirin, folic acid, amoxicillin, paracetamol, Ibru fen tablets, multivitamin tablets, etc.) to exclusively reserve production for local manufacturers. Further initiatives involving the allocation of funds to domestic pharmaceutical manufacturers for the establishment of facilities adhering to good manufacturing practices, and the creation of a pharmaceutical industrial park to facilitate large-scale production by pharmaceutical companies is expected to boost activities in the pharmaceutical sector. For entrepreneurs seeking to invest in the country’s pharmaceutical sector, establishing or expanding domestic pharmaceutical facilities can be a potentially lucrative opportunity given the increasing demand for locally manufactured pharmaceuticals both domestically and in international markets. Companies can take advantage of Ghana’s favorable export terms within the Free Zones policy to supply pharmaceutical products to international markets.

Additionally, there are opportunities to invest in the distribution networks and supply chain for pharmaceutical products. Entrepreneurs can explore avenues in logistics, distribution, and wholesale businesses to ensure the timely and widespread availability of medicines.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to a number of local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors. Read more on https://firmusadvisory.com/.

About the Authors

Anita Nkrumah

Head, Research and Business Development

Firmus Advisory Limited

Research Executive

Firmus Advisory Limited

REFERENCES

[1] GCB Bank. 2022. “Pharmaceutical Industry”. Available at PHARMACEUTICAL INDUSTRY (gcbbank.com.gh)

[2] GCB Bank. 2022. “Pharmaceutical Industry”. Available at PHARMACEUTICAL INDUSTRY (gcbbank.com.gh)

[3] Food and Drugs Authority. “List of Local Pharmaceutical Manufacturing Facilities as at July 2022”. Available https://fdaghana.gov.gh/img/reports/LIST%20OF%20LICENSED%20LOCAL%20PHARMACEUTICAL%20MANUFACTURING%20FACILITIES.pdf

The post FMCG MARKET WATCH: AN OVERVIEW OF GHANA PHARMACEUTICAL MARKET [COMPETITIVE LANDSCAPE, DISTRIBUTION CHANNEL, AND EXPORT ANALYSIS] appeared first on Firmus Research.

]]>The post FMCG WATCH: A Snapshot of the Frozen Fish Market in Ghana appeared first on Firmus Research.

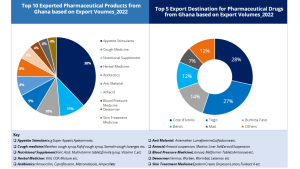

]]>The demand for frozen fish in Ghana has been on a steady rise for the past decade, with a 0.4% growth rate annually. Over the years, local production of fish is declining due to the depletion of Ghana’s fish stocks and logistics challenges, leading to a growing dependence on imported frozen fish to supplement the market demand.

Although locally the country relies on artisanal fishers, semi-industrial fishers, and major fishing companies for its fish stocks, Ghana imports over 60% of the fish it consumes[1]. Frozen fish is imported from across the world, with a chunk of imports coming from Mauritania, Morocco, and Belgium. Historical data for the past eleven years revealed that Ghana imports an average of 325 million kgs of frozen fish annually.

Figure 1: Historical Import Trends for Frozen Fish in Ghana

Imported frozen fish are shipped in standardized paper packages of 10kg, 15kg, 20kg, 25kg, and 30kg in weight. These weights serve as the basis for pricing for the different varieties of frozen fish available on the market. Further, a major distinguishing feature among these packages is the size of the fish which are usually expressed as; 14+, 16+, 20+, 25+, 200+, 400+, etc. depending on the individual size of each fish in a pack. However, the most prominent sizes sold in the Ghanaian market are 16+, 20+, and 25+.

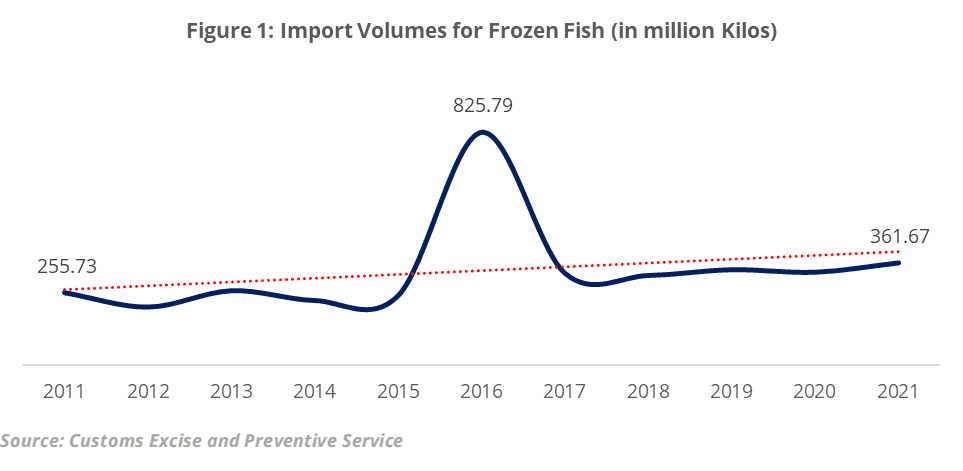

Types of imported Frozen Fishes

Over 50 different types of frozen fish are imported into the country annually including Mackerel, Red Snapper, Herrings, Hake, Yellow Tail, Cassava Fish, Sprat, Dentex, Sardinella, Horse Mackerel, Bonito, Blue Fish, Tuna, and Sardine. Some of these frozen fishes: red snapper, cassava fish, etc. are usually classified as premium fishes and are priced relatively higher. Regardless of price factors, however, there are some fish types with greater demand among consumers owing to their quality; the ability to retain their taste over a long period when frozen, and their health benefits. For instance, sardines are essential to omega-3 fatty acids and Vitamin B-12.

Figure 2: Popular Imported Fish Species in Ghana

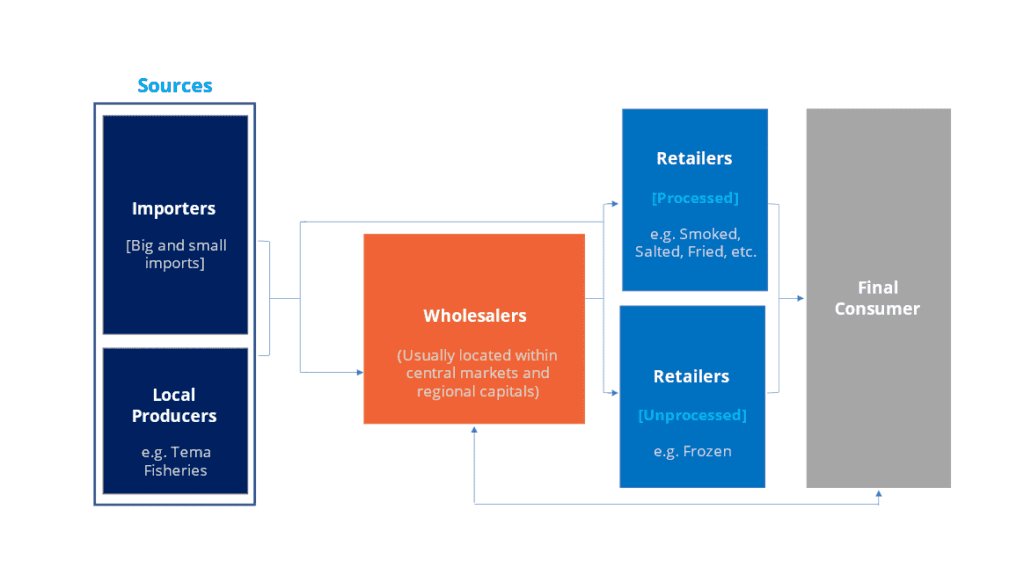

The Value Chain of the Frozen Fish Market

Figure 3: The Value Chain of the Frozen Fish Market

The value chain within the frozen fish market begins with the local producers and importers and ends up with the final consumer. The importers and local producers within the value chain are the primary sources of frozen fish in the market. About 60% of the frozen fish in the market are sourced from importers who import from across the world and sell either to wholesalers or directly to retailers.

The primary role of the wholesalers within the value chain is to conveniently make frozen fish available to retailers for resale and the final consumer for consumption. These wholesalers are usually located within central markets across major cities in the country. The retailers either sell the frozen fish in its raw state to final consumers in smaller quantities usually weighed in kilograms. Other retailers add value to the frozen fish and sell it to the final consumers either smoked, salted, or fried via restaurants, eateries, open markets, and other small shops. Further details on each stakeholder within the value chain are highlighted below:

-

Importers and Local Producers

Both importers and local producers of frozen fish are located within the main port harbour i.e. Tema and Takoradi. There are over 200 importers of frozen fish within the value chain who operate as frozen food companies, enterprises, or individuals who import in both small and large quantities. About 55% of the importers operate as frozen food companies and import an average of 1.6 million kg of frozen fish annually.

Major fisheries usually make up of local producers like Tema Fisheries and fishermen, located at the various shores of the country, who fish for different fish species including tuna, yellow tail, hake, etc. in big fishing vessels directly from the sea. There are also large and small-scale fish farmers who farm fish in ponds and lakes across the country. The predominant type of fish reared locally by fish farmers include catfish, tilapia, etc. Oftentimes, these local producers within the value chain double as wholesalers and exporters.

-

Wholesalers

A typical wholesaler stocks large quantities of frozen fish sourced from importers or domestic producers in their frozen food shops. These wholesalers are located within or near central markets across cities. Wholesalers with retail customers in distant areas deliver via distribution trucks for bulk orders. Like importers, wholesalers usually sell to retailers and final consumers in cartons. Similarly, some wholesalers operate as small-scale importers who import the frozen fish they distribute but in smaller quantities.

-

Retailers

Retailers in the frozen fish value chain are classified as processed or unprocessed, depending on the level of value added. Retailers either sell frozen fish in its processed state or unprocessed state, usually in kilograms to their final consumers. These retailers may include small cold stores, grocery shops, neighbouring shops, market women, etc.

-

Consumers

The value chain within the frozen fish market ends with the consumer. Consumers within the value chain buy frozen fish in its raw state for cooking or processing in their various homes. Consumers purchase processed frozen fish from restaurants, food vendors, and modern and traditional trade outlets.

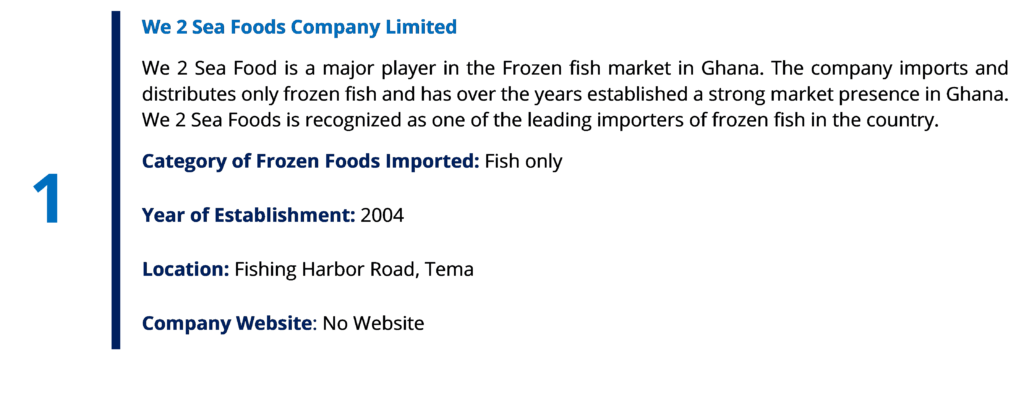

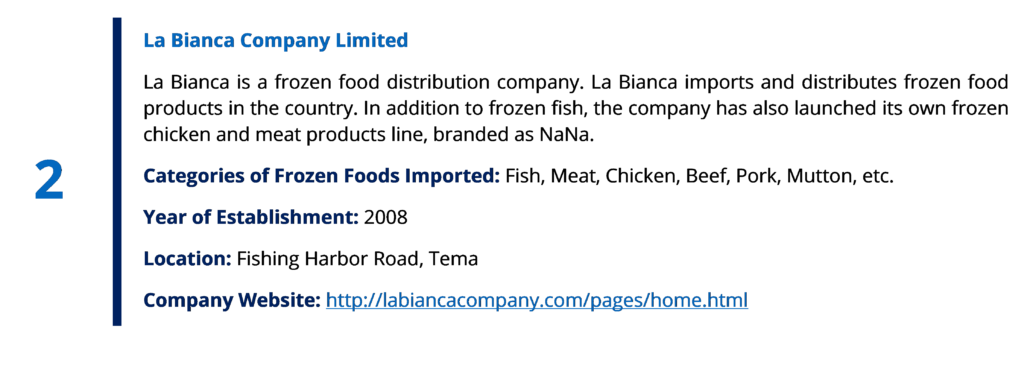

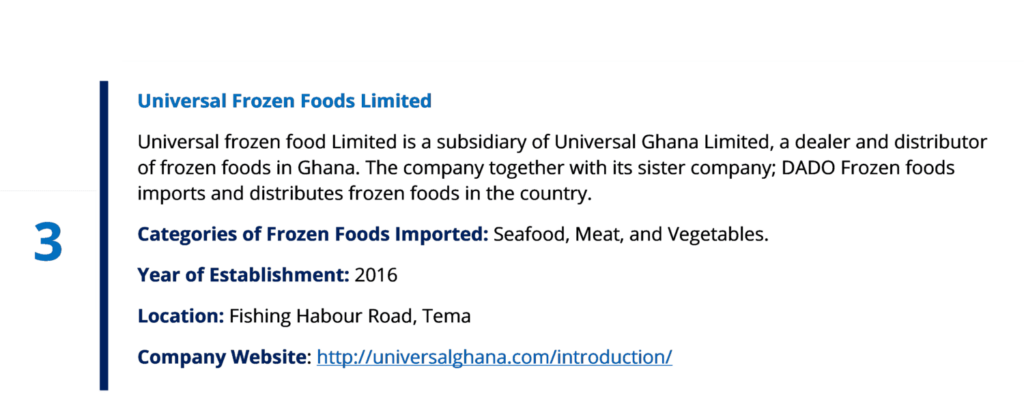

Top Importers of Frozen Fish in Ghana

Key importers located in the main port area, Tema, predominantly control the frozen fish market. These importers source their fish directly from various countries across the globe. A brief profile of some of the top players is provided below.

Top Players in the Frozen Fish Market in Ghana

Market Outlook

Although the demand for fish in Ghana is somewhat inelastic, with a low effect of price on demand compared to other Fast-Moving Consumer Goods (FMCGs), demand is largely dependent on consumer preferences. Specifically, consumers attach a greater priority to their preferences for a particular fish species in terms of taste and satisfaction rather than to prices.

Despite the current inflationary situation in Ghana significantly affecting consumption levels for several FMCGs, we expect it to have a muted impact on the consumption of different species of fish. This is because fish continues to be a primary protein preference among Ghanaians and will remain so in the medium term.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights and customer satisfaction studies. We use market research tools to help businesses gain insights and make profitable decisions. We have extensive experience in conducting customer surveys, market research, and brand tracking for both local and international companies. Talk to us today

About the Authors

[1] Citifmonline. 2016. “Ghana Imports 60% of fish consumed.” Available at Ghana imports 60% of fish consumed – Fisheries Minister – Citi 97.3 FM – Relevant Radio. Always (citifmonline.com)

The post FMCG WATCH: A Snapshot of the Frozen Fish Market in Ghana appeared first on Firmus Research.

]]>The post FMCG Market Watch: Price over Quality in the Canned Fish Market appeared first on Firmus Research.

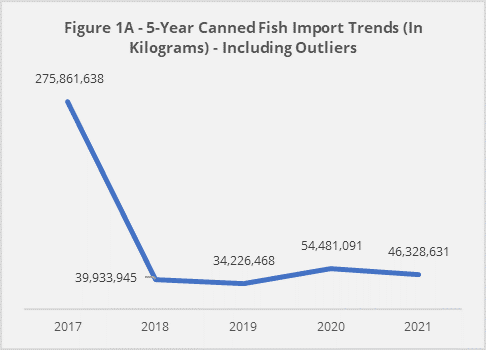

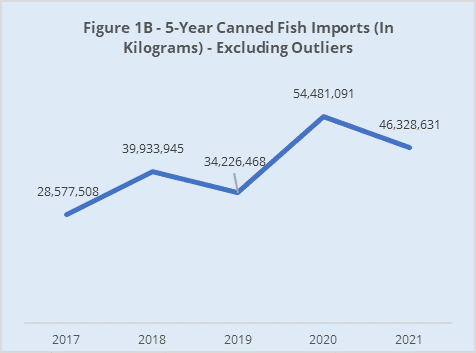

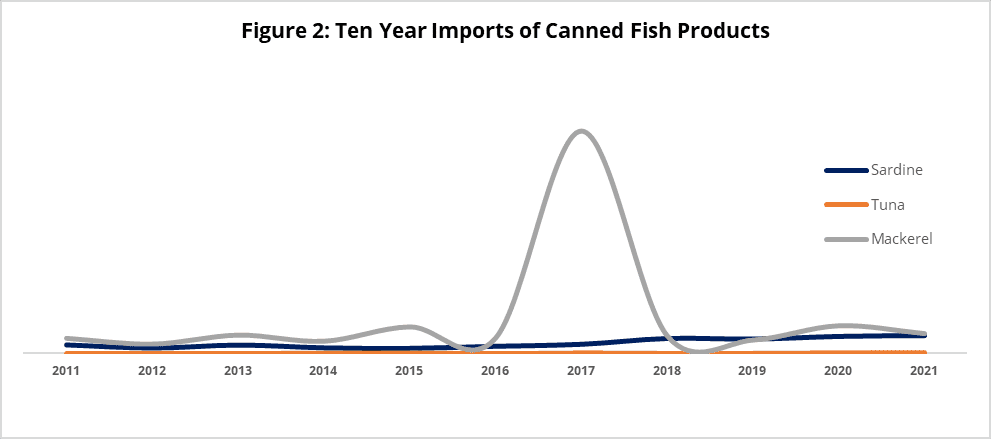

]]>The growing acceptance of canned fish products in the Ghanaian market is seen in the steady rise in its imports and the growing number of brands introduced into the market. In the early 1990s’, there were a handful of canned fish brands in the market; brands such as Titus sardines and Starkist tuna flakes were the preferred and sort after brands in most homes and on top of store shelves. Recently, however, consumers have embraced a variety of canned fish brands as several of them have been introduced into the market. The figure below highlights the import trends for canned fish products.

Figure 1: 5-year Canned Fish Imports Trends

| Source: Customs Division of the Ghana Revenue Authority |

Figure 1A and 1B shows the trend of canned fish imports in the past 5 years (from 2017 – 2021), with Figure 1A including outliers. In 2017, there was a huge import by a first-time importer that constituted more than 80% of 2017’s imports. This is treated as an outlier. Without the outlier, generally, canned fish imports have been increasing steadily, as shown in Figure 1B, averaging 40.7 million kgs per year.

Canned Mackerel Dominates the Canned Fish Market

Among the various categories of canned fish products consumed by Ghanaians, canned mackerel constitutes the highest volume, followed by canned sardines and tuna.

In 2021, total import volumes of canned mackerel were estimated at 23.8 million kgs, constituting about 51.2% of all imported canned fish products. Canned sardines followed closely with total import volumes of 20.9 million kgs, constituting 41.5%. Among the three main imported canned fish products, canned tuna is the least imported, most likely due to the well-established domestic production sector. Other canned fish products (salmon, anchovies, herrings, squid) constitute just 0.1% of the total canned fish (and seafood) imports.

The chart below provides more information on the import volumes of different varieties of canned fish from 2011 and 2021. From the chart, we see a sharp rise in the import volumes of mackerel in 2017. This was an outlier situation with a single entity importing 247 million kgs of mackerel.

Figure 2: 10-Year Import of Canned Fish Product

Price Trends in the Canned Fish Market in Ghana

Price is king

Consumers have become very price sensitive in the canned fish market, owing to the challenging economic environment and the multiplicity of brands in the market. Data gathered from ten wholesalers at Makola indicated that 80% of consumers choose less expensive brands of canned mackerel, sardines, and tuna, regardless of their quality. As a result of this trend, several less expensive brands of canned fish products have been introduced to the Ghanaian market. Aside from price, brand visibility also plays a key role in attracting consumer interest. Among the numerous less expensive products on the market, consumers choose products that are more visible to them through advertisements or referrals.

Three Categories of Prices Can be Identified in the Canned Fish Market

Data gathered from fifteen retail stores indicate price differences for products of the same size. Price differences are usually due to consumer brand perception, demand, product quality, advertising, and promotion among other factors. According to the retailers, canned fish products with higher prices are mostly considered to be traditional brands[1] (e.g. African Queen Mackerel, Geisha Mackerel, Titus) and some few new but popular brands (e.g. Enapa, Delay)

Three categories of prices can be identified in the canned fish market in Ghana: high-price range, middle-price range, and low-price range. The categories are defined in the figure below.

Figure 3: Prices of Canned Fish Products in Ghana

| Source: Field Survey, 2023 |

Online Retail Shops Prices at Premium

There is a small variation in price for canned fish products sampled in physical stores compared to the price of the same product on various online platforms. According to interviews conducted with two online vendors, the reason for the price premium is to cover premium services offered to online customers such as the convenience of online shopping and to cover the cost of website maintenance.

The tables below show the retail prices of canned products sampled on the market and online platforms[2]. Market information for canned products includes categorization based on the size (weight) of the product and average retail prices (for online and physical stores).

Table 1: Prices of Selected Canned Mackerel, Canned Sardines, and Canned Tuna in Ghana

|

CANNED MACKEREL |

||||

| Product Category |

Size per unit |

Avg. Retail Prices (Gh¢) per unit[3] | ||

| Pieces in Box | Physical Market | Online Market | ||

| High end

( e.g., Geisha, African Queen) |

425g | 24 | 20 | 22 |

| 155g | 50 | 9 | 10 | |

| Mid end

( e.g., Ena Pa, Lele) |

425g | 24 | 14 | 16 |

| 155g | 50 | 7.5 | 8 | |

| Low end

(e.g., Cindy, Costa) |

425g | 24 | 12 | 14.5 |

| 155g | 50 | 6.5 | 7 | |

|

CANNED SARDINES |

||||

| Product category |

Size per unit |

Avg. Retail Prices (Gh¢) per unit | ||

| Pieces in Box | Physical Market | Online Market | ||

| High end

(e.g.,’ Titus, Bella, Belma) |

125g |

50 |

9 |

10 |

| Mid end

(e.g., Milo, Lele, ATLANTA) |

125g |

50 |

7.5 |

8.5 |

| Low end

(e.g., Rosalinda, Laser) |

125g |

50 |

7 |

8 |

|

CANNED TUNA |

||||

| Product category | Size per unit | Avg. Retail Prices (Gh¢) per unit | ||

| Pieces in Box | Physical Market | Online Market | ||

| High end

(e.g., STARKIST, JOHN WEST) |

160g |

24 |

16 |

18 |

| Mid end

(E.g. Ena Pa Tuna, Lele Tuna) |

160g |

24 |

15 |

16.5 |

| Low end

(*Daphnis Tuna) |

160g | 24 | 11 | 14 |

Market Outlook

Though there are already numerous brands of canned fish products in the market, there is still an opportunity for new brands to make significant headway as consumers are still open to options that meet their preferences and budget. Further, potential investors may also explore domestic production to meet the increasing demand, especially for canned mackerels. There are also possibilities to explore further localization of the canned fish products, such as infusing them with pepper and other local spices and herbs. Finally, the full implementation of AfCFTA (African Continental Free Trade Agreement) opens up other markets in Africa to both producers and importers of canned fish products

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights and customer satisfaction studies. Employing the full set of market research tools (depending on a business’s particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to several local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights, and brand tracking studies across multiple sectors.

About the Authors

| Anita Nkrumah

Head, Research and Trade Development |

| Laudina Adjei-Boatey

Research Executive |

[1] Traditional brands are brands that have been in existence for a longer period of time. These brands are well-known and accepted among Ghanaians. They are considered to be the best in quality.

[2] Online platforms for pricing information were accessed on Hubtel online, Glovo supermarket, Jumia, GH basket, Market express, and Melcom online

[3] Average prices were collected for two brands each of sardine, mackerel and tuna from online platforms and the Makola central market between 24 – 28 October 2022.

The post FMCG Market Watch: Price over Quality in the Canned Fish Market appeared first on Firmus Research.

]]>The post What Are Ghanaians Spending On? Import Trends and Insights for a New Market Entrant in 2021 appeared first on Firmus Research.

]]>The post What Are Ghanaians Spending On? Import Trends and Insights for a New Market Entrant in 2021 appeared first on Firmus Research.

]]>

Source:

Source: